Edition 747 - October 5, 2018

EXTRA! EXTRA! READ ALL ABOUT IT!

PROFESSIONAL TRADER ANDY JORDAN HAS RELEASED A NEW PRODUCT AND IS OFFERING A LIMITED TIME FREE TRIAL!

CLICK HERE - TRADERS NOTEBOOK LIVE TRADING ROOM!

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Basic Law of Charts 2

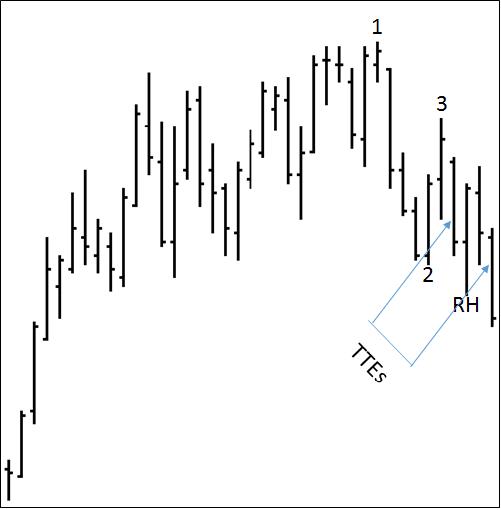

The chart below shows a situation that comes up from time to time. The chart was sent in by one of our students, along with some questions.

First: Was that a 1-2-3 high formation? Answer: Yes!

Second: Do the arrows point to Traders Trick Entries? Answer: Yes!

Third: Would you have lost money had you gone short? Answer: that depends on your management. Certainly there was sufficient room in the trade for you to have covered costs, taken a profit, and moved your stop to breakeven.

Fourth: Was the Traders Trick from the 1-2-3 formation still in effect based on the third bar following the bar marked "3?" Answer: Yes and No!

Why Yes? Because the outside bar, the second bar following the bar marked "3," is actually a Ross Hook.

Why No? Because the fact that there is a Ross Hook means there is no need to perceive the Traders Trick Entry as being based on the 1-2-3 formation. I know that at first glance, on an unmarked chart it appears (if you didn't see the Ross hook) that the Traders Trick Entry based on the 1-2-3 formation might still be in effect.

If the bar marked "Rh™" had a low equal to or higher than the first bar following the bar marked "3." it would have indeed rendered the second Traders Trick Entry to be in exactly the same place as it is shown by the arrow on the right.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Chess and Trading. What do you think?

Although I haven't the faintest idea of how to play chess, it certainly seems like a great idea. I imagine you can improve stock and futures trading by learning how to play chess. It might also help to develop an interest in physics. Every trader should learn to develop his problem-solving and pattern recognition abilities. I’ve been told that nothing does this better than learning how to play chess. Some of the first computer algorithms were designed to play chess. Just as chess taught the computer how to think, it seems likely chess can teach traders how to think more logically and effectively. Chess is something that might be taught in the first grade through high school in all schools to help children develop problem-solving abilities, and to create self-confidence and self-reliance. Chess, when taught to under-privileged children, was responsible for the greatest overall grade improvement for all students on all levels. Of course no one knows for sure what the social impact of such a plan might be. What about the kid who really has trouble seeing ahead; kids who have dyslexia like me? Pattern recognition is the key to understanding bar chart structure. Variations of similar patterns are constantly occurring in the markets. Prices move either up or down 100% of the time. Truly, prices do not move sideways. Markets move sideways, not prices. If a price moves, by definition it is either up or down. If a price ticks sequentially more than once at the same price, it hasn’t move at all. Sideways for the market indicates virtually all price movement within a certain range. A key to correct technical analysis is simplicity; breaking the market down to its basic price structures for comparisons of highs, lows, opens and closes within various time periods. Profitable trading can be derived from recognition of simple recurring price patterns based on the action, reaction, and interaction of market perception.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

