Edition 745 - September 21, 2018

Use coupon code Ambush30 to receive 30% off

Marco Mayer's Ambush Trading Method eBook!

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Hogs and Cattle

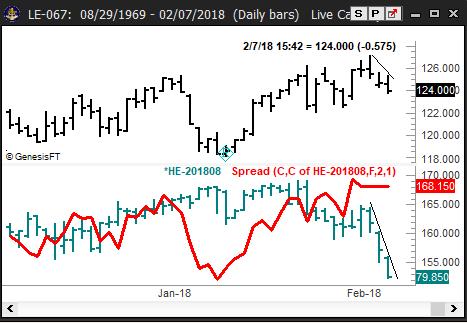

Four primary building blocks of Midwestern US agriculture are corn, soybeans, hogs, and cattle. But as winter draws to a close, how do hogs and cattle interact?

Because feed is both a primary and a variable cost of production, all livestock producers want to feed as many animals as possible when feed is most plentiful and therefore (usually) least expensive. So, the number of cattle on feed reaches a seasonal peak during and immediately after corn harvest in October/November. Similarly, even though hog production is now more concentrated in large commercial facilities that operate more steadily year round, those facilities tend to be as full as possible at harvest.

But hogs require less time to reach market weight. So, slaughter weights soar in October and marketing traditionally peaks at the end of corn harvest. Slaughter then begins a slow but steady six-month decline. But with retail pork demand greatest in July/August, the industry accumulates inventory during that seasonal decline in numbers. Steadily declining production and strong demand has tended to drive prices for summer hogs higher into April/May. In fact, July Hogs typically close higher in the 3rd week of April than on the last week of February.

In contrast, feeder cattle normally require four to five months after placement to reach market weight. Cattle placed in feedlots September-November will typically be ready for market January-April. But cattle in outdoor feedlots tend to gain weight more slowly during the cold of winter. That means slaughter more often remains moderate until early April — when it surges, only to peak in May/June. With beef supplies large after June and retail beef consumption lower during the heat of summer, cattle prices can suffer into spring. In fact, August cattle usually close lower at the end of March than at the end of February.

The net effect has been for summer-delivery hogs to outperform summer-delivery cattle in late winter and into spring. For example, the Long August Hogs/Short August Cattle spread has closed more favorably toward hogs in the 3rd week of April than on the last week of February more than 80% of the time. So, this is a high percentage winning trade.

The normal tendency for this spread has been to modestly favor hogs over cattle from December through January before leveling off for a few weeks in preparation for another surge in favor of hogs.

In fact, as I write this on February 7, the move may already be happening.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Easy Trading

Throughout the day you make everyday decisions that mean little to you. You drive your kids to school and along the way, you make a host of decisions about which route to take, where to turn, or when to stop off for gas. Each decision is made with little thought. Later in the day, you may decide to stop off at the supermarket. You decide what to buy for dinner and how much you will spend. Do you obsess over these everyday decisions? You probably don't. Why should you? What's the big deal? The implications of the decisions are almost nil. But tell that to someone with obsessive-compulsive disorder. They have a different perspective regarding the significance of such decisions. Even minor insignificant everyday decisions are a big deal to individuals with such an ailment. Aren't you glad that you don't have obsessive compulsive disorder? If you are a novice trader that has trouble making trading decisions a seasoned trader may think you have a kind of obsessive compulsive disposition.

Traders can often take the decisions they make during the trading day too seriously. It's natural. When your money is on the line, you can't help but worry about losing it, and you want to protect it, even if it means obsessing over minor details or reacting with extreme emotions. Some people even personify the markets by viewing a trading decision with the same emotional intensity as they do with their interpersonal relationships. In "Trading in the Zone," for example, Mark Douglas points out that traders often equate losses in the markets with their parents punishing them for breaking rules. When the markets are viewed in this way, losses take on a great personal significance. But it doesn't help to make such a big deal of things.

It's much better to take a more detached, objective approach. How can you do it? First, don't think about, or obsess about, the outcome of a single trade. Think of the bigger picture. You may lose on a single trade, but across a series of trades you will come out ahead, if you have a trading strategy that has a high probability of success. Successful traders plan on executing many trades, rather than just a few key significant ones. As they trade, they know that not all trades need to be winners in order to increase the equity in their accounts. It's your success overall that counts. Keeping this fact in mind takes some of the pressure off. Second, it is vital to use proper risk management. Successful traders risk only a small percentage of their trading capital on a single trade. Limiting the risk on a single trade further relieves some of the pressure to feel that every trade needs to be a winner, and thus, some of the personal significance is reduced.

There's no need to treat each a trade with great personal significance. By limiting the amount of capital you risk on a trade, the actual consequences of the trade are limited, so what's there to worry about? You might as well trade free and easy.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

CF Trade

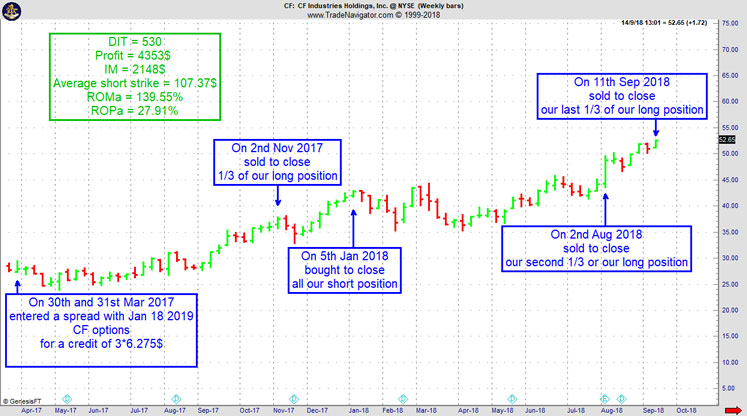

On 30th March 2017, we gave our Instant Income Guaranteed subscribers a trade for CF (CF Industries Holdings Inc.), which was showing accumulation on a pullback on the weekly chart.

