Edition 743 - September 7, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Lesson from the Past

"A chart is a chart, is a chart." If I kept count, I would guess this is the ten thousandth time I have spoken or written those words.

The chart I am showing you today presents a comparison between euro fx (the euro as traded in the futures market) and EUR/USD (the euro as traded in the forex markets). Notice the plural, "markets." There is no set single price for the euro among all of the banks that trade it. This is one of the differences between futures and forex. It is called transparency. In futures everyone sees the same price at the same time, give or take a millisecond. In forex, you see the price at the bank or banks where your broker places your order. Some brokers have a single-bank feed, and some have a blended feed. In any event, what you see is what you get, and it is what you have to trade. "Trade what you see" has been my motto for all of my trading life. After all, what else is there?

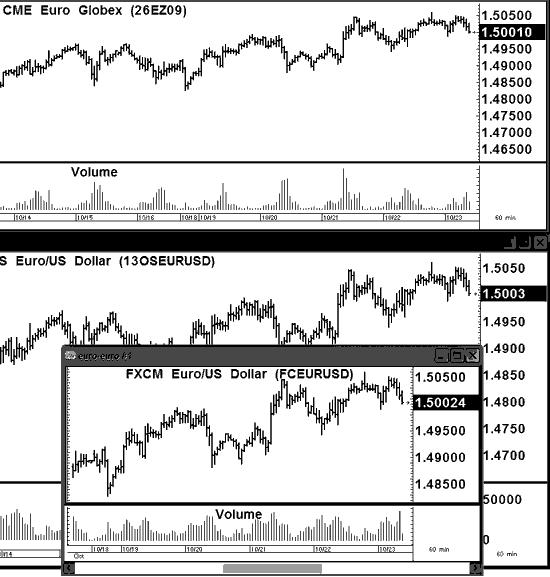

I have captured 3 screens simultaneously, so that you can see what I mean by a chart being a chart, and at the same time show you that there is no real transparency in forex prices.

The screen at the top is euro fx in the futures. The next screen down represents EUR/USD as presented by the GTIS data feed. Notice the price, 1.5003. The bottom inset screen is EUR/USD as presented by the FXCM data feed. There we see the price as 1.50024. To get an idea of what the price is on the GTIS data feed, we will have to add a digit. I will make a guess at 1.50030, but that is only a guess. For all I know, it could be 1.50039, or 1.50034, or something else.

So a trader using the GTIS data feed is seeing a different price from that of the trader viewing the FXCM data feed, whereas everyone viewing the futures chart sees 1.50010, no matter where on Earth they happen to be.

If you look closely at the charts, you will see that they look like triplets. There is very little difference in the way they look.

Both forex and futures represent a ratio spread, i.e., the euro divided by the dollar. At the time these charts were created – it took approximately 1.5 U.S. dollars to buy one euro. That made it expensive for U.S. citizens to travel to Europe, but easy for Europeans to travel to the U.S.

Here is another difference. Let's say I wanted to be long the yen and short the euro. Using forex, I would simply sell EUR/JPY – a ratio spread.

However, if I wanted to do that in the futures, I would have to buy the yen futures and sell the euro futures – two separate trades. Since all of the futures are denominated in U.S. dollars, the price I would see for the spread would be in dollars – a fixed value in terms of dollars, or $12.50/tick (the minimum fluctuation that prices can move). However, in forex the minimum fluctuation prices can move is called a pip, and the value of a pip can vary. Unlike a futures tick, a pip is not fixed in dollars.

There is one other item I will point out. When I chart the spread long yen, short euro, I can subtract the euro from the yen and see a differential spread, or I can divide the yen by the euro and see a ratio spread. So I can view the spread either way I choose, while still being long yen and short euro. The ratio spread yen/euro would approximate the spread EUR/JPY. The differential spread yen-eur would give me a different, but similar looking view.

All of the charts below are 60-minute. Have fun:

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Stay Calm

Charles is on edge. He isn't extremely uptight but he isn't completely calm either. He is just a little fidgety and it's getting to him. He is having a little trouble concentrating. He's reading charts incorrectly and he is having trouble outlining a trading plan. He can't figure out where to place his stops, where to enter or where to exit. Can you relate to Charles’ plight? There are times when you just can't calm down. Your physiology is elevated and you are restless and on edge. It's natural and understandable, though. When your money is on the line and you are fighting for your livelihood, you can't help but feel a little uneasy. There's a lot you can do to calm down in the midst of a storm of chaos.

Sometimes we get flustered and upset without our conscious awareness. It seems to have come out of the blue. There was probably something that started it, however. Maybe we remembered a set of past losing trades earlier in the day, or saw a media report on a stock we traded last year and lost. However, it happens, we end up on edge. How it happens may not matter in the end. All you know is that your physiology is elevated and you are ready to overreact to even a minor setback. What do you do at this point? You don't have to mull over the reasons why you are agitated. You can take decisive action to calm down.

