Edition 742 - August 31, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Fibonacci Fallacy

For years I have been laughing about the Fibonacci ratios. Guess what? I'm still laughing. (I know I will make some enemies with this article.)

They are so predictable that you have to wonder why anyone wants to bother with them. But there are traders who care a lot about them, and they make a ton of money by trading them. Would you care to guess who that might be? [hint] It's not your average Fibonacci trader.

It is the market movers who make money from so-called Fib Nodes and the areas called "confluence." What a joke! But it is a sad joke for those unwary traders who are suckered into studying about the Fibonacci ratios.

Last Friday, I was working with a tutoring student, watching crude oil. There were some nasty economic reports and crude reacted violently, as did a number of markets.

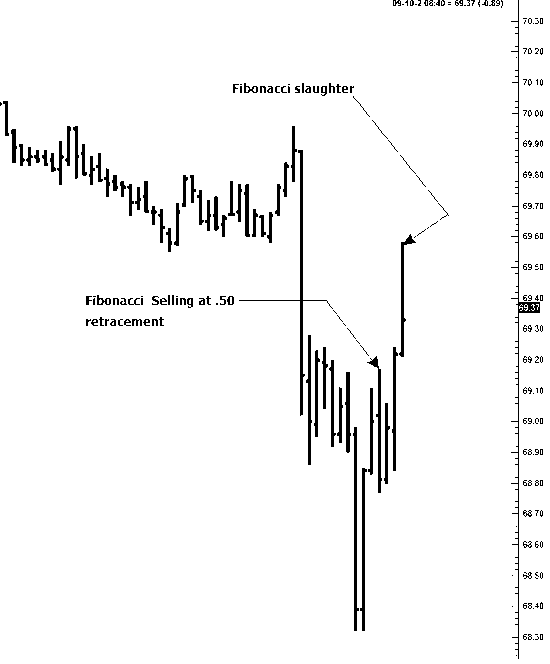

Prices more or less raced to a double bottom as you see on the chart. I said: "Watch prices retrace to the 50% mark and then, when the Fib traders go short, watch the market movers take them to the cleaners.

Prices dropped from 69.96 (3-minute chart) to the double low 68.32. A 50% retracement would take prices to 69.14 (69.96+68.32)/2.

Prices moved up from the double bottom to 69.14, and quickly ticked 2 ticks above a 50% retracement of the down-leg. You can see that in the first chart below. I can just imagine the Fib traders who were filled at 69.16 thinking they were filled two ticks better than they ought to be. Oh happy day, what luck!

Then, take a look at what happened once the Fib traders were suckered into the market.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Self-Sabotage

Every time Dino gets ahead as a trader, he sabotages his efforts. It comes about in many ways. He may feel guilty for getting ahead, and so distraught over his success that he doesn't pay attention to market conditions. This leads to a few bad trades, wiping out a month's worth of profits in a day. Other times he may seemingly forget to stick with his trading plan, which results in a significant setback. Then there are those times when he gets so ambitious that he abandons risk limits and strives for a return on his trades that is impossible to realize. He ends up mounting huge losses. He can't figure out why he would allow such mistakes to happen. He knows better but seems powerless to prevent his unconscious need toward self-sabotage to get the better of him.

Not everybody has a need to sabotage his or her efforts. Some people feel they deserve success, work assiduously to achieve success, and relish every victory. But other people let deep-seated, unresolved conflicts sabotage their best efforts. In her book, "Self-Sabotage: How to Stop It and Soar to Success," Martha Baldwin outlines the profile of a self-saboteur. Do you fit the profile?

