Edition 740 - August 17, 2018

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush keeps on hitting new all-time equity highs in 2018, get the eBook before its price hits a new all-time high too!

Marco Mayer is offering you a very special deal, so keep reading to the end!

You all know what’s going on from our regular Ambush updates and samples in Chart Scan. Correct, Ambush is hitting new equity highs again this year, just like it did in previous years.

I won’t go into too much detail here, but you can find out more on my Performance Page with sample portfolios and the long-term performance on each of the Ambush Markets!

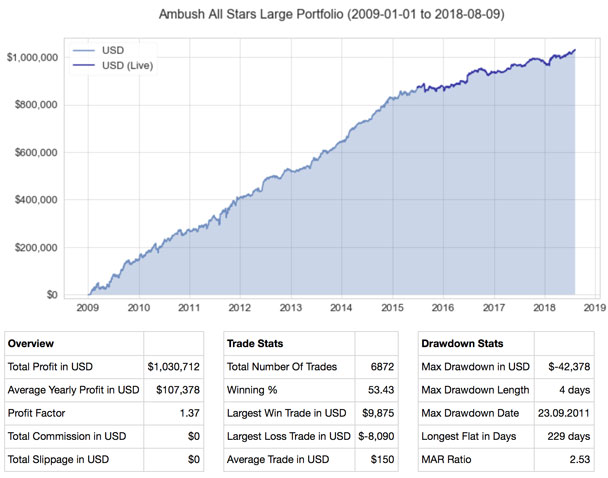

To give you an overall picture, let’s take a quick look at the Ambush All Stars Large Portfolio:

Ambush has been around for more than 10 years and that’s really exceptional for a trading system. Actually, it’s the only one I know that’s been around for that long. As markets tend to change, I review Ambush once a year for any necessary changes to adapt to changing market conditions. The last time any changes were required was back in July 2015! As you can see on the chart, Ambush kept on performing as expected since then in live trading. Those of you who have tried and followed other trading systems know how rare that is in the real world. Most systems (and traders) just implode once they “go live“. But Ambush kept on proving itself in a huge variety of markets like equity indices, currencies, bonds and commodities.

What happens when a trading system actually keeps on doing well in the markets over many years after it’s "live" while almost all other systems fail? That's right, it becomes more valuable. You obviously cannot expect to pay the same price for a trading system that just performed well in a backtest as for one that proved itself going forward.

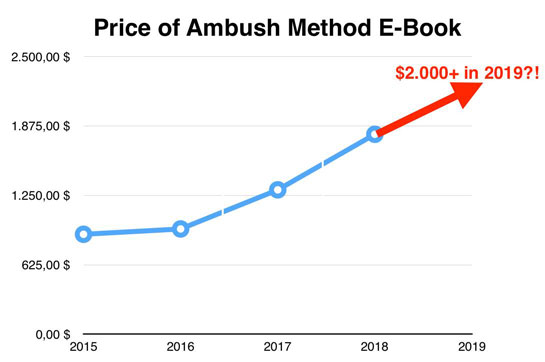

Because of this, over the years, we have regularly raised the price of the Ambush eBook. While it was available for just $899 back in 2015, it’s price more than doubled to $1,799 this year!

What’s next? Will its price crack the $2,000 in 2019? We can’t say for sure, but right now it looks like it might go well above!

Buying the eBook now will be a real bargain! But there's more. As traders, we know how bad it feels to have to pay a high premium because you missed out on an opportunity in the past. So here’s a very special offer just for you! Purchase today the Ambush eBook for 30% off, that’s over $500 and gives you the opportunity to purchase the eBook at the low price of 2017! Simply use the coupon code "Ambush30" during checkout!

Use Coupon Code, Ambush30, during checkout to recieve 30% off my eBook!

This is a rare special and it is only valid for a few days, August 20th. Hurry up and don’t miss out!

Happy Trading!

Marco

Feel free to email Marco with your trading questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Ledges

Some time ago I received a chart with the question: "Where is the ledge?"

