Edition 741 - August 24, 2018

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Several traders reached out asking to extend this sale past the summer, so we listened!

Until the end of September, use coupon code Ambush30 during checkout to receive 30% off Marco Mayer's eBook!

Check out Ambush's latest trade example and Performance Page!

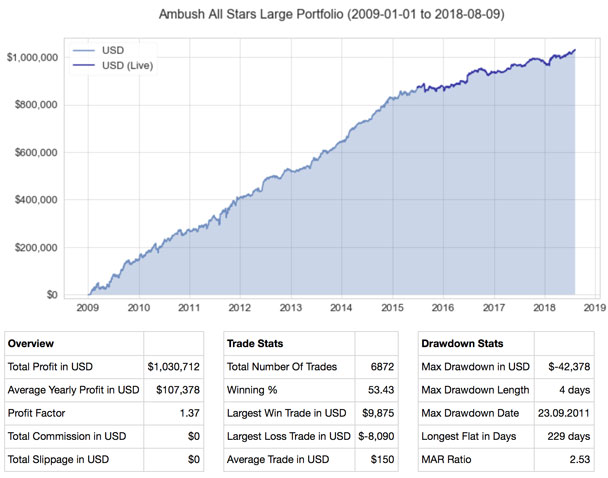

Ambush hits new all-time equity highs in 2018!

Ambush Trading Method is one of the longest standing and exceptional trading system, for over 10 years! Marco Mayer personally reviews his system annually to adapt it to the ever changing market conditions and his most recent change was in July of 2015. The chart shows that Ambush kept on performing as expected since live trading started. Those of you who have tried and followed other trading systems, know how rare it is in the real world. Most systems (and traders) just implode once they “go live“. Not Ambush, it proves itself in a huge variety of markets like equity indices, currencies, bonds and commodities.

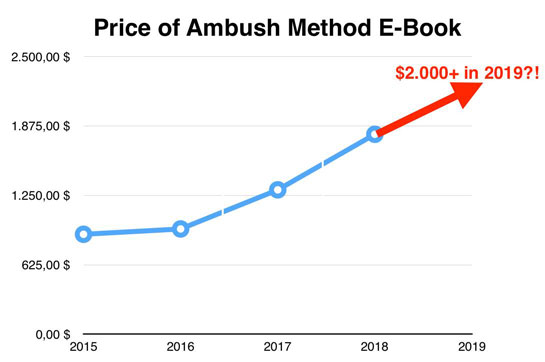

What happens when a trading system actually keeps doing well in the markets over many years after it’s "live" while almost all other systems fail? That's right, it becomes more valuable. Don't risk paying a higher premium for a trading system that proves itself going forward.

In 2019, my eBook may exceed $2,000. Did I read that right? Yes, you did! Take advantage of this savings to avoid paying a higher premium down the road. Purchase the Ambush eBook for 30% off, that’s a savings over $500 and gives you the opportunity to save money at the 2018 low, low price!

Use Coupon Code, Ambush30, during checkout to recieve 30% off my eBook!

I want to hear from you! Send me an email asking questions about the Ambush Trading Method., This email address is being protected from spambots. You need JavaScript enabled to view it.. It will be a good fit for you!

Happy Trading!

Marco

This promotion expires Septmeber 30th.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Series Probability

So, you had a winning day. What now?

I am so happy that at age 14, when I made the very first trade of my life, I lost! I lost my whole $60 — wow did that ever hurt. Along with it went some of my self-image, but the pain made me think, and put a caution into me that has never left, although I still regularly goof. I have a physical and medical excuse, but I never excuse myself and determine to do better.

But what about the times you win? What do you do with the euphoria that comes with a win? How do you handle that?

I can tell you for certain, winning is the most dangerous time in a trader's life. When you win, you are just as apt to make stupid changes as you are when you lose.

When you have a couple of losses in a row, you begin casting around for what you can change to take away the pain. I know. I’ve done it. But when you win is when you have a great tendency to throw caution to the wind. You feel like “king of the mountain,” and when that happens, a tiny but deadly gland that medical science has never discovered kicks in.

