Edition 732 - June 22, 2018

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article - Staying on the “Sideline”

Don't get irritated or angered because you haven't put on a new trade in a long time. Whenever there is nothing to trade, don't trade. Accept it and stay on the “sideline." There will be an attempt by the “trading gods” to wear you down by giving you bad markets over and over, and for extended periods of time. This will happen, and it will happen on numerous, often successive occasions. Know this ahead of time so you are mentally prepared for it when it happens.

Just because you haven't entered a new trade for a long time doesn't mean its time to trade. Some traders think there is some kind of invisible statute of limitations on being passive. After two weeks, you've paid your dues and you've proven that you are a disciplined trader. So now you've earned the right to trade again, right? Unfortunately, this is not the case, and you have to stay on the sideline until a good trade shows up.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

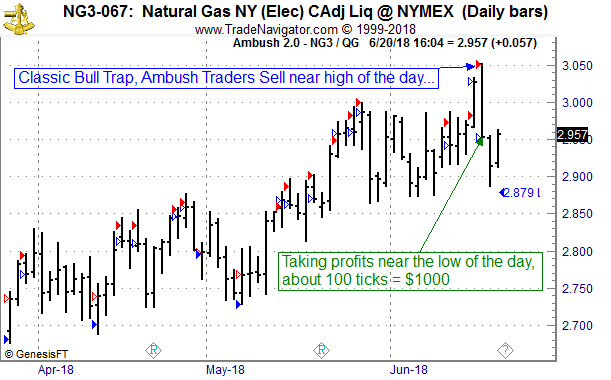

Trading Example - Natural Gas Bulls got trapped badly by Ambush Traders

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the Natural Gas Future (NG) traded at the NYMEX, where Ambush Traders are having an amazing run lately.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

In Natural Gas the Bulls and breakout traders got trapped badly on Monday buying like crazy into the market at a price premium. This caused the market to open with an up gap above Friday’s close. Ambush Traders already had their order in to sell and sold right to those novice buyers.

That open turned out to be pretty much the high of the day and the bulls trapped in their long positions quickly got to realize they’ve been on the wrong side of the market that day. While Ambush Traders started to count their profits they had to get out of their long positions as quickly as they got in and Natural Gas closed about 100 ticks lower near the low of the day:

What’s going to happen next in NG? Well we’re back in our trading range now again and looking forward to the next Ambush Trade! The profit rally for Ambush Traders has been going on for a while now as you can see below even though this Monday we got the biggest fish so far:

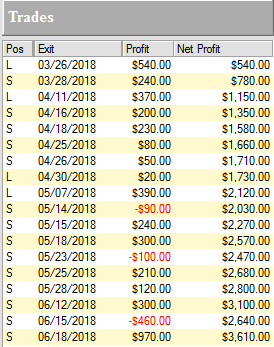

Here’s the result of these trades, trading one NG contract, including $10 commissions per trade. Yes, that’s over $3600 trading just one contract!

Don’t miss the next trade and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals.

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook.

Happy Trading!

Marco Mayer

Feel free to email Marco with your trading questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary - Trend?

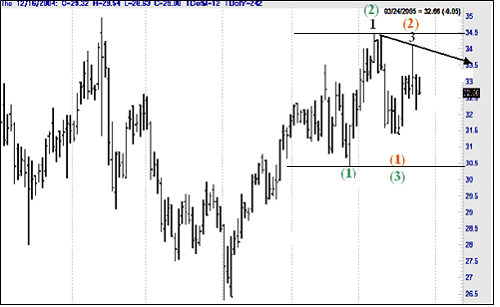

Someone sent me the not so beautiful chart you see below. However, it doesn’t matter about what it is or how it looks. There is a lesson to be learned, and I want to show you how I evaluate such a situation.

The question associated with this chart is: Do we have a clue as to which way prices will break out?

I think we do, so look closely to see why I think that. We have 1-2-3 formations in both directions in what appears to be a market with rising prices. Some people call such a market a “rising wedge” or “rising triangle.: That’s because of the way I drew a trendline. However, I could have just as easily drawn horizontal lines indicating that prices were moving sideways.

In the above situation, I favor the direction of the previous trend, which is “up.” Does it matter where I drew the trendline? I don’t think so. Who is to say where to draw it, or whether or not I should have drawn it. Where people draw lines is a matter of opinion. Yours is as good as mine. Basically, I drew a trendline rather than enveloping the sideways consolidation with horizontal lines, because my bias was toward the rising market. I wanted to show direction, not a geometrically perfect trendline. By the way, what is a geometrically perfect trend line?

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article - Overconfidence

How should a trader deal with “overconfidence?” Maybe a better question about confidence--trading and otherwise--is not why people are overconfident to begin with, but why they stay overconfident. You see, the problem with overconfidence is not the innate bias toward optimism that most people seem to possess. That’s a good thing it keeps the world moving forward.

The problem is the inability to temper optimism as a result of prior experience. The truth is, we don’t learn well enough from our mistakes. Consider this: If overconfidence is as big a problem as some say it is, it should be a short-term problem at worst. The learning process would ideally go something like this: “We think highly of ourselves, the world and events show us who the boss really is, and we become less confident and more realistic about our knowledge and skills.” Yet usually, this does not happen. Why? It seems to me that what we face as traders is that we fail to mix confidence with caution. It is when we are on a hot winning streak that we begin to think of ourselves and our trading as invincible. I can’t count the number of times I have seen traders make a few nice sized wins and then watched them drift into a state of euphoria thinking to themselves: “At last, I’ve found ‘the’ way to trade. They actually become giddy. They are so happy with themselves. But as the book of Proverbs so clearly states: “Pride goes before a fall.” Overconfidence leads to pride, even as far as arrogance. It is then when a trader must rein himself in and put up the wall of caution. When you are overconfident, you are ripe for a major setback in the market.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

BBY Trade

On 4th June 2018 we gave our Instant Income Guaranteed subscribers the following trade on Best Buy Co Inc. (BBY). Price insurance could be sold as follows:

- On 5th Jun 2018, , we sold to open BBY Jul 20 2018 62.5P @ 0.53, with 45 days until expiration and our short strike about 11% below price action.

- On 11th June 2018, we bought to close BBY Jul 20 2018 62.5P @ 0.20, after only 6 days in the trade for quick premium compounding

Profit: 33$ per option

Margin: 1250$

Return on Margin annualized: 160.60%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.