Your mind and body are closely linked. When your body is energized, you look at your physiology and try to interpret it. Sometimes you feel hyped up, and rather than interpret your physiology as excitement, you may label it as fear, uncertainty and anxiety. The way you think about dictates how you feel about your physiology. If you feel fearful, it is because you are looking at your physiology and thinking that something bad is going to happen and you are not sure what you will do. To change your physiology, you have to change your thinking. When you are worked up, you can use it to your advantage. Rather than feel in a state of panic, you can reinterpret your high agitated energy level as excitement and start feeling enthusiastic about what you might want to do next as a trader. It may also be useful to cultivate a carefree attitude. You might think, "It doesn't matter what happens. I'm going to just do my best and pat myself on the back for whatever I accomplish.

It's easy to get a little uptight while trading, but it's all a matter of perspective. If you feel on edge, tell yourself encouraging thoughts to turn things around. By cultivating a winning attitude, you can feel calm during the storm and take home huge profits.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Example: Instant Income Guaranteed

ATVI Trade

On 22nd Aug 2018 we gave our Instant Income Guaranteed subscribers the following trade on Activision Blizzard Inc. (ATVI). Price insurance could be sold as follows:

- On 23rd Aug 2018, we sold to open ATVI Oct 19 2018 62.5P @ 0.55 , with 56 days until expiration and our short strike about 13% below price action.

- On 29th Aug 2018, we bought to close ATVI Oct 19 2018 62.5P @ 0.23, after 6 days in the trade for quick premium compounding.

JBL went mostly sideways after our entry but we could still exit the trade fairly quickly thanks to time decay.

Profit: 32$ per option

Margin: 1250$

Return on Margin annualized: 155.73%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Sometimes Others Get to Play and You Don’t

Sometimes in softball games, as a kid, they handed out the bats, balls and gloves, and there weren't enough to go around – so you had to sit it out. You had to sit on the bench and watch.

The same thing happens in trading. Sometimes you don't get to participate.

You must get used to the idea that sometimes you will sit in front of your charts for days or weeks, and nothing at all will happen. Others will have all the fun. There won't be enough bats and balls to go around. You will simply be warming the bench – watching.

In trading, you must be comfortable with this – welcome it. Make peace with this idea. Cross your arms and sit back. Wait for YOUR trades and setups, and don't get irritated by other traders. You cannot be in every trade. If you don't get your entry signal, there is nothing to feel sorry about if you miss a profitable trade. Sometimes it is just not your trade; others get to play and you do not!

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

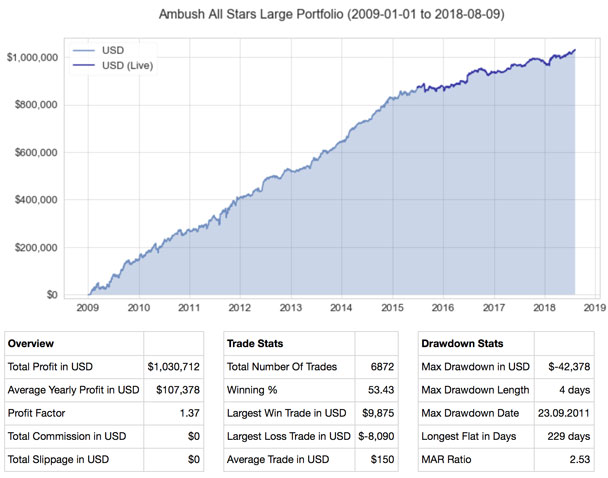

Ambush hits new all-time equity highs in 2018!

Did you check out Ambush's latest trade example and Performance Page?

Ambush Trading Method is one of the longest standing and exceptional trading system, for over 10 years! Marco Mayer personally reviews his system annually to adapt it to the ever changing market conditions and his most recent change was in July of 2015. The chart shows that Ambush kept on performing as expected since live trading started. Those of you who have tried and followed other trading systems, know how rare it is in the real world. Most systems (and traders) just implode once they “go live“. Not Ambush, it proves itself in a huge variety of markets like equity indices, currencies, bonds and commodities.

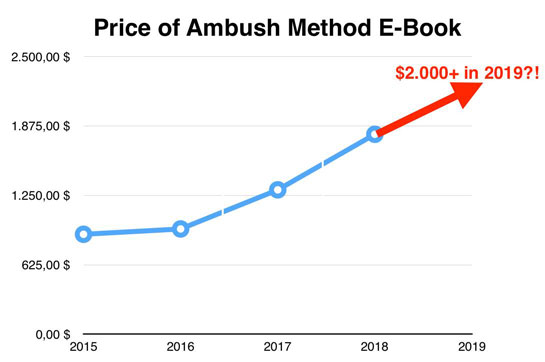

What happens when a trading system actually keeps doing well in the markets over many years after it’s "live" while almost all other systems fail? That's right, it becomes more valuable. Don't risk paying a higher premium for a trading system that proves itself going forward.

Use coupon code Ambush30 to receive 30% off Marco Mayer's eBook!

In 2019, my eBook may exceed $2,000. Did I read that right? Yes, you did! Take advantage of this savings to avoid paying a higher premium down the road. Purchase the Ambush eBook for 30% off, that’s a savings over $500 and gives you the opportunity to save money at the 2018 low, low price!

Use Coupon Code, Ambush30, during checkout to recieve 30% off my eBook!

I want to hear from you! Send me an email asking questions about the Ambush Trading Method., This email address is being protected from spambots. You need JavaScript enabled to view it.. It will be a good fit for you!

Happy Trading!

Marco

This promotion expires September 30th.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.