Edition 729 - June 1, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary - New Zealand Dollar-Japanese Yen Spread

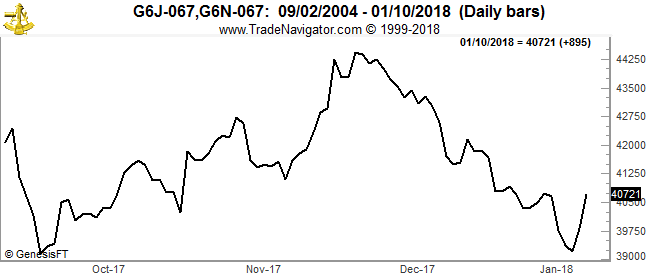

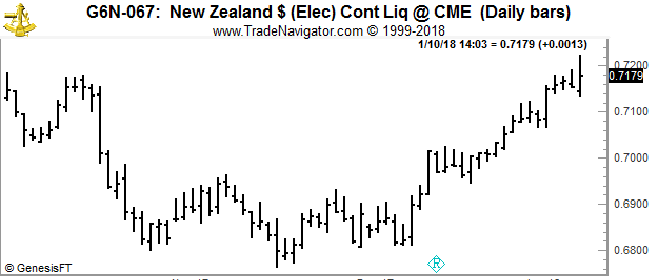

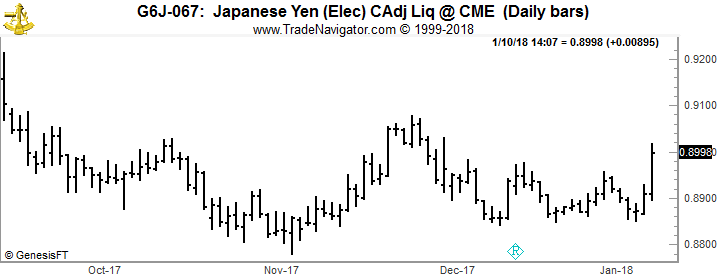

"Hey Joe! I’ve been watching the spread between the Japanese Yen and the New Zealand Dollar. I don’t have a Forex account, so I watch the spread as a differential spread long yen and short kiwi. Based on the chart below, do you think we are looking at a bottom for the yen? "

I think it’s much too soon to call for bottom in the yen. A one-day move is not sufficient for calling a bottom, in the yen or even a bottom in the spread.

The kiwi is still in an established uptrend.

And, all the yen has done is make a one-day spike upward in a trading range, which could be nothing more than stop running.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article - Greed

In the movie "Wall Street," Gordon Gekko argues, "Greed is good." Greed can motivate you to strive for perfection and keep you persisting in the face of adversity, but greed has its downside. It is often said that the markets are driven by fear and greed. The masses have a natural desire for wealth and all the advantages that money can buy. In their zeal, the masses invest in stocks and believe that their investments will allow them to achieve their financial goals. When the price starts going down, though, they fear losing their investment and they sell, often too prematurely and at a loss. The dynamics of greed drive the dynamics of the market.

In the movie "Wall Street," Gordon Gekko argues, "Greed is good." Greed can motivate you to strive for perfection and keep you persisting in the face of adversity, but greed has its downside. It is often said that the markets are driven by fear and greed. The masses have a natural desire for wealth and all the advantages that money can buy. In their zeal, the masses invest in stocks and believe that their investments will allow them to achieve their financial goals. When the price starts going down, though, they fear losing their investment and they sell, often too prematurely and at a loss. The dynamics of greed drive the dynamics of the market.

As an individual trader greed may drive you. Trading is a challenging profession. Not everyone makes it. You have to study the markets and learn how to take out profits from the market action. How to do this is not obvious. Finding profitable trading strategies is an unending search. You may find a strategy that works for a while, but market conditions change and the strategy no longer works. The challenge is to make profits in market after market. Why bother? If you aren't driven to achieve success, you won't make it. You won't persist. You won't try to overcome setback after setback. Greed is a powerful motivator. It is natural to seek out happiness. If you are similar to most people, you dream of eternal bliss. For centuries people have fantasized that if they had immense wealth, they could solve all their problems, but this fantasy is often unrealistic. The human mind is capable of fooling itself into falsely believing that unrealistic fantasies can come true.

Money is a powerful motivator, but many people know deep down that money can't solve all our problems. And those thoughts and feelings that lie deep down in our psyche can often influence us when we don't want them to. Since we know that money isn't going to solve our problems, we can lose hope when everything seems to be going against us. It's important that we acknowledge how greed can be a motivator but also a barrier. It can distract us from focusing on our trading plan. We can become so consumed with the pursuit of money that we fail to appreciate the inherent rewards of trading. Trading offers an intellectual challenge. You can build up your trading skills through practice and experience and feel good knowing that you have mastered a skill that few have developed. Don't focus all your energy on money and the accumulation of it. Instead, focus on developing your skills and enjoying the process of trading. In the long run, you'll find that you will enjoy trading a lot more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

MU Trade

On 15th May 2018 we gave our Instant Income Guaranteed subscribers the following trade on Micron Technology Inc. (MU). Price insurance could be sold as follows :

- On 17th and 18th May 2018, , we sold to open MU Jun 15 2018 44P @ 0.25 (average price), with 26 days until expiration and our short strike about 17% below price action

