Edition 728 - May 25, 2018

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush Traders having a crazy winning streak in Natural Gas Futures

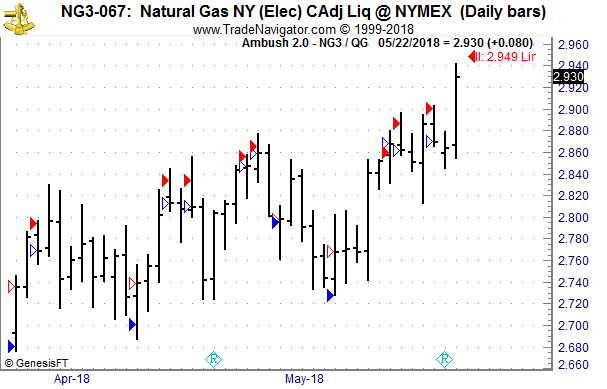

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the Natural Gas Future (NG) traded at the NYMEX, where Ambush Traders are having an amazing run lately.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day. Now NG has been doing what it’s doing most of the time, moving sideways in a jerky way:

As you can see we had a lot of trades at the tops and bottoms of that trading range. With Ambush we’re in the trade when the reversal is actually happening and a new top/bottom is being put in place. Not when it’s over which is when other traders notice it after the fact and try to jump in way too late!

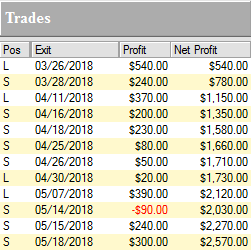

Here’s the result of these trades, trading one NG contract, including $10 commissions per trade. Yes, that’s a winning rate of over 90% with a profit factor of almost 30!

Is it always like that? Of course not, but it’s these periods Ambush traders love the most, literally dominating a market often for months at a time.

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals!

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook.

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary - Copper

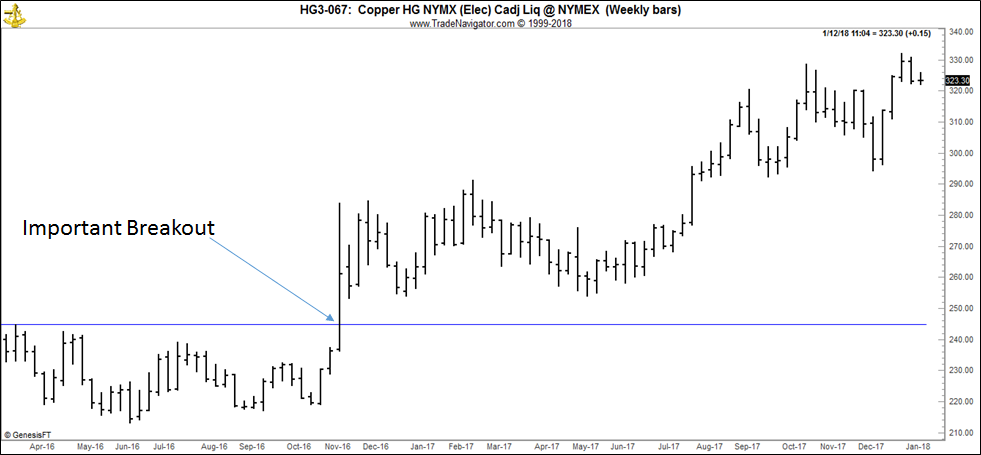

In this issue of Chart Scan, we look at a very encouraging price breakout on the weekly chart of the price of copper.

The price of copper is one of the best gauges of global economic health. Copper is a key ingredient in transmission lines, plumbing, automobiles, appliances, and electronic equipment. The demand for copper rises and falls with manufacturing, infrastructure spending, and residential construction.

Copper had been suffering a huge decline, but as you can see on the chart below, it reached the critical price of $2.40 per pound. This price of $2.40 happened to be the lowest point copper had reached during its huge correction in 2007. From there prices had gone even lower, and so $2.40 became a point of resistance.

