Edition 749 - October 19, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

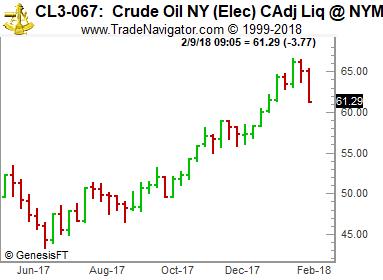

Chart Scan with Commentary: Crude Oil

Hey Joe! What’s your take on crude oil? Will it recover from the recent leg down?

I’m not a prophet, but for now it looks to me like profit taking time, as longs sell out their positions to cash in on the previous move up.

At some point, oil will price itself "out" of business, at least to the extent it is currently "in" business. If economies crash due to the high price of oil, there will be less demand. The high prices spur governments and industry to look for substitutes. Alternatives to crude suddenly become quite reasonable in price. Together, all factors work towards lower oil prices, whenever crude becomes relatively expensive.

It seems that on any chart of crude there have been numerous chances to employ The Law of Charts In-Depth Webinar. Since the week of June 23, 2017 crude has mostly trended, eventually becoming a genuine bull market as can be seen on the weekly chart. At this point the one-week move down is nothing more than a correction.

Traders have the mistaken idea that if they have a small account, they must trade from very short-term charts. It is my firm belief that such thinking is wrong. It is a common misconception that if you use a larger time frame, you have to take a bigger risk. If your trading setup is correct, the move in the larger time frame chart is going to be much more explosive than it is from a similar move in a smaller time frame.

I have had no trouble day trading from weekly and daily chart signals, while at the same time keeping my risk very low. There need not be a relationship between risk and time frame for a day trader. Whether you trade a 1-minute chart or a 1-week chart, if you are a day trader you are going to be out by the end of the session in which you are trading. The lines between day trader and position trader are not nearly as clear as they used to be. With trading sessions lasting throughout the night, what exactly is day trading?

Once you decide how much you are willing to risk on a trade, what difference does it make from which time frame you trade? One of the best trades I witnessed last year was done from a weekly bond chart with a risk of only $200. The single most important item in any trade is risk. Risk must always be determined before the trade is entered. Sadly, many, if not most, traders fail to assess risk before they enter.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Making Progress

Learning to master the markets can sometimes seem like climbing a tall mountain: You know it can be done, but you don't know how to do it, or whether you could do it if you had to. The task may seem insurmountable, and as you think about it, daunting. Fully mastering the markets takes time; time is needed to gain the vast experience required to trade in a variety of market conditions, and the advanced skill set required takes a great deal of practice. Rather than tackle the experience all at once, however, it is more useful to pick a few key trading strategies, identify the market conditions where they perform optimally and trade under these ideal conditions to build up trading skills and confidence. Rather than strive for instant success, it's better to make sure and steady progress.

There are benefits in taking it slow when it comes to learning how to trade. It's essential that a novice trader build up a sense of confidence with a few key strategies. Psychologists refer to this process as building up self-efficacy beliefs. Self-efficacy is different from self-esteem. A person can have low self-esteem yet believe that he or she can perform a specific task under a specific set of circumstances with a feeling of self-efficacy. Similarly, a beginning trader may believe that he or she is an average trader but has specific abilities when trading a particular trading strategy under specific market conditions. For example, suppose you know you can trade in a bull market using just a few key signals. It may be useful to trade this strategy at the start of the trading day. There's a good chance that you'll achieve success and feel good about your initial abilities. In other words, you'll feel a sense of self-efficacy. Now, you may also know that should market conditions change, you are better off standing aside.

Research on self-efficacy has shown that when people believe they have self-efficacy regarding a specific set of skills, they set challenging goals, show unfailing persistence, experience pleasant moods, and can easily handle stress. These characteristics are conducive to profitable trading. Anything you can do to increase self-efficacy will help you master the markets and achieve long term profitability. The two most obvious ways to increase self-efficacy are to start off trading with methods you have mastered so that you meet with initial success and increase your feelings of efficacy, and to practice and gain experience as a trader. The more success you achieve, the greater your self-efficacy, and the more likely you'll be able to trade in a greater variety of market conditions and persist until you achieve consistent profitability. So don't be overly ambitious. Set realistic goals, achieve initial success, and build up your sense of self-efficacy. The greater your self-efficacy, the better you will succeed in the markets.

Let me give you an example. Pete was only a breakeven trader after 22 years trying to make a living trading in the markets. He never seemed to be able to make that important breakthrough that would enable him to trade for a living. That’s when he came up with a simple trading idea that enabled him to achieve success.

Pete liked to trade options, but the many different option strategies did nothing more than complicate his trading. From trading complicated option positions in the futures markets, Pete switched to trading stock options. Changing markets was a good way to get a fresh start.