We entered a "complex position", entered for a net credit (still working with Others People Money (OPM), i.e. other people's money, as usual), but with unlimited upside potential.

-

On 30th and 31st March 2017, we entered the trade for an average credit of 6.275$ (or 18.825 for 3 positions)

-

On 2nd November 2017, we closed one third of our long position

-

On 5th January 2018, we bought to close all our short position

-

On 2nd August 2018, we closed the second third ofour long position

-

On 11th September 2018, we closed the last third of our long position

Profit: 4353$

Margin: 2148$

Average Short Strike: 107.37$

Return on Margin annualized: 139.55%

Return on Principle annualized: 27.91%

We stayed 530 days in the trade, but the annualized returns were on the high side and all we had to do was to maximize our profits along the way, by being patient.

This was a low maintenance, low stress trade with lots of upside potential.

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Being Flexible

By being flexible I mean that over time, your trading philosophy will undergo changes. These changes are brought about because of external events (economic considerations, natural disasters, political events, etc.), and because of internal events, usually my own mistakes.

My views change as economic, political, and technological changes occur both on and now off our planet. My views change as I see the market change. It is imperative that I be willing to change my thoughts and actions to meet new conditions. So, I am always looking to adapt my trading to the market conditions. Example: In recent years, markets failed to trend as long and as far as they used to. These days, primarily because of computerized trading, markets tend to swing between perceived over and under valuation. If I hadn’t adapted to this reality, I would long ago have lost my money and probably would no longer be trading.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush Traders keep on profiting big time from stock market uncertainty!

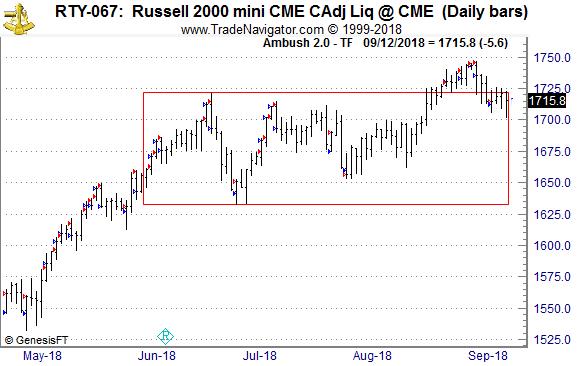

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the Russell 2000 mini Future (RTY) traded at the CME, where Ambush Traders are having a really nice time lately. Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day!

Many of you might remember that back in July we talked about the uncertainty in the stock markets and how well that worked out for Ambush Traders. Since then about two months have passed and guess what, not too much changed! After the Russell 2000 tried to breakout of its trading range, it’s now back inside it and is trading at about the same price as it has been two months ago. At the same time Ambush keeps on hitting those market turning points that are driving other stock market traders crazy…

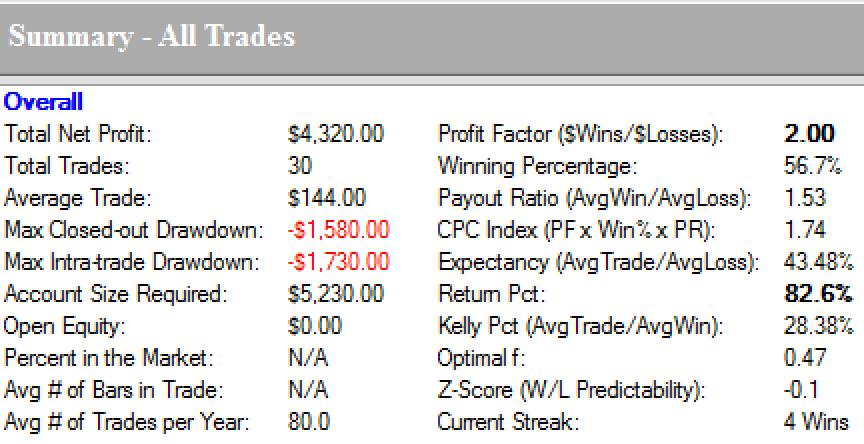

Here’s the result of all of the trades shown on the chart, trading one Russell 2000 mini (RTY) contract, including $10 commissions per trade:

Yes, that’s a profit of $4320 with a profit factor of 2.00!

Let’s face it, you don’t want to be on the one caught on the other side of these trades. Also if you’re actively day trading by getting in and out of the market all day long, honestly ask yourself if that’s worth your time? And are you actually doing better than this? With Ambush you’re day trading without even having to be there during the day!

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals.

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook. We currently have a special running for the eBook. You can get it 30% off, that’s over $500! Simply use the coupon-code "Ambush30" at the checkout.

Did you check out Ambush's Performance Page? For over 10 years, Ambush Trading Method is one of the longest standing and exceptional trading system in markets like equity indices, currencies, bonds and commodities.

Use coupon code Ambush30 to receive 30% off Marco Mayer's eBook!

I want to hear from you! Send me an email asking questions about the Ambush Trading Method., This email address is being protected from spambots. You need JavaScript enabled to view it.. It will be a good fit for you!

Happy Trading!

Marco

This promotion expires September 30th.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.