Edition 726 - May 11, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary - Weekly Spread Charts

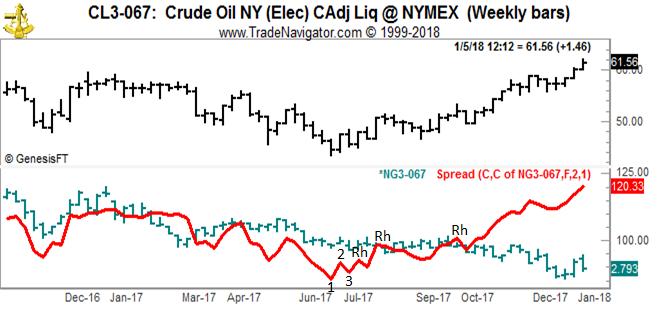

The chart below shows an inter-market spread between Crude Oil (CL) and Natural Gas, (NG) Both are very liquid markets and of course CL is one of the most consumed commodities on Earth. When NG first began to trade in the 1990s it was a wild and crazy market—extremely volatile. To tell the truth, I was afraid to trade it all by itself. However, trading it as part of a spread with CL took away a lot of the volatility and a lot of the risk.

At the time NG began to trade there was little in the way of seasonal information, and certainly nothing at all in the way of regression analysis to indicate that NG today is trading the same way it did in the early years. All I had to go on then was chart analysis, and I used the Law of Charts on both the weekly and daily spread charts to make my trading decisions.

A few months ago, there was a 1-2-3 low on the weekly spread chart long CL and short NG. Entry was taken just above the spread value at the last Ross Hook (Rh) at 101.40. As of the day I took the picture of the chart the spread had made 19 points (A full point in the spread is valued at $1,000. There was no real entry signal on the daily chart.

Despite the fact that today there is more seasonal and correlation information available, I still like to look at The Law of Charts, the way I have done it for years.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article - Why Stops

Would you ever think of jumping out of an airplane without a parachute? Of course not, but that's what some people do when they trade the markets. They are very willing to put their money on the line, but they don't have much to protect them from a major disaster. Placing a stop, for example, can prevent you from allowing a small loss to turn into a big one, but many traders avoid placing stops. Why do some traders take risks by not placing stops? It can be difficult to know where to place a stop. If you fail to account for volatility, you will get stopped out too soon. Other people are afraid to place stops. Placing a stop requires you to consider the worst-case scenario, and to many, it's difficult to consider failure. It's easier to deny the potential problem, and to pretend it will not possibly happen. Many experts, however, suggest placing stops. They know that nothing is certain when trading the markets. They view protective stops as a kind of insurance policy that prevents a catastrophic loss.

One seasoned trader I talked to, says "I never take a trade without knowing my stop. When I take a trade, I'm pretty convinced it's something worthwhile. I've already figured out my stop. I've accepted the (potential) loss before I ever clicked the button or made the call. So if it starts going against me, I don't feel a flood of emotions." For that trader, stops not only protect him from losses, but they help him control his emotions. Stops give him a feeling of security, and allow him to feel calm and relaxed.

Experienced traders may use stops all the time, but even the most experienced traders have difficulty following them. For example, one trader I know, admits, "I've blown stops and it's painful. The weird thing is that money does not seem to be driving it. Afterwards, I sit and try to analyze the incident. I certainly knew better. I believe trading is something of a self-journey. It involves learning about your character, your self-control, and your ego."

Still another trader also admits he blows his stops: "Sure. That happens all the time. There's nothing I can do about it. That's one of challenges that continue to engross me. Do you hold them or do you fold them? If you fold a long position and prices go up, you get angry because you made a mistake. If you hold a long position and prices go down, you become angry again. Nevertheless, you have to stay focused on what's going on and learn from the experience and try to apply it to the future. You're going to take your lumps in the market."

