Edition 753 - November 16, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Classic Chart Revelation

If you would like to learn to read the language of the charts you might consider taking private tutoring, or taking our online webinar “The Law of Charts in Depth.”

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: The Sinful Trader

From time to time we get this very important question: Is trading a sin? Often this question comes from people in ministry who want to become traders in order to fund various church activities.

The answer is: No, trading is not a sin, but trading without knowing what you are doing can lead to a lot of problems. Trading in and of itself is not considered to be gambling. The futures markets exist as a venue in which hedgers are able to “purchase” price insurance. The ability to hedge against rising or falling prices is the economic and social justification for the futures markets. However, gambling is considered to be foolish and sinful. Trading without adequate knowledge of the markets and of self is foolish, because by doing so you are gambling.

There is a certain amount of self-knowledge needed to choose the proper trading method. It has even been suggested that many small traders in the futures market, without knowing it, secretly want to lose. They jump in with high hopes - but feeling vaguely guilty. Guilty over "gambling" with the family's money, guilty over trying to get "something for nothing," or guilty over plunging in without really having done much research or analysis. Then they punish themselves for these or other perceived sins by selling out, demoralized, and at a loss for what to do next.

Interestingly, scripture itself say that "that which is done in doubt, is sin." That brings up a very interesting point to think about. I have often written that if you don't believe in yourself and in what you are doing, you are almost certain to end up a loser. If you don't have the courage of your convictions, you are trading in doubt.

Does this kind of sin mean you are condemned? Not at all! Sin is a very interesting subject. Sin has its own built-in penalties. But first we need to define what sin is. According to scripture, sin is breaking the law. But there are all kinds of laws. Not all law-breaking need result in the death penalty. For instance, you can break the law of gravity and not necessarily die. You can leap from a high place and maybe only break a bone! You can sin against your body by consuming lots of junk food. The result may not be death. The result may be the pain and suffering of a long illness.

There are all kinds of laws. There is even a Law of Charts! The Law of Charts is a concept that describes how a chart will look as the result of human emotional action and reaction in the market place. If you break that law, i.e., go against the clear flow of market energy, thrust, and momentum, you will pay the penalty for your sin. So the things we try to teach you at Trading Educators are all designed to get you in step with the flow of the markets. And far away from sin!

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

DAL Trade

On 28th October 2018 we gave our Instant Income Guaranteed subscribers the following trade on Delta Air Lines Inc. (DAL). Price insurance could be sold as follows:

- On 29th October 2018, we sold to open DAL Dec 21 2018 45P @ 0.42, with 52 days until expiration and our short strike about 16% below price action, making the trade very safe.

- On 2nd November 2018, we bought to close DAL Dec 21 2018 45P @ 0.22, after only 4 days in the trade for quick premium compounding.

Profit: 23$ per option

Margin: 900$

Return on Margin annualized: 233.19%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Practice

If you play tennis once a week against an opponent who plays tennis five times a week, who is likely to win? If you play chess or backgammon twice a year against someone who plays every day, who will mostly likely win?

You don’t have to start trading real money right away. Whenever someone goes through my mentoring program, there comes a time when I encourage the student to start paper trading before starting to trade with real money. Trading is like playing chess; you can learn a lot about it by reading books but if you really want to get good in it, you actually have to do it on your own. Practice is necessary to becoming successful in many professions; and trading is one of them!

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

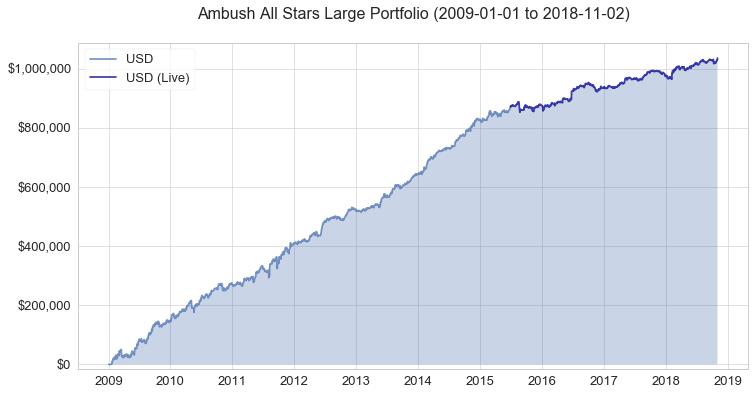

Ambush takes off to an Amazing End-of-Year Rally!

Yes, Ambush did it again as most of the Ambush markets and portfolios just hit new all-time equity highs in November. Looks like it just started off to a nice end-of-year rally, don’t miss it!

Trading has surely been tough lately for a lot of traders, especially due to the crazy correction we had in the stock markets in October. This also lead to higher volatility in many markets mixed with a lot of uncertainty and crazy market moves.

That’s a recipe for disaster for many trading strategies but for Ambush it’s one of the most favorable market conditions. And oh boy did it rally during that period .The Ambush Small Portfolio, for example, showed a performance gain of over 8k within just two months of trading! Thanks to that rally, almost all Ambush markets are now showing nice gains for 2018.

Of course this is just a tiny part of the whole Ambush history, so let’s zoom out and have a look at the broader picture. Ambush has been around for about 10 years now. That’s exceptional for a trading system. Actually, it’s the only one I know that’s been around that long with most systems working no longer than a couple of months. But as markets tend to change, I do review Ambush once a year to see if any changes are necessary to adapt to changing market conditions. The last time any significant changes have been required was in July 2015. As you can see on the following chart Ambush kept on performing as expected since then in live trading.

You can find out more about the sample portfolios and the long-term performance of each of the Ambush Markets on the Performance Page.

2018 has been quite a year for Ambush and if you missed it so far, join us now for what looks like a promising finale of the year and start 2019 on the right side of the markets.

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

We offer you 6 months of Ambush Signals for just $499. That’s a saving of $215, giving you almost two months of Ambush Signals for free. As we usually only offer monthly or 3-months subscriptions, this is a very special offer!

These 6 months will allow you to get to know Ambush Signals without too much stress or pressure and to follow it for a long enough time period that it simply won’t that much if you’re lucky and start on Ambush’s best trading month ever or not.

Don’t miss out on this and get your 6 months of Ambush Signals for $499 today!

CLICK HERE! AMBUSH SIGNALS 6-MONTH SUBSCRIPTION

Now many of you already have been following Ambush for years now and so you’ve been asking for a long-term subscribers bargain. Get a whole year of Ambush Signals for $799. That’s a whopping $629 off the regular yearly subscription price, giving you over five months for free!

CLICK HERE! AMBUSH SIGNALS 1-YEAR SUBSCRIPTION

Ambush eBook

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook. We also have a very special offer for you then:

Coupon Code for $500 off:

- Ambush eBook: use during check out "ambush500“ to get the Ambush eBook $500 off, for $1,299 instead of $1,799.

All special offers are valid only until December. So hurry up and don’t miss out!

Happy Trading!

Marco Mayer

Learn all you need to know about our new Ambush Signals service during this presentation by Marco Mayer. What is the Ambush System, what's the idea behind it and how does Ambush Signals make trading Ambush so much easier! Find out more about Ambush and Ambush Signals!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.