What is happening to cause copper and other industrial metals to move higher? Construction of the new Chinese Silk Road for one. Threats of war for another. Infrastructure spending in the US is contributing as well. Overall, the global economy looks good for copper prices to rise, although we don’t really know how rotten the global economy may actually be. But even if the global economy is not so good, wars and rumors of war are enough to keep copper in demand with steadily rising prices.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article - Maintaining Discipline

Winning traders are disciplined. Discipline means controlling impulses and fighting the urge to abandon your trading plan prematurely. Maintaining discipline is often easier said than done, especially when the market is moving in your favor. It's hard to avoid closing a trade out early in order to lock in profits. Some winning traders face more losers than winners, and when you hit upon a winner, it's tempting to take profits as soon as possible. But since winning traders are relatively rare, it's important to fight the impulse to sell prematurely and let the winning trade run for a while. In order to win big, it is necessary to delay gratification and patiently wait for the price to rise to your exit point according to your trading plan. Discipline is key, and it is vital to take whatever steps are necessary to maintain discipline.

Your mood can play a major role in determining your ability to stick with your trading plan. When you are in a bad mood, you may have trouble sticking with your trading plan. A 1991 study illustrates how feelings of emotional distress can influence your ability to maintain discipline. Participants engaged in a laboratory simulation in which waiting patiently resulted in greater profits. Specifically, participants were asked to pretend they were fishing in a lake, and that they would be given a monetary reward for each fish they caught. Taking too many fish out of the lake early in the game produced immediate profits, but when fish are taken out early, fewer fish are left in the lake to reproduce, and so, few fish can be taken out for a profit in the long run. Thus, waiting patiently to take out fish later is the most profitable strategy. Participants' moods influenced their ability to wait patiently and fight the urge to take profits too early.

You might see how this experiment has relevance for trading. When you are in an unpleasant mood, you may have a strong need to feel better. How can you feel better? Making money usually makes you feel better. You can either take profits out of a winning trade immediately or you can make an impulsive trade to get a quick thrill. Your mood can make all the difference. It is useful to make sure you are in a good mood while trading. When you are in a bad mood, you may act impulsively in order to make yourself feel better.

Of course, if you are a scalper, your plan may be to take quick profits whenever you can, as long as you are a high percentage winner.

Maintaining discipline is vital for trading success but it is difficult at times. The best ways to keep disciplined are to trade with a detailed trading plan, but this may not be enough. You must also make sure you are in a good mood. A good mood can mean the difference between trading impulsively and maintaining discipline.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

WDC Trade

On 10th May 2018 we gave our Instant Income Guaranteed subscribers the following trade on Western Digital Corporation (WDC). Price insurance could be sold as follows:

- On 11th May 2018, , we sold to open WDC Jun 22 2018 71P @ 0.79, with 41 days until expiration and our short strike about 10% below price action.

- On 16th May 2018, we bought to close WDC Jun 22 2018 71P @ 0.39, after only 5 days in the trade for quick premium compounding.

Profit: 40$ per option

Margin: 1420$

Return on Margin annualized: 205.63%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article - The "Crush Spread"

The spread is defined as buying one futures contract, and selling a different, but related futures contract. Specifically, when trading the crush spread, you would buy soybeans and sell its respective products, the soybean meal and soybean oil. This is what is referred to as being crushed. If you buy the soybean meal or the soybean oil and sells soybeans, that is what is referred to as being reversed crushed. Soybeans alone have relatively little value. The value of soybeans is the fact that when crushed, the products have great value globally. Soybean meal is of value to the farms that raise chicken and hogs. Soybean meal is rich with protein and is fed to these animals to fatten them up. Soybean oil is of value across an array of industries. Primarily, soybean oil is used in food as one of many available edible oils. Soybean oil is also being used in a mixture to create an alternate source of energy to compete with crude oil. These uses and others of the products give soybeans their value.

There is more to you than your business. You are more than your trading. A proper fence informs you that the results of one trade are not to be confused with the results of all of your trading. Fences guide you as to the difference between the past, the present, and the future.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.