Edition 751 - November 2, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Markets Fall Faster…

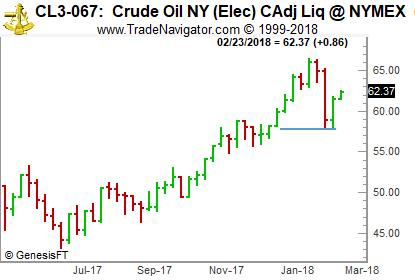

I believe that the precipitous fall in just about any futures market is the result of huge manipulation by governments. Conversely, I believe the incredible rise in the price of crude oil was also market manipulation — but not entirely. A good part of the rise in crude oil prices was due to the buy and hold strategies of commodity index funds. Commodity index funds are long-only funds, and they buy and hold commodities as an asset class. Of course, they got their assets kicked and their panicked selling has caused a lot of the steep decline visible on the weekly chart.

We all know that what goes up, must come down (usually). It is also known that markets fall much faster than they rise. We have seen a lot of that lately, as well.

As I was looking through my charts, I couldn't help but notice a perfect illustration of prices falling much faster than they had risen.

It took 5 weeks for crude oil prices to reach the recent high. It took only 2 weeks for prices to give it all back.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Get Back on Track

Have you ever had a bad day and wanted to stand aside until the feeling passed? Sometimes it is a good idea. It may be necessary to take a break, relax, contemplate, and refocus on the task at hand. The winning trader trades freely and effortlessly and it is vital to trade with such a mindset. Traders are similar to star athletes who perform at their best, or musicians who are virtuosos. What these people have in common is that they can focus their attention on the task at hand; inadequacies, conflicts, or current life stressors do not easily distract them. The more you can remove stress and anxiety in your life, the more easily you can trade effortlessly with a focused, concerted manner. Some of the conditions you need to address are unconscious and involve a certain amount of reflection, but other conditions are just a matter of the right attitude. A winning approach to trading is often just a matter of approaching trading by following some basic guidelines.

A key guideline is to think in probabilities. Don’t focus on the outcome of a single trade. Think optimistically about the bigger picture. You may lose on a single trade, but if you are trading with sound trading strategies, you will come out ahead across a series of trades. It's this long-term perspective you need to focus on, not the short-term transitory outcomes. Remember that your overall success is the bottom line. You must strategically execute trade after trade in a calm and logical manner to make the law of averages work in your favor.

It's also vital to control your risk. Successful traders risk only a small percentage of their trading capital on a single trade, for example. Limiting the risk on a single trade further relieves some of the pressure; you are less likely to feel that every trade must pay off big. Trading a detailed trading plan is also important. When you know what you are going to do and when you are going to do it, you'll feel more in control. If you leave parts of your trading plan unspecified, you'll feel a sense of uneasiness. And in all likelihood, you'll not be able to follow your plan easily. Your discipline will falter. It's essential that you plan out when to enter and when to exit. Once you have a clear idea of when you'll decide to enter a trade and what signals indicate you should exit, you will be able to focus more easily on monitoring the trade and taking decisive action.

There's also a psychological aspect to trading like a winner, and sometimes it's important to just remember some common human tendencies to think "irrationally." For example, there's a human need to avoid loss and this need is often manifested in the need to be right. But don’t be afraid to admit you are wrong. And don't think that you must capitalize on every opportunity to make a profit. These expectations are so high that they can be cause fear and anxiety. When you hold such high expectations for your performance, you place too much pressure on yourself, and it interferes with your train of thought. By trading under the right mental conditions, you stay calm and trade more profitably.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

CLF Trade

On 19th October 2016, we gave our Instant Income Guaranteed subscribers a trade for CLF (Cleveland-Cliffs Inc.).

We entered a "complex position", entered for a net credit (still working with OPM, i.e. other people's money, as usual), but with unlimited upside potential.

- on 20th October 2016, we entered the trade for an average credit of 2.77 (or 8.31 = 831$ for 3 positions)

- on 10th February 2017, we closed one third of our long position

- on 9th March 2017, we bought to close all our short position

- on 24th September 2018, we closed the second third of our long position

- on 19th October 2018, we closed the last third of our long position

Profit: 1158.90$

Margin: 138$

Average Short Strike: 6.90$

Return on Margin annualized: 419.89%

Return on Principle annualized: 83.98%

We stayed 730 days in the trade, but the annualized returns were on the high side and all we had to do was to maximize our profits along the way, by being patient.

This was a low maintenance, low stress trade with lots of upside potential.

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Idea

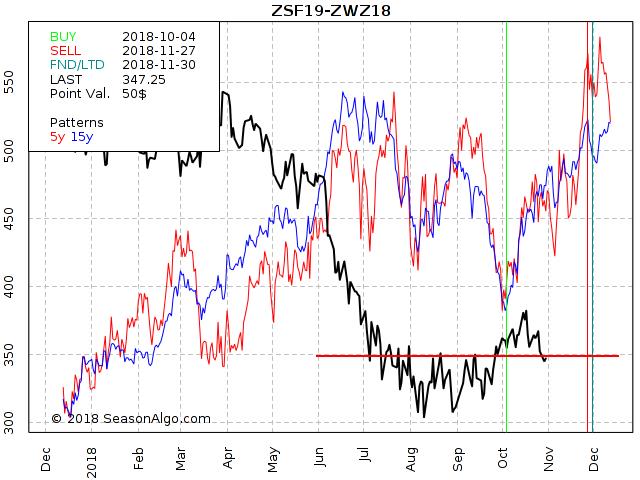

This week, we're looking at ZSF19 – ZWZ18: long January 2096 Soybeans and short December 2018 Wheat (CBOT on Globex).

Today we consider a Grain inter-market spread: long January 2096 Soybeans and short December 2018 Wheat (CBOT on Globex). After trading mainly sideways in August and September with resistance at approx. 350 the spread moved higher in October. Will the former resistance level at 350 become support? As long as the level holds, there is a good chance the spread will continue its movement to the upside in November. Traders with smaller account might want to use the Mini-Sized contracts instead of the normal futures contracts.

Do you want to see how we manage this trade and do you want to get detailed trading instructions every day?

Click here for additional information!

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading Blog: How much to risk per Trade

One of the questions every trader has to think about at some point is, how much of my account should I risk per trade? A percentage? If so, what percentage?

I’d love to have the right answer in my pocket for you, like "exactly 1.25% per trade/market and no more than 5% at the same time," but unfortunately, read more....

Happy Trading!

Marco Mayer

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.