- On 22nd May 2018, we bought to close MU Jun 15 2018 44P @ 0.05, after only 5 days in the trade for quick premium compounding

Profit: 20$ per option

Margin: 880$

Return on Margin annualized: 165.91%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Example - Inter-Market spread

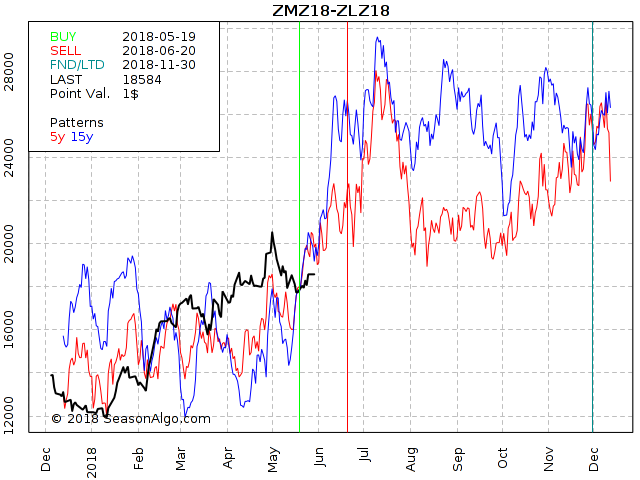

This week, we're looking at 100*ZMZ18 – 600*ZLZ18: long December 2018 Soybean Meal and short December 2018 Soybean Oil (CBOT on Globex).

Today we consider an Inter-Market spread in the Soybean Complex: long December 2018 Soybean Meal and short December 2018 Soybean Oil. While the spread has been in a long term up-trend since the beginning of 2018, it has retraced from its May during the last few weeks. But the spread has found support at around $18,000 in April as well as in May. With an initial stop below the May low at approx. $17,700 and a potential target at $20,000 or even higher, the risk/reward ratio is in our favor. Please note: To alleviate the problem in spreads wherein tick values are not equal, one can convert the price of each contract into an equity value for each contract. Therefore, we multiply the Soybean Meal by 100 and the Soybean Oil by 600.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

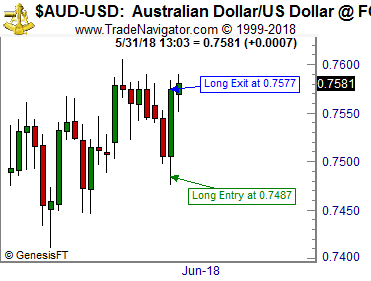

AlgoStrats:FX Live Account hits new high for the year thanks to a 90 pip profit in AUD/USD

Trading the Forex markets can be tough and a lot of traders have been caught by the reversal in the USD related markets this week. The AUD/USD being one of the strongest markets, making back a week of losses within a single trading day.

Thanks to one of our mean reversion systems at AlgoStrats:FX we could catch almost the whole trading range of that day! As you can see on the chart below, we got in close to the low of the day and out close to the high, caching in a 90 pips profit.

At AlgoStrats:FX there is no "fantasy-trading" as with most signal services where you’re shown trades that actually never happened! All of the trades are real trades, traded in a live trading account. As a subscriber, you get access to all of the daily account statements of this account.

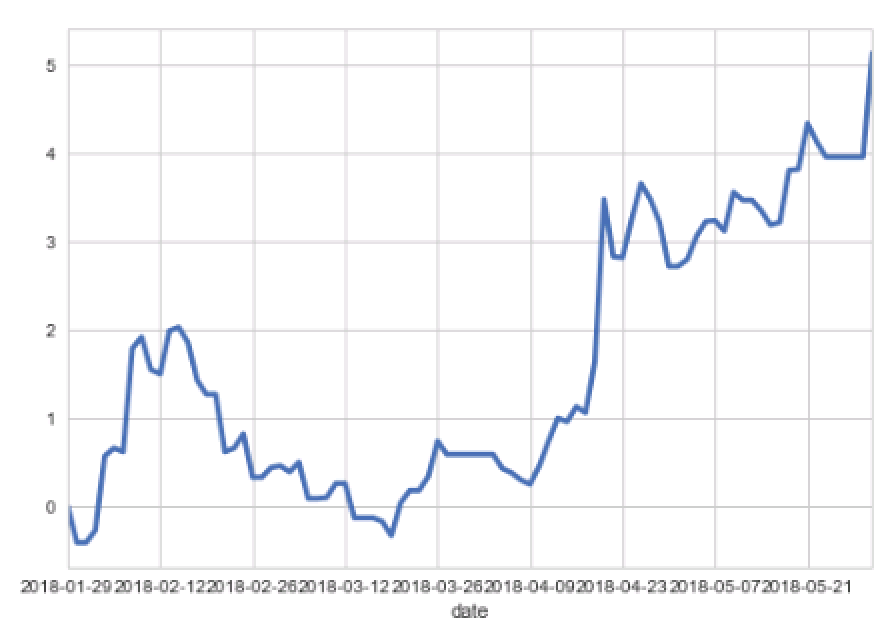

Overall we are up about 5% so far this year using very conservative risk management:

Learn More about AlgoStrats:FX

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.