Edition 730 - June 8, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary - Markets Fall Faster…

I believe that markets fall faster than they rise, except perhaps in currencies, where the rate of descent seems approximately the same as the rate of ascent, from one currency to another. A good part of these moves is due to market manipulation, but also when prices are falling there is a huge emotional component—fear and panic. We all know that what goes up, must come down (usually). It is also known that markets fall much faster than they rise. We have seen a lot of that lately, as well.

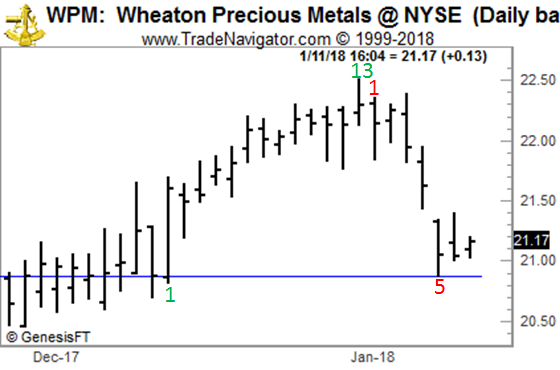

As I was looking through my charts, I couldn't help but notice a perfect illustration of prices falling much faster than they had risen with Wheaton Precious Metals.

Counting from the bar marked “1,” It took 13 bars to reach bar number 13. However, it took only 5 bars to wipe out any gains made since bar number 1.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article - Efficiency and Success

How much time do you spend preparing for the trading day? Do you spend hours scouring the markets for a winning trading opportunity? Do you watch hours of commentary or read all the major financial newspapers? You don't need to spend hours and hours reading about the markets if it doesn't directly lead to a profit. For example, most media coverage of the markets is for entertainment value, so spending hours reading or viewing it is a waste of valuable time. You need to work efficiently and make sure that the time you spend learning about trading and the markets does indeed pay off.

Consider how a seasoned hedge fund manager, prepares. "I look at about 300 charts every day. That gives me a good feel for what the markets are doing overall. I try to see whether a lot of different markets are signaling the same thing and breaking out at approximately at the same time. I wait for that to happen before I take a position. When it happens, it's fairly clear, and I really don't have any problem with courage at that point." The expert trader doesn't spend hours the night before preparing. Instead, the experienced, winning trader can prepare right before the trading day begins. Rather than wasting time on tasks that don't pay off, the winning trader works efficiently.

Veteran traders may work efficiently, but novice traders may need to spend a little extra time preparing. It's difficult to become a skilled and consistently profitable trader. Only an individual with rare talents can rise to the top 2% who make it as a top-notch trader. It does indeed take dedication and hard work. However, some make the mistake of thinking that trading is like a regular 40-hour a week job. The idea that an hour of work directly produces an hour of pay is not pertinent to trading. Trading is more about accomplishing a specific target, and making a profitable trade, rather than putting in a specific number of hours. For instance, if it takes only 15 minutes for a skilled trader to make enough profit to have a year's worth of living expenses, then so be it. Seasoned traders don't have to spend 40 hours a week to make a living, if they have the requisite skills (and novice traders may need to put in more time building up these requisite skills).

The point is that if you're a novice trader, you can't work under the belief that everything you do will have a payoff. You must also consider that there are a fixed number of hours in the day that you can work, so you must spend that time efficiently. Trading is a challenging profession, and you need to focus your psychological energy on what matters most. For example, don't be distracted by learning additional trading strategies that you will never use, or new indicators that are redundant with basic indicators of trend. And don't believe you must keep up with all the media hype. Focus, work efficiently, and in time you will build the skills you need to become a consistently profitable trader.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

M Trade

On 16th May 2018 we gave our Instant Income Guaranteed subscribers the following trade on Macy's Inc (M). Price insurance could be sold as follows:

- On 18th May 2018, , we sold to open M Jun 29 2018 28P @ 0.29, with 41 days until expiration and our short strike about 16% below price action

- On 24th May 2018, we bought to close M Jun 19 2018 28P @ 0.14, after only 6 days in the trade for quick premium compounding

Profit: 15$ per option

Margin: 560$

Return on Margin annualized: 162.95%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article - Traders "Pro Active" and "Ray Active" – A Story!

Pro Active and Ray Active are both wannabe traders, but their approach to trading is quite different. Ray is consumed with trading for profits. He imagines himself achieving great wealth, and thinks that when he amasses the riches he is after, he'll finally get the respect and recognition he always wanted from his wife, family and friends. He thinks, "If I can only make it as a trader, I can show everyone that I deserve their respect."

Pro doesn't care about what other people think of him. He concentrates on building up his trading skills. He thinks it would be nice to make consistently regular profits, but he doesn't feel that he absolutely has to obtain great wealth. He enjoys trading. It's fun. It’s what he has discovered he always wants to do. He would trade for minimum wage if he needed to. He doesn't want to do anything else. He feels confident that if he applies himself, he will eventually become a profitable trader.

Pro has a strong sense of his own value as a person, and because he lets his own motives and values guide him, he is likely to reach his goal of become a winning trader. On the other hand, Ray is looking for his value through the eyes of others.

If you want to be a happy winning trader you cannot allow your “net worth” to define your “self-worth.” Any confidence you have has to be within yourself.

Winning traders develop or already have a sense of inner, rather than external, self-value. You are, what you think you are, and the only evaluation of yourself that counts is the one that comes from inside you. That is why anyone who wants to succeed at the business of trading must confront him/herself and discover and deal with who they really are.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush Traders profit big time from novice traders who’re having a hard time trading the Canadian Dollar!

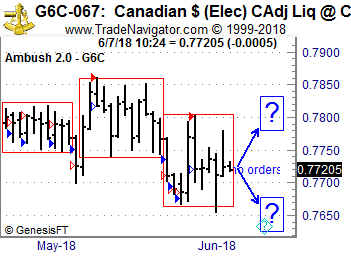

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the Canadian Dollar Future (6C) traded at the CME, where Ambush Traders are having a really nice time lately.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day. Now the Canadian Dollar has been doing what it’s doing most of the time, moving sideways in little boxes in a jerky way which is of course driving most traders nuts!

Luckily Ambush has no trouble in such markets and so Ambush Traders exploited and profited nicely from all the losing breakout traders lately! As you can see we had a lot of trades at the tops and bottoms of these trading ranges, whether they’re small or a bit more expanding.

Where’s the CAD going next? For sure to either the top or the bottom of the trading range it’s in. As Ambush Traders we don’t mind, we’ll be there ready to sell to or buy from the novice traders who’ll then accelerate our profits as they got to get out of their next losing trade.

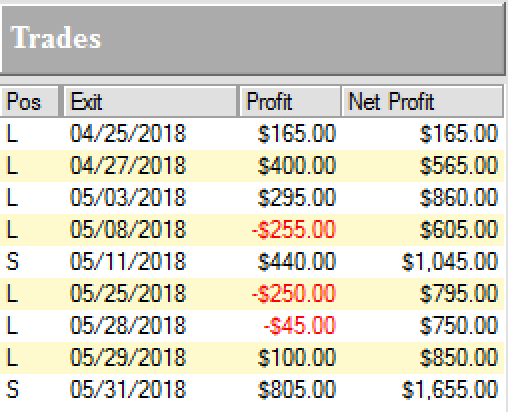

Here’s the result of these trades, trading one 6C contract, including $10 commissions per trade.

Is it always like that? Of course not, but if you’ve been on the other sides of these trades you maybe should think about switching sides!

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals!

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook.

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.