Pete then did a very simple thing. He decided to sell covered calls only on stocks that were rising. Bingo! He began making money. Selling covered calls exactly fit his efficacy profile. There’s virtually always something that is going up, even in bear markets. Although the choices are fewer in a bear market, the excessive price of all options—calls and puts rise due to a rise in volatility. After all those years of trying, Pete found his way to trade. He is now a full-time professional trader.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

EWZ Trade

On 2nd October 2018 we gave our Instant Income Guaranteed subscribers the following trade on iShares MSCI Brazil Index Fund (EWZ). Price insurance could be sold as follows:

- On 4th October 2018, we sold to open EWZ Nov 16 2018 28.5P @ 0.29, with 42 days until expiration and our short strike about 20% below price action.

- On 8th October 2018, we bought to close EWZ Nov 16 2018 28.5P @ 0.11, after 4 days in the trade for quick premium compounding

Profit: 18$ per option

Margin: 570$

Return on Margin annualized: 288.16%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Many Kinds of Emotions Go with Winning and Losing

Once a trade is entered, there are two possible outcomes: Win or lose. Between the two is the breakeven point, and because it is in-between, it’s psychologically significant. Losing is involved with fear and hope. Winning is involved with greed.

When on the losing side of a trade, the breakeven point is a place that inspires hope. Being human we have a natural tendency to avoid risk and loss. When in the agony of a losing trade, we tend to hold on and hope that the losing trade will turn around and return to the breakeven point, where there may be no profits, but at least there are no losses. But hoping often leads to losses in the end. Hope has no place in making trading decisions. The entry point and the protective stop should be determined before putting on a trade. When this is done properly, there is no reason to let hope, or any other emotion, influence your trading decisions. You should trade almost mechanically. If the trade goes against you, simply exit once the stop price is hit. Don't let hope play a role in your trading plan. There are many good reasons to cut your losses, rather than hope for the losing trade to turn around.

The point of view a trader has from a winning trade is quite different. When in a winning trade, a lot of traders tend to take all their profits too early, again because they are averse to risk and potential loss. By exiting the entire position too early they don't let their profits run. This limits the size of the winning trades, so that across a series of trades, the overall profit is greatly lessened. But there's a way to lock in profits, let the trade run a little longer, and pile on a little more profit. Once the profit exceeds the initial stake, a stop can be placed at the breakeven point. This strategy lets you lock in some initial profits while virtually eliminating risk. The most you can lose is commission costs. Besides reducing financial risk, the emotional stress is also eliminated. And reduced stress means you can evaluate the bigger picture more objectively.

Unfortunately, many novice traders are so consumed with capturing a profit and showing a good profit/loss statement that they cannot follow through with moving the stop to the breakeven point. They feel the strategy inhibits them and may limit their potential profits. They wrestle with moving the stop back to its original point, where they entered, or simply canceling it altogether. This can be disastrous to a trading account. Stops should never be changed to a more harmful position or canceled altogether. Such practices will stir up emotions that adversely affect trading decisions, and eventually lead to the end of a trading career. Discipline is always the best strategy.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

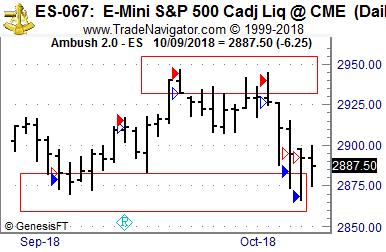

Ambush Traders make over $3,400 winning 100% of the time in the E-Mini S&P 500

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the E-Mini S&P 500 (ES) traded at the CME, where Ambush Traders are having a really nice time lately. Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

The S&P 500 has been moving sideways along with most other stock indices over the last months. That’s perfect for the Ambush Method that is specialized in catching tops and bottoms in such market conditions. As you can see on the chart that worked out perfectly over the last month. Right at the bottom of the range Ambush bought close to the low of the days and had sell orders ready right at the very top of the range.

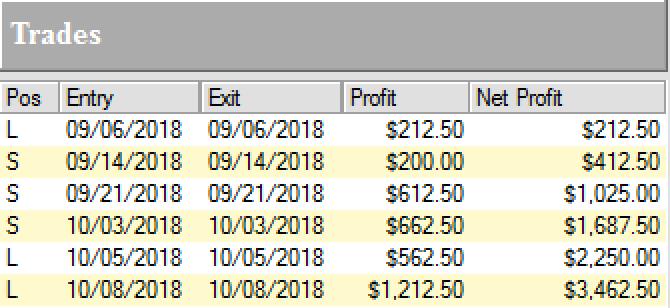

Here’s the result of all of the trades shown on the chart, trading one E-Mini S&P 500 (ES) contract, including $10 commissions per trade:

Yes, that’s over $3,400 profits per contract within just six trades, all of which have been day trades without a single loss!

Let’s face it, you don’t want to be on the one caught on the other side of these trades. Also if you’re actively day trading by getting in and out of the market all day long, honestly ask yourself if that’s worth your time? And are you actually doing better than this? I know day traders who place more than 6 trades within a single hour, but they just make their brokers rich and are all stressed out. With Ambush you’re day trading without even having to be there during the day!

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals.

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook.

Happy Trading!

Marco Mayer

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.