UAA Trade

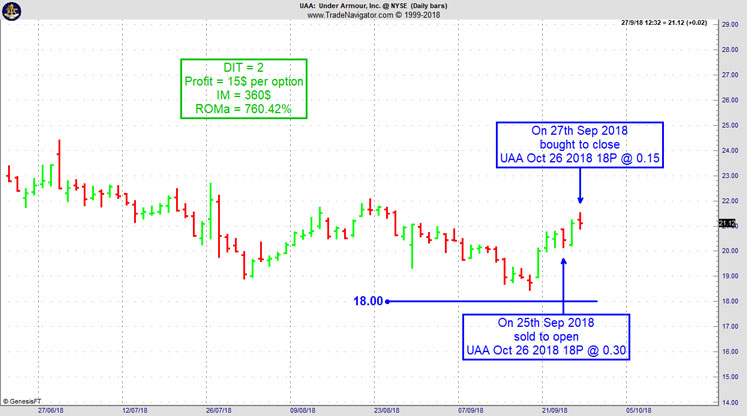

On 24th September 2018 we gave our Instant Income Guaranteed subscribers the following trade on Under Armour, Inc. (UAA). Price insurance could be sold as follows:

- On 25th September 2018, we sold to open UAA Oct 26 2018 18P @ 0.30, with 31 days until expiration and our short strike about 13% below price action

- On 27th September 2018, we bought to close UAA Oct 26 2018 18P @ 0.15, after 2 days in the trade for quick premium compounding

Profit: 15$ per option

Margin: 360$

Return on Margin annualized: 760.42%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: How to handle fear?

Let’s get one thing straight. Fear, for the majority of traders is a very real thing. You have it, I have it. Others have it as well.

In order to become a professional trader, you must learn to deal with fear. The first step is to acknowledge that you have, which is what you have done. Once you admit to fear, you can begin to deal with it.

When you notice the impulse to trade based on strong fear, it is usually best to literally step out of the trap by stepping out of the situation.

You need to get up, walk away from the computer. Turn off the television, take a walk, get something to eat, go outside and cut the grass, water the lawn, or do anything that will move you out of the fear/panic mode.

Don’t return to your trading desk until you have managed to achieve some emotional control over your fear/panic reaction. If you can’t get a grip on your fear, then don’t come back that day.

Most likely you will find that even if you keep thinking about the miserable market conditions while you water the lawn, simply getting away from the keyboard and monitor is enough to make a difference. It removes the demand to take action and gives you the mental space to gain perspective and let go of your impulsive, fear-based reaction.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Article: Everybody gets what they want out of the market

This is one of the quotes about trading that stuck with me. I googled it and it's from Ed Seykota, I probably read it in one of the Market Wizards books, which I can highly recommend.

The exact quote is “Win or lose, everybody gets what they want out of the market. Some people seem to like to lose, so they win by losing money.”

Now this applies especially well to the retail world of traders. And it's one of the first things I tend to ask when coaching someone: "Why are you trading". Now of course the answer "to make money" is the one that comes back the most often. And to be honest it should be the #1 motivation, even though it helps tremendously if you enjoy trading and especially the process of research and development to gain an edge in the markets.

But what are you really in for? I know for sure that many traders out there are just trading out of fun. For whatever reason they're bored and need some excitement in their life. Or they're just gamblers who could also have ended up in Poker or sport bets. Then they'd get ripped by the professional poker players out there...

So really ask yourself why you're trading or why you want to get started. Do you really want to learn a new, complex and difficult business from scratch? One where you're competing against some of the smartest and most competitive people in the world? You're ready to put in the time, nerves and money needed to get started the right way and keep on going even though the market shows you the finger again and again?

If so congratulations! So far I haven't found another profession that's as challenging and interesting day in and day out as trading. I love waking up and knowing what I'm up against. Knowing I might find a new little edge today in the markets. Going through my trading routine and enjoying the freedom trading provides. It's also one of the most scalable businesses out there and it has many other advantages...but to make it here as in any business you'll need to do some hard work that isn't always exciting.

Now if you're just in for the exciting ride, that's fine too! As Seykota said, "Everybody gets what they want out of the market". If you want a fun ride, you'll get it, again and again. Just put in some trades because "the market looks like it's going up", leverage up those positions and then watch every tick on the chart while keeping a close eye on your P&L. Sure you'll blow a few grand every now and then but that's simply the cost you pay for the ride. Just be honest to yourself and simply enjoy it! We're happy about you providing us liquidity just where we might need it ;)

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.