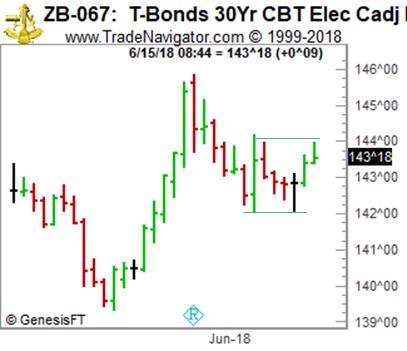

Below you see the chart with the ledge as I drew it. In order to understand the concept, you have to know how a ledge is defined within The Law of Charts In-Depth Webinar. A ledge comes when prices are trending or swinging. It consists of 4 to 10 bars, and has two matching or close-to-matching highs and two matching or close-to-matching lows. There must be at least 1 price bar between each of the matches. In the case below there were several bars between the matches. Entry is made when prices break out in the direction of the most recent swing or trend. Entry would be 1 tick below the low of bottom marker defining the ledge at 142^00. The matching lows were 142^02 and 142^01. The swing in this case was down from approximately 145^28 to 142^01.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Fighting Spirit

When trading the markets, you can’t merely sit back and wait for the profits to roll in. You have to take an active approach to trading. You must search the markets for new opportunities. That can mean looking through stacks of boring reports, scanning through a hundred charts, or working as an amateur specialist to see if anything can give you an insight as to how prices will move. If you want to trade the markets profitably these days, you have your work cut out for you. How can you get yourself motivated to persist in such a demanding, challenging field? There are three key strategies that can help you get motivated when you are feeling challenged or beaten down: (1) Cultivate a fighting spirit, (2) set up an alternative reward system, and (3) focus on the process not the prize.

Traders often walk a tightrope between arrogant and unrealistic overconfidence and feelings of incompetence and inadequacy. When we feel beaten down, we have a natural need to lift our spirits. Most people's confidence is severely shaken when frustrated. Their knee-jerk reaction is to feel arrogant overconfidence. They build themselves up to the point where they are unrealistically optimistic. But it is vital to remain realistic, ready to face setbacks head on and unafraid to look at your limitations. It’s better to cultivate a fighting spirit. What is a fighting spirit? When approaching a problem with a fighting spirit, you set a realistic course of action. You look at the reality of your circumstances and take an active problem solving approach to get ahead. One does not arrogantly believe that anything can be accomplished, but optimistically and realistically devises a plan to get ahead, and once a plan is set, a person with a fighting spirit works hard to make a plan come to fruition.

Although profits are an obvious and natural reward for trading efforts, they may not be forthcoming or closely tied to the amount of work we put in. A single-minded focus on profits is likely to impact your mood in adverse ways. Your mood will rise and fall with your profits and losses. Setting up an alternative reward schedule will provide more consistent rewards and will allow you to persist even when faced with a losing streak. Reward yourself after putting in a fair amount of time and effort toward achieving your goals (the end of each day, for example). Buy yourself a nice dinner or do something you find enjoyable. By patting yourself on the back for your efforts, you'll consistently feel satisfied with your performance, and this will keep you feeling optimistic and motivated.

Finally, it is essential to focus on the process, not the prize. Trading is about making money, but the irony is that if you focus on the outcomes of your trades, you'll put excessive pressure on yourself and choke under it. By focusing on intrinsic rewards, you'll feel more comfortable and creative, and trade more profitably in the long run. It may seem counterintuitive, but by focusing on the process of trading, rather than profits, rewarding yourself for effort rather than outcome, and cultivating a fighting spirit, you'll be willing to work hard and make huge profits trading the markets.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Example: Instant Income Guaranteed

CBD Trade

On 25th Jul 2018 we gave our Instant Income Guaranteed subscribers the following trade on Companhia Brasiliera de Distribuicao (CBD). Price insurance could be sold as follows :

- On 26th Jul 2018, we sold to open CBD Sep 21 2018 17.5P @ 0.20 , with 55 days until expiration and our short strike about 21% below price action.

- On 6th Aug 2018, we bought to close CBD Sep 21 2018 17.5P @ 0.10, after 11 days in the trade for quick premium compounding.

Profit: 10$ per option

Margin: 350$

Return on Margin annualized: 94.81%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Example: Develop a Trading Plan

The main message I want traders to understand is how important the disciplined execution of a well thought out trading plan is in today's markets. Nobody knows for sure what a given market will do next. Having a plan of attack will allow you to successfully cope with the uncertainty that is an inherent part of trading. I think it makes good common sense to have a well thought out plan of attack for trading all markets.

Make time to study and organize a trading plan for each and every trading day. This is a serious business that requires dedication and discipline to succeed. Arm yourself with the best tools you can find and make sure your own personal armor has no weak points. Trade with an objective of doing the right thing, which is sticking to rules!! Making money, which is a second objective, derives from sticking with your trading plan. Let your strengths be in that you are a trader who is able to take losses quickly and think defensively. Learn to use a time stop and if prices are not moving your way when you expect them to, get out. Also, be quick to take some profits when they are there but leaving the bigger part of your position in the market in case the move is strong in the direction you want it to go.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.