Edition 752 - November 9, 2018

ALL EBOOKS 30% OFF

Coupon Code: boo30

expires 11/12/2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

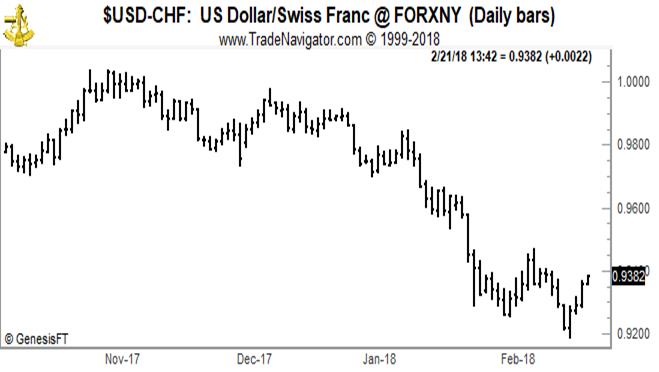

Chart Scan with Commentary: Swiss Franc

Hey Joe! I was looking for some clue as to what to do with the USD/CHF Forex chart. I tried looking around for comments and found this: “The bearish move in USD/CHF is stretched, and so far on the day we’re seeing a bit of near-term resistance develop at that prior two-year low around .9257. Traders should be very careful of looking at short-side continuation strategy on a Friday ahead of an extended holiday weekend out of the United States. We look at a couple of deeper resistance levels below that could be usable for next week.”

Well, I really am not into predicting where markets will go long or short term. The only thing I see for certain from the point of view of day, or short-term trading would have been to buy the high of the reversal bar that made the recent low on the chart (0.9188). My buy order would have been at 0.9288 for an expected follow-through to the reversal bar. I would have been out with my objective and done with the trade in the same day as my entry. If I were a short-term trader, it would have been somewhat of a sweat to hold overnight because prices finished only 3 ticks higher than my entry. Tough decision on that one. However, holding over would have had its reward over the next couple of days.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Write Down Your Thoughts

Have you ever made a dumb mistake? Perhaps you knew you should have used a protective stop before leaving for two days to take your children on a road trip. You may have thought, "I'll stop off at an Internet café and monitor the trade." But it didn't happen. You got wrapped up taking care of your children or worrying about traffic, and you didn't get around to looking at the market. It fell hard and you lost more than you had planned. In hindsight, you probably thought, "I knew it would happen, but I just didn't care." For some traders, it's the little things that knock them off balance: the argument they had with their spouse, or staying up too late visiting with friends the night before a significant trading day. Whatever they are, these little things can make you feel tired and on edge. Suddenly, you make trading errors that would not have made sense in a more rational state of mind.

How do you prevent little things from getting the better of you? One way is to keep a diary of your thoughts and emotions during the trading day. For example, on the day of making a trade, you might write down the events in your personal life that happened before the trade and how you felt about these events: "I had a dinner at my neighbor's house and we lost track of time. We talked about interest rates and how the markets were down for the second straight week. I was a little worried about what might happen the next day. I didn't sleep well. I woke up tired the next day. And then, my spouse forgot some important papers at home and I had to fax them. It didn't seem like a big deal at the time, but I guess I was angry that I had to take time out of my busy schedule. I was tired and a little frustrated. In the back of my mind, I felt that I hadn't been performing at my best. I guess I really wasn't looking forward to putting on a trade that day. My heart wasn't in it. I tried to follow my trading plan but I did not succeed.

In this diary entry, you can see that little things were the culprits of a losing trade. The trader was not in an optimal state of mind. That can happen to traders. They can just have a bad day. A bunch of little things come together to make a big problem, and trading plans are ruined. How does a diary entry help? By keeping a description of your trades, even if you don't log all of them, you can look for patterns that interfered with an optimal state of mind. In this case, staying up too late and feeling frustrated by having to do something the trader didn't want to do put the trader in mindset that was not conducive to trading. A trader may find that specific events predispose a bad mood or feelings of frustration. For this trader it was not getting a sound night's sleep and dealing with interpersonal hassles. For other traders, it may be missing a day at the gym or hearing bad news about family and friends. Whatever these events are, it is useful to identify the specific events that mess up your trading plan.

prohibited without the prior written consent of Trading Educators, Inc.

ALL EBOOKS 30% OFF

Coupon Code: boo30

expires 11/12/2018

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

XLNX Trade

On 25th October 2018 we gave our Instant Income Guaranteed subscribers the following trade on Xilinx Inc (XLNX). Price insurance could be sold as follows:

- On 29th October 2018, we sold to open XLNX Dec 21 2018 62.5P @ 0.61, with 52 days until expiration and our short strike about 21% below price action, making the trade very safe.

- On 31st October 2018, we bought to close XLNX Dec 21 2018 62.5P @ 0.30, after only 2 days in the trade for quick premium compounding.

Profit: 31$ per option

Margin: 1250$

Return on Margin annualized: 452.60%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Counting the Cost

Almost anyone who wants to succeed needs to ask themselves certain questions before beginning to trade. Essentially, it is a matter of counting the cost BEFORE, not after you decide you want to pursue trading as a serious part of your life.

What time period trader are you? How long do you feel comfortable holding a trade and how such financial risk can you comfortably assume on a one contract basis? How much money would you need to lose before you quit trading? How much would you need to win to quit? You should know the answers to these important questions before trading, and review them frequently. Your money management skills are the most important tools you have to trade the markets. With good risk averse money management skills, and even a mediocre trading approach, you will be successful. With a great trading approach and poor money management skills, you will lose money. Remember, a winner will find a way to win with a losing trading system and a loser finds a way to lose with a winning trading system. No man with a failed home life truly achieves any success.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Marco Mayer's Ambush Signals is performing well so his next article will offer YOU big savings. Until then, watch his video to learn how his trading method works.

Learn all you need to know about our new Ambush Signals service during this presentation by Marco Mayer. What is the Ambush System, what's the idea behind it and how does Ambush Signals make trading Ambush so much easier! Find out more about Ambush and Ambush Signals!

Happy Trading!

Marco Mayer

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

ALL EBOOKS 30% OFF

Coupon Code: boo30

expires 11/12/2018

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.