Edition 746 - September 28, 2018

Marco Mayer's 30% Off Special Ends this Monday!

Ambush Trading Method eBook

Don't miss out, scroll down for more details!

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Basic Law of Charts 1

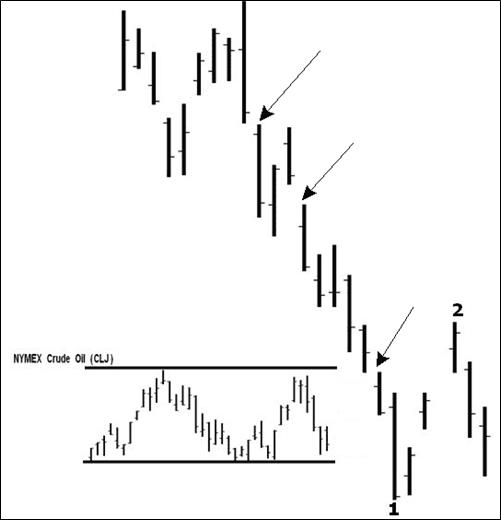

Crude Oil Inventories came out unexpectedly low one week. The weekly chart (Inset) shows Crude Oil in a trading range for several months, with prices at that time near the low of the range. The daily chart had produced #1 and #2 points of what may have turned out to be a 1-2-3 low formation. The #2 point was created when there was both a lower high and a lower low on the chart. According to the Law of Charts, what will it take for the #3 point to be in place? The answer is we would have to see a daily bar or combination of daily bars that make both a higher high and a higher low. Traders of Crude Oil would have been on alert. The 3 arrows point to classical chart analysis gaps: breakaway, runaway, and exhaustion, indicating the downward move would soon be over.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Talk to Yourself

Yesterday, Jack went over to his best friend Tom's house to look at his new Porsche Turbo. Jack has wanted a Porsche since he was a teenager but could never afford one. Four years ago he taught Tom how to trade. Tom's been doing great ever since. Each year he has made greater and greater profits, even during bear markets. Jack can't help but envy Tom's success, yet at the same time, he berates himself for failing to do as well. He thinks, "What am I doing wrong? I taught this guy how to trade. How can he be doing so much better than I am? It just isn't fair. I should just give up." Have you ever felt like Jack? You look at your friends and can't believe how much better they are doing. Soon, you're so upset that you can't face another trading day. You may make a solid $200 on a trade, but think, "I'll never reach my financial goals at this rate." When you are so consumed with envy that you're beating yourself up for failing to meet your performance standards, it's time to take action.

The reactions to certain events can seem to come out of nowhere. We can be happy and content one minute, and suddenly disappointed when faced with a setback. It can happen quickly, instantly without thinking. It's important to get back on track when this happens, however. Although it may seem that our emotions happen automatically, they don't. We quickly think things through, and it's our thoughts that lie behind our emotions. For example, when we are envious of what others have, and feel disappointed with our lives, it is all because we believe that we should succeed. We believe that we should be doing as well as others. We believe that it is our right to do well. We feel entitled and disappointed by life when we discover that we are not living up to our expectations. It's natural to feel this way. In today's culture, the virtues of ambition and success are touted with almost every commercial, every movie, and page after page of print ads. If you work hard, you deserve wealth, fame, and respect.

It would be nice if life always worked that way, but it doesn’t. In the trading realm especially, sometimes our hard work pays off, but many times it does not. When you feel envy, or disappointment, it's useful to pull out a list of sayings that changes your perspective and restores your enthusiasm and mental edge. What are some of these statements? Consider some of our favorites: "Run your own race. Don't let your net worth determine your self-worth. Focus on the process, not the prize." Say these and other positive affirmations out loud to yourself. We've written articles on each of these slogans. In summary, "run your own race," refers to the idea that comparisons to others are unproductive. Everyone has his or her own resources and talents. Some people start out ahead in ways that you are unaware of, so if they do better than you, there is no reason to think that you are doing poorly; they are merely doing better than you because they have more resources. You don't have to compete with others. All you have to do is run your own race.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

APA Trade

On 5th September 2018 we gave our Instant Income Guaranteed subscribers the following trade on Apache Corporation (APA). Price insurance could be sold as follows:

- On 6th September 2018, we sold to open APA Oct 19 2018 37.5P @ 0.29, with 43 days until expiration and our short strike about 15% below price action.

- On 14th September 2018, we bought to close APA Oct 19 2018 37.5P @ 0.10, after 8 days in the trade for quick premium compounding.

Profit: 19$ per option

Margin: 750$

Return on Margin annualized: 115.58%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: The Ideal Parameters for Successful Trading

- Your trading goals and objectives must be possible to complete. They cannot be too abstract or too high. It is best to just execute a trade rather than being overly concerned with profits or achieving unrealistic performance standards.