Even though stops are difficult to set and difficult to keep at times, they are an essential component of risk management. Losses are commonplace in trading. As hard as it is to focus on losses, they are impossible to avoid. Rather than avoid thinking of the worst-case scenario, face it head on. Figure out what could go wrong and where you can place a stop to protect you from a huge financial loss. In the long run, you'll find you will limit losses and trade more profitably.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

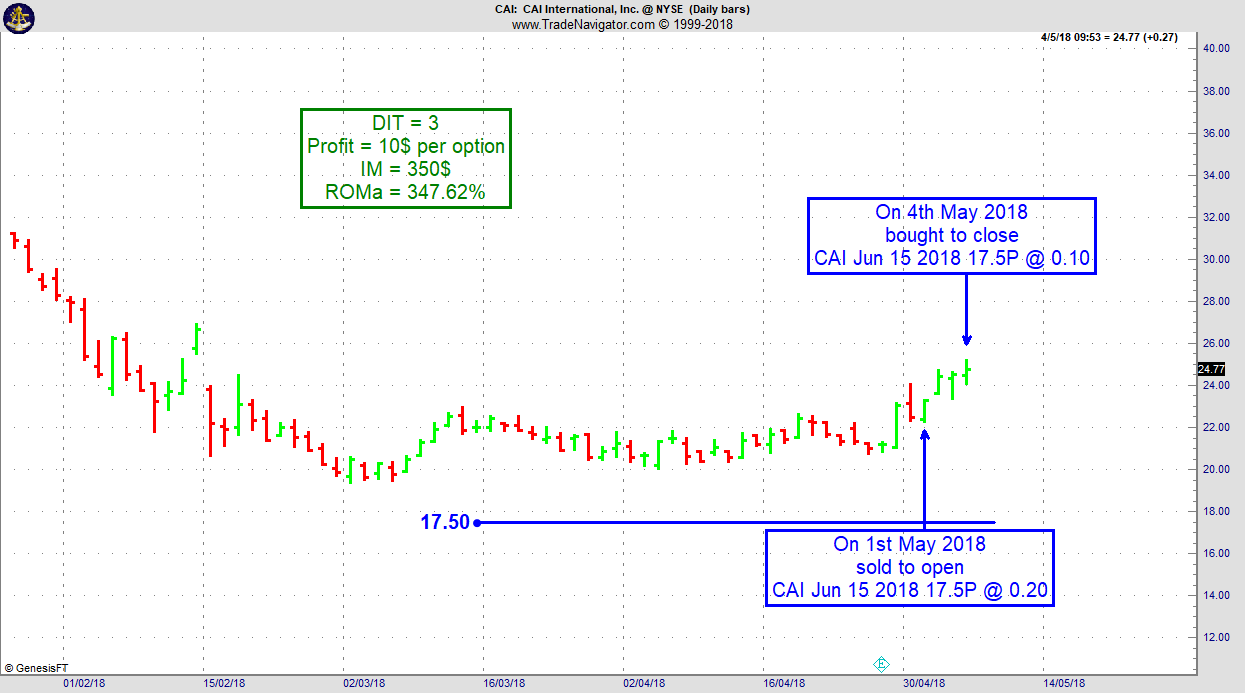

CAI Trade

On 30th April 2018 we gave our Instant Income Guaranteed subscribers the following trade on CAI International Inc. (CAI). Price insurance could be sold as follows :

- On 1st May 2018, we sold to open CAI Jun 15 2018 17.5P @ 0.20, with 44 days until expiration and our short strike about 22% below price action, making the trade very safe.

- On 4th May 2018, we bought to close CAI Jun 15 2018 17.5P @ 0.10, after only 3 days in the trade for quick premium compounding

Profit: 10$ per option

Margin: 350$

Return on Margin annualized: 347.62%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Idea - RBOB Gasoline

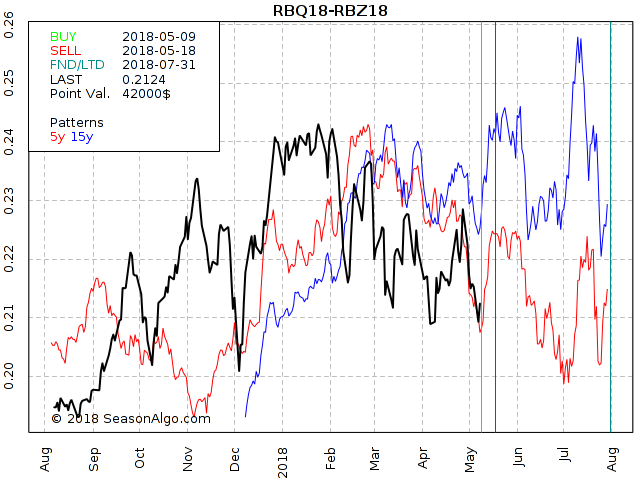

This week, we're looking at RBQ18 – RBZ18: long August 2018 and short December 2018 RBOB Gasoline (NYMEX at Globex).