I call it the greed gland, and it secretes a substance that has a profound effect on human behavior.

The glandular secretion causes you to want more — greed. Greed can never get enough, so you increase your position size. You become more daring, and you overtrade — too big and too often.

However, this strange glandular secretion affects some other things in your human nature. One of them is pride. Yes, when the greed gland kicks in, so does the pride hormone. And in much the same way that a proud peacock puffs up his tail feathers, you, too, become puffed up. You become vain, and you think:

A saving grace in trading is learning to take advantage of series probability, which allow for you to enjoy a series of wins, provided you have an edge.

Prior to 1984, not all software had OHLC charts. Some still showed only the high, low, and close, and ignored the open.

A series can occur in just about anything that is measurable. For example, you can find series on charts that are comprised of nothing more than values produced by a random number generator.

The high-low-close chart above is a chart of random coin flips, proving that even randomly flipping a coin can have a series of wins or a series of losses. It is also convincing evidence of why you cannot afford to be cocky, because the series of wins was soon offset by a huge series of losses. :-)

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Dream Trade

When trading the markets, it's vital to stay grounded in reality. You can't get caught up in dreams. For instance, it may sound "easy" to people outside the profession to make money by trading Google, but there are a couple of real obstacles to taking home huge profits. First, risk should always be considered when making a trade, and while trying to manage risk, some traders would not want to take a certain trade. For example, 100 shares at $270 would cost $27,000. If you followed the guideline of risking only a small amount of capital on a single trade, such as 1-3%, you might want to stand aside on such a trade. The volatility may be too great and create too much risk, unless you have a large account. Other traders see diversification as essential for proper risk management. So even if the trade made a great deal of profit, in all likelihood, other trades in a portfolio may have lost money, creating less of a profit across a series of trades.

Getting caught up thinking about dream trades can be upsetting. At first you may realize that you are engaging in harmless fantasy, but at some point you may start believing that it's possible to make some of these dream trades. The mind has a way of thinking that fantasy is reality, but just because your mind can think the impossible can happen does not mean that dreams can become reality. It's better to realize that winning streaks go in cycles. You may run hot at times, but cold at other times. Occasionally, you may hit upon a big trade that makes up for months of losses, but you should not count on it.

It may be fun to dream of what might have been. If only we had a time machine to go back and make those trades that turned out to be huge winners, or a crystal ball to predict the next big trade, but in reality, trading is about working hard, making a series of trades, and patiently waiting for the profits to roll in. Profits don't always roll in when you expect them, but if you work diligently, they do roll in.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Example: Instant Income Guaranteed

MRVL Trade

On 6th Jul 2018 we gave our Instant Income Guaranteed subscribers the following trade on Marvell Technology Group (MRVL). Price insurance could be sold as follows:

- On 17th Jul 2018, on a GTC order, we sold to open MRVL Aug 17 2018 19P @ 0.15 , with 30 days until expiration and our short strike about 12% below price action.

- On 6th Aug 2018, we bought to close MRVL Aug 17 2018 19P @ 0.05, after 20 days in the trade.

MRVL went mostly sideways after our entry but we could still exit the trade fairly quickly thanks to time decay.

Profit: 10$ per option

Margin: 380$

Return on Margin annualized: 48.03%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Example: A True Passion for Trading

I believe that to be a truly successful trader you have to have a true passion for trading. This is probably true for any field of endeavor. I believe that the people who do best are not primarily motivated by fame, glory, respect, or status. They are driven by the pure love of the what they do. Winning traders, similarly, have strong interests in the markets, and this passion is the driving force that puts them at the top, year after year.

However, many wannabe traders come to the markets having deep-seated psychological problems and needs. For example: Needing money is not a good reason to take up trading. All too many novice traders show up at our doorstep having lost a job and wondering how they will be able to make a living. Many traders show up here with major ego problems making them overconfident, or just the opposite, with very little self-confidence, which causes them to fail.

Trading from a motive of “I have to make it as a trader” often leads to disastrous consequences.

When you have a true passion for trading, you will not stop trying until you finally succeed. You have to really love it. If you do, you will find ways to persist until you are on top.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.