- You must be able to intensely concentrate on what you are doing. While trading, it's vital that you have a detailed trading plan and control risk so that you can focus on monitoring the trade. Do not allow interruptions or anything that takes away your focus.

- You must maintain control over any psychological conflicts you may have as well as keeping control over those things that cause you stress. Nothing can be allowed to interfere with your concentration.

- Your trading must have clear goals and immediate feedback. A detailed trading plan helps you keep the goals clear. Similarly, the proper signals specified beforehand allows for immediate feedback.

- You must strive for deep and effortless involvement. Work on becoming so deeply involved in your trading that the everyday worries of life tend to be cast aside.

- Maintain a decisive sense of control over all your actions.

- Become so focused on your trading that you are no longer self-conscious; there is no self-doubt or self-reproach. Just focus on your trading.

- Be so intent that time seems to just slip away. You want the hours to go by like minutes.

- To have the kind of focus and intensity I just described, plan on trading only in very short intervals. You are human, not a machine. A period of 45 minutes of intense focus has proven to be best for most traders. Take a break of at least 5 minutes before you go back to trading.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Use coupon code Ambush30

to receive 30% off Marco Mayer's eBook!

Ambush Traders keep on profiting big time from stock market uncertainty!

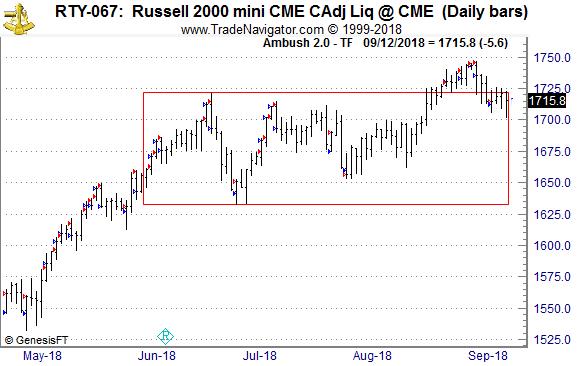

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the Russell 2000 mini Future (RTY) traded at the CME, where Ambush Traders are having a really nice time lately. Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day!

Many of you might remember that back in July we talked about the uncertainty in the stock markets and how well that worked out for Ambush Traders. Since then about two months have passed and guess what, not too much changed! After the Russell 2000 tried to breakout of its trading range, it’s now back inside it and is trading at about the same price as it has been two months ago. At the same time Ambush keeps on hitting those market turning points that are driving other stock market traders crazy…

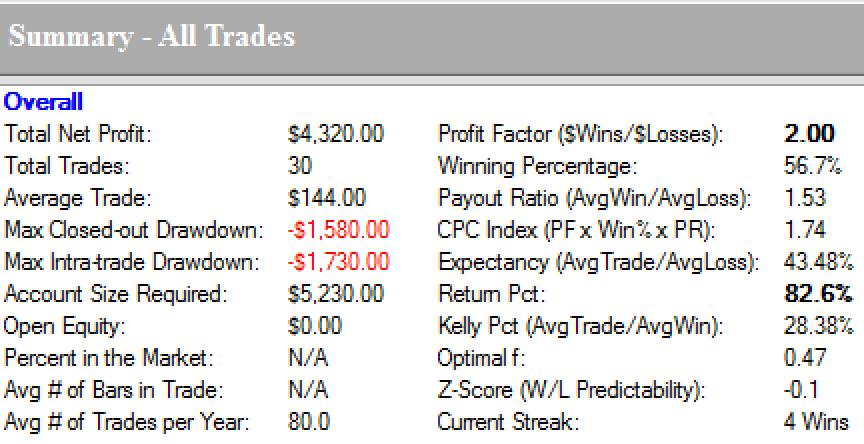

Here’s the result of all of the trades shown on the chart, trading one Russell 2000 mini (RTY) contract, including $10 commissions per trade:

Yes, that’s a profit of $4320 with a profit factor of 2.00!

Let’s face it, you don’t want to be on the one caught on the other side of these trades. Also if you’re actively day trading by getting in and out of the market all day long, honestly ask yourself if that’s worth your time? And are you actually doing better than this? With Ambush you’re day trading without even having to be there during the day!

Use coupon code Ambush30

to receive 30% off Marco Mayer's eBook!

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals.

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook. We currently have a special running for the eBook. You can get it 30% off, that’s over $500! Simply use the coupon-code "Ambush30" at the checkout.

Did you check out Ambush's Performance Page? For over 10 years, Ambush Trading Method is one of the longest standing and exceptional trading system in markets like equity indices, currencies, bonds and commodities.

Use coupon code Ambush30 to receive 30% off Marco Mayer's eBook!

I want to hear from you! Send me an email asking questions about the Ambush Trading Method., This email address is being protected from spambots. You need JavaScript enabled to view it.. It will be a good fit for you!

Happy Trading!

Marco

This promotion expires September 30th.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.