Edition 757 - December 21, 2018

FROM OUR FAMILY TO YOURS...

We have a few deals wrapped up to send your way,

check your emails later today.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Congestion

This week's Chart Scan is from an email I received from my friend Jack.

A lot of people have been asking about gold; should they go long, short, stay out, what? On the chart you will see a long bar with an arrow. It is marked "MB." That bar is a measuring bar. Notice how all Closes (and Opens) fall within the range of that measuring bar. At my seminars, in my books, and in various writings elsewhere, I have described the use of a measuring bar. The rest, slightly edited for clarity, is from Jack:

"The weekly gold chart below presents a great lesson in congestion. The HUI, as you know, is an index of gold mining stocks. I use it on a weekly time frame to give me the scoop on where we are trend-wise or not.

"With so many newsletter gurus spouting gold is going to the sky, I use HUI as a proxy for the gold stock market. Do I want to be long or short or out? It has been a tough summer for many gold bug traders, and if you look at the HUI on a weekly chart can you spot the congestion?

"Joe's method of congestion identification has saved my bacon more times than I can count.

"Using the bar formed 2017-03-03 as the measuring bar (MB), there has been an open or a close inside that bar's range for 8 weeks! In this case every bar’s open, close, or both took place inside the measuring bar. If you wanted to trade gold stocks on a daily chart, the weekly trend will guide you to look for daily entries and exits. The longer term is the more powerful term, and you must know where it is to be able to survive trading on a shorter term (daily) chart.

"One of the most valuable things I have ever learned from Joe is when to stay out of a trade. Jumping in when there is no underlying force from a longer time period has cost me plenty. If I am frustrated with a lot of stop outs, I will go out to the longer term and usually spot the congestion.

"Also, notice that the present congestion on the weekly chart is adjacent to a previous sideways price action began 2017-01-06.

What if you had a rule to move up your stop to just above a reversal bar in a downtrend or underneath any reversal bar in an uptrend? It is what Joe teaches and it works. You let the price action