Today we consider a RBOB Gasoline calendar spread: long August 2018 and short December 2018 RBOB Gasoline. The spread has found support around 0.21 several times and is now trading right in front of the seasonal time window. The seasonal window is very small with only 9 days but the move can be strong to the up-side with a reasonable risk/reward ratio.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Idea - AlgoStrats:FX Traders

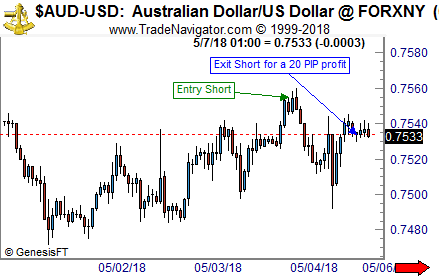

A stress free-trade in AUD/USD and a good start into 2018 for AlgoStrats:FX Traders

Like all professional traders, we get a mixed bag of trades at AlgoStrats:FX. Some turn out as losers, others as big winning trades. And some of the trades are not spectacular in any way but nice stress-free bread and butter trades.

Here’s an example of a trade we did in AUD/USD. This is a 60-minute chart and as you can see our sell limit order to go short was filled at 0.75547. We got almost no drawdown on the trade and closed the trade at 0.75341 for a nice 20 pip profit.

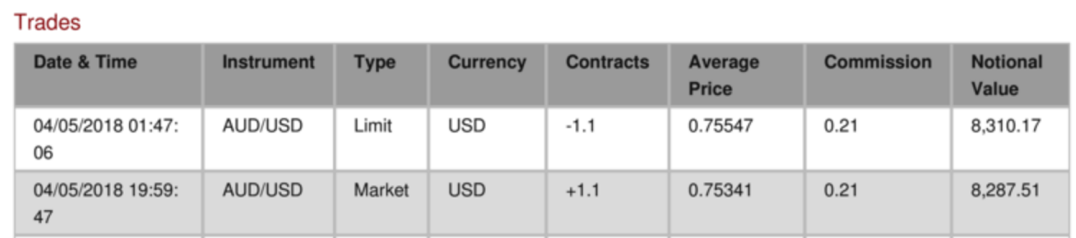

At AlgoStrats:FX there’s no "fantasy-trading" as with most signal services where you’re usually shown trades that actually never happened! This means all of the trades are actually traded in a live trading account. As a subscriber, you get access to all of the daily account statements of this account. Here’s the discussed trade in detail, showing the trade statement of LMAX exchange:

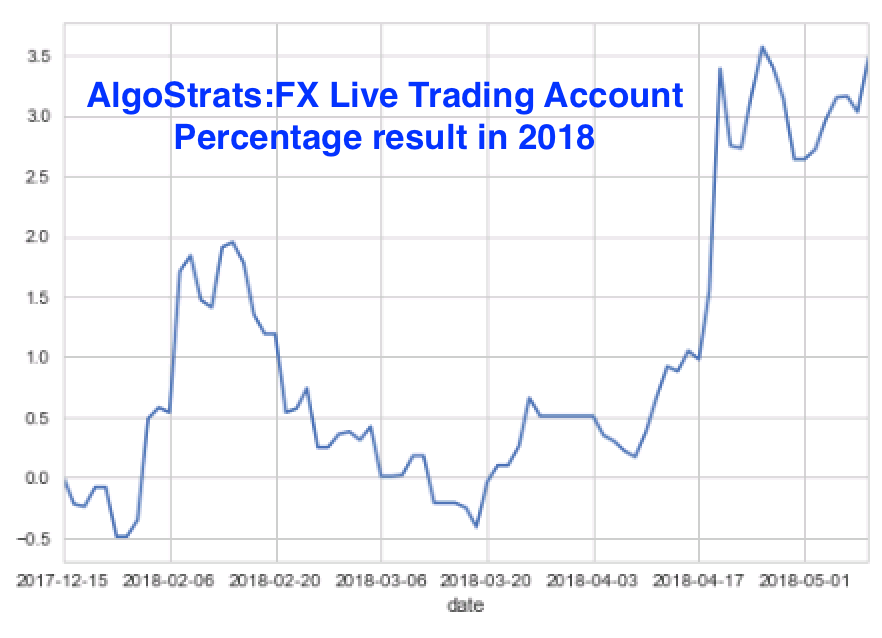

Overall we’re up about 3.5% so far this year using very conservative risk management:

Learn More about AlgoStrats:FX

Happy Trading!

Marco Mayer

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.