Edition 731 - June 15, 2018

HAPPY FATHER'S DAY!

Use Coupon Code During Checkout!

dad10

(excludes Private Mentoring and 1-Month Traders Notebook)

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary - Lesson from the Past -- NQ

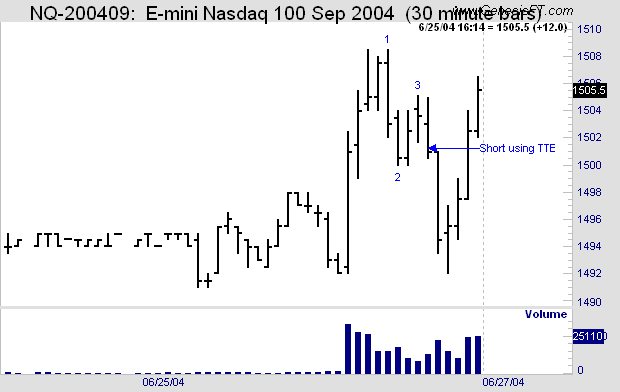

It’s truly amazing how much the price of the Nasdaq Mini has changed over the years. We are looking at the e-mini Nasdaq from 2004, shown a 30-minute chart. The reason I chose this chart was because I want to show that regardless of time frame and date, a chart is a chart. The only thing that really changes over the years is how you manage what you see. As long as human beings trade a market, human emotional reaction to the movement of price will cause certain patterns to form. In this case we had a 1-2-3 high formation followed by an opportunity to enter, which we call a Traders Trick Entry.

As you can see, prices formed a 1-2-3 high. I’ve shown you my entry point using the Traders Trick Entry.

Prices moved from my entry at 1501 to as low as 1492. Even using a 50% trailing stop, you could have made 4.5 points.

In my online day trading seminar, I show you how to select a market, a time frame, and how to manage your trades. Follow this link to learn more about the seminar:

If you are not using The Law of Charts™ and the Traders Trick Entry to take profits out of the market, you are missing out on a lot.

There is a logical way to choose a market and time frame for trading. There is a logical and structured way to determine trading objectives and stop placement.

Using The Law of Charts you can even know when to expect a trend to end. We hope you will come to find out our structured and disciplined way to trade.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article - Confidence

When it comes to trading the markets, nothing is certain. How do you cope with uncertainty? Many traders are overconfident. Rather than face the possibility of losses due to market uncertainty, they fool themselves into thinking they are omnipotent. Behavioral economists Brad Barber and Terrance Odean illustrated how novice traders are especially overconfident. They analyzed account records from a large sample of online investors. Overconfident investors showed this ailment after a large windfall. They put on substantially more trades than other investors, yet achieved few rewards for their efforts. By putting on significantly more trades, they paid more in commissions, which in turn resulted in overall lower account balances. Clearly, overconfidence has a price. Are you willing to pay it?

Tom a seasoned trader told me, "Every time I have issues with confidence, I become overconfident. I try to be very humble when I trade. You're only as good as your last trade. It doesn't matter what you did last month, last year, or the last ten years, it's what are you doing today." But Tom does not lack confidence. He may get beaten down, but he doesn't stay down for very long: "I get worried or depressed for a very short period of time. Rather than dwell on it, I immediately shift my focus and think, 'Okay, fine, let's see how we can get out of this?' What's done is done."

Although overconfidence can lead to risky trades that may produce losses occasionally, a lack of confidence can be even more detrimental. It's probably not a good idea to be optimistic to the point of putting on trades without carefully managing risk, such as limiting the size of a position or using protective stops, but a moderate amount of optimism and confidence is useful.

Pessimists often panic, become fearful, and tenaciously deny they are in a losing trade. A moderate amount of optimism keeps a trader calm and inquisitive. Even in the midst of a losing trade, an optimist may be more likely to seek out information and make an informed decision. Finding the proper level of confidence is key. It is a little like walking a tightrope between extreme unrealistic optimism and extreme debilitating pessimism. Finding the right balance will allow you to pick yourself up when you are beaten down.

The winning trader is both confident and realistic. If you want to trade like a winner, you need to develop a true sense of self-confidence. By gaining a wealth of experience, your confidence will be based on your actual trading skills. When you know what you can do and what you can't, you'll feel calm and self-assured. You'll know what you can handle, and you will be able to trade with solid, realistic confidence.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

ANDE Trade

On 25th May 2018 we gave our Instant Income Guaranteed subscribers the following trade on The Andersons Inc. (ANDE). Price insurance could be sold as follows:

- On 29th May 2018, , we sold to open ANDE Jul 20 2018 30P @ 0.30, with 51 days until expiration and our short strike about 9% below price action

- On 4th June 2018, we bought to close ANDE Jul 20 2018 30P @ 0.15, after only 6 days in the trade for quick premium compounding

Profit: 15$ per option

Margin: 600$

Return on Margin annualized: 152.08%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article - What's my real reason for trading?

"The Rorschach test (also known as the Rorschach inkblot test, the Rorschach technique, or simply the inkblot test) is a test in which a subject's perceptions of inkblots are recorded and then analyzed using psychological interpretation, complex scientifically derived algorithms, or both. Some psychologists use this test to examine a person's personality characteristics and emotional functioning." (Copied from Wikipedia)

Trading is a kind of a Rorschach test, mirroring the personality of the trader's needs and desires. We need to ask ourselves "What is my real reason for trading?" because whatever our underlying motives are, they will show up while trading. Pursuing these hidden goals will negatively affect our trading. Not knowing why they exist may cause us to wonder why certain things keep happening over and over. Finding out the real motives behind why we want to trade will help us to understand why we do certain things, and will help us to become better traders.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

The right mindset to deal with drawdowns

Drawdowns are an unavoidable fact in trading that's tough to deal with. But you probably already noticed that and might have encountered some of the serious issues this can lead to during your trading career. Maybe you tend to stop trading a system or switch systems always at the wrong time. Or worse. But as I've written about these issues before, here's a mindset that has helped me a lot to deal with drawdowns in the long run.

Things got a lot easier for me once I started to treat trading a system or just following a specific trading plan or strategy like an investment. Let me explain.

Let's say you believe in the success and growth of a certain company, Apple for example. Therefore you decide to invest a certain amount of money in it and buy the stock. You get in at $100. Right after you bought the price of the stock goes down to $95. You're down 5% and probably a little bit disappointed about your bad timing. If you're sane that's where you stop worrying. You won't start questioning your investment because the price of the stock dropped $5. You still believe in the company, nothing fundamental changed so you just keep your stocks. A year later Apple trades at $140 and you're quite happy but it might have been a volatile journey up to $135 during the year. Again though that's no big issue as you expect this. Stock prices can be volatile and you don't expect them to move higher in a straight line!

Why not apply the same mindset to trading a system? Take a certain amount of money and invest it into the strategy. As long as you believe in the strategy and the drawdown is within what you expect, why worry? Just keep on trading it, stop worrying about the daily ups and down and questioning it on every little drawdown. Of course, if something fundamental changes or you hit unexpected drawdowns you act. But otherwise, it really helps to treat it like an investment, leave it alone and let it do its thing.

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.