According to Baldwin, a self-saboteur is motivated by fear, sorrow, hurt, isolation, abandonment, and anger, which often arise from the belief that it is vital to please others at the expense of one's own personal needs. The message the self-saboteur heard as a child and still lives by as an adult is, "Don't be who you are." The self-saboteur is afraid of fighting against his or her parents' wishes that were to completely satisfy their needs at the expense of his or her own. The mission of the self-saboteur is to thwart all efforts at success and independence. By staying inept and dependent, the self-saboteur will never threaten his or her parents and remain an innocuous, non-threatening do-nothing. Parental messages remain with the self-saboteur throughout his or her life. Self-saboteurs allow a part of themselves to criticize them. A cynical, fearful voice takes over, especially during stressful times. Rather than spurning the person to take action and make things happen, the voice tells them, “You’re no good, you can’t do this. You’ll never be successful at anything.”

Trading is a tough business. You don't need to sabotage your efforts; the markets will do that for you. If you let your hidden motives for self-sabotage take over during critical moments of trading, you are bound to make trading errors. Don't let self-sabotaging tendencies get the better of you. Be aware of your tendencies to give yourself pessimistic messages. Deep down, you may think, "I can't really be a success, so I might as well not try." There are many ways to avoid trying your best. You can neglect disciplined action, such as failing to make and follow a trading plan, or forgetting to monitor a trade and failing to see that the market has moved against you. Even apparently active efforts to win can be manifestations of self-sabotage. For example, you may decide to make a covert plan to fail. You may think, "I'll raise my standards and trade on a larger scale." On the surface, this looks like a strong drive to succeed, and it may reflect ambition, but only if you have the skills to make it become reality.

Don't sabotage your efforts. Acknowledge your tendency to thwart your efforts, especially when you feel stressed out. The best antidote to self-sabotage is to set realistic goals. When you set realistic goals, you will accomplish them and feel good about what you have done. And with these feelings of accomplishment will come an optimistic view of the future. There's no reason to get a swelled head or to trade impulsively. If you set specific, realistic goals, you will trade like a winner and quell the self-saboteur that lurks deep in your psyche.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Example: Instant Income Guaranteed

JBL Trade

On 13th Jul 2018 we gave our Instant Income Guaranteed subscribers the following trade on Jabil Circuit Inc. (JBL). Price insurance could be sold as follows:

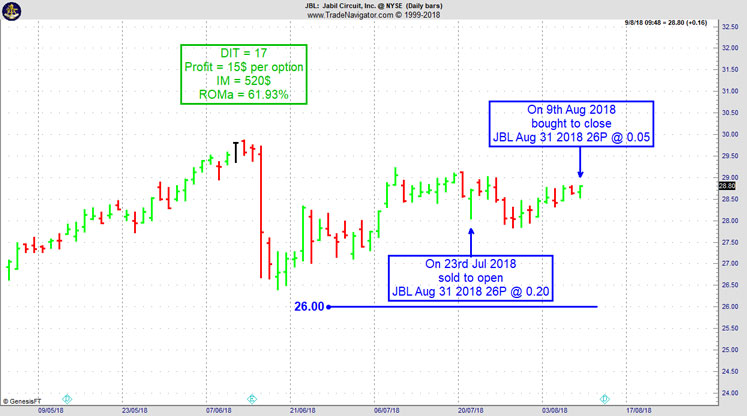

- On 23rd Jul 2018, on a GTC order, we sold to open JBL Aug 31 2018 26P @ 0.20 , with 45 days until expiration and our short strike about 9% below price action.

- On 9th Aug 2018, we bought to close JBL Aug 31 2018 26P @ 0.05, after 17 days in the trade.

JBL went mostly sideways after our entry but we could still exit the trade fairly quickly thanks to time decay.

Profit: 15$ per option

Margin: 520$

Return on Margin annualized: 61.93%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Enhancement – Mediation

As a professional trader, I try to enhance my trading on a daily basis. Learning how to trade is an ongoing process - a process that never stops. Those who know me or who have traded with me know that I am always looking for a simple and straightforward approach to trading. Yes, of course I am testing indicators, new chart patterns, new charting techniques, and anything else that is showing up on my desktop. But I have noticed that the main issue in trading is still “me”. The psychological aspect of trading is usually underestimated, especially by new traders.

During the next couple of weeks, I will present some ways of how I enhanced my own trading. Maybe you will like some or all of these ideas, and feel free to use them for yourself.

Meditation

Richard Wyckhoff wrote in his book Studies in Tape Reading: The tape reader evolves himself into an automaton which takes note of a situation, weighs it, decides upon a course, and gives an order. There is no quickening of the pulse, no nervousness, no hopes, no fears. The result produces neither elation nor depression. There is equanimity before, during, and after the trade.

It is crucial for a trader to be in a healthy state of mind during the trading session. I can tell you, it is not easy to stay at this high performance level all the time, especially after a few losing trades in a row. Meditation can help, and every trader should consider a meditation session on a daily basis. I am not talking about any religious meditation - I am talking about straightforward meditation to calm the mind.

Give it a try, and you will be surprised about how positively it will affect your trading!

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Use coupon code Ambush30 to receive 30% off Marco Mayer's eBook!

Check out Ambush's latest trade example and Performance Page!

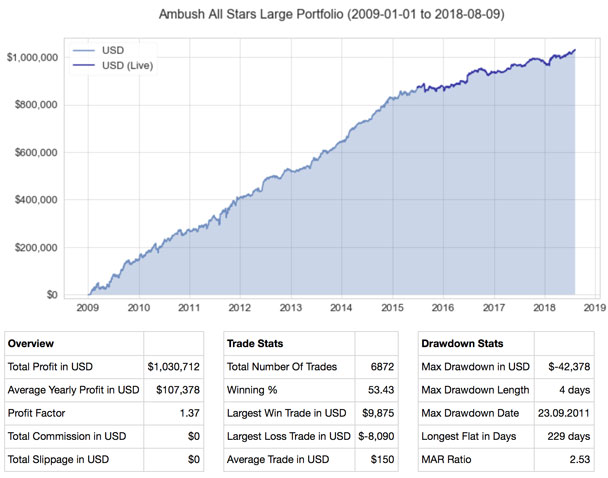

Ambush hits new all-time equity highs in 2018!

Ambush Trading Method is one of the longest standing and exceptional trading system, for over 10 years! Marco Mayer personally reviews his system annually to adapt it to the ever changing market conditions and his most recent change was in July of 2015. The chart shows that Ambush kept on performing as expected since live trading started. Those of you who have tried and followed other trading systems, know how rare it is in the real world. Most systems (and traders) just implode once they “go live“. Not Ambush, it proves itself in a huge variety of markets like equity indices, currencies, bonds and commodities.

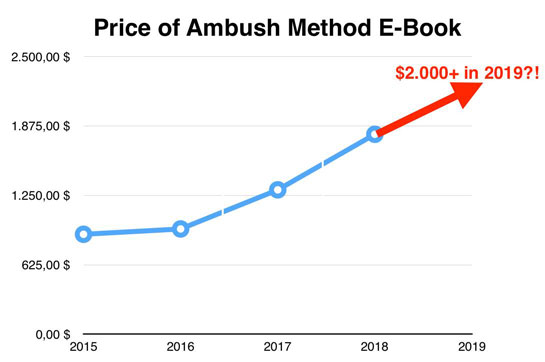

What happens when a trading system actually keeps doing well in the markets over many years after it’s "live" while almost all other systems fail? That's right, it becomes more valuable. Don't risk paying a higher premium for a trading system that proves itself going forward.

In 2019, my eBook may exceed $2,000. Did I read that right? Yes, you did! Take advantage of this savings to avoid paying a higher premium down the road. Purchase the Ambush eBook for 30% off, that’s a savings over $500 and gives you the opportunity to save money at the 2018 low, low price!

Use Coupon Code, Ambush30, during checkout to recieve 30% off my eBook!

I want to hear from you! Send me an email asking questions about the Ambush Trading Method., This email address is being protected from spambots. You need JavaScript enabled to view it.. It will be a good fit for you!

Happy Trading!

Marco

This promotion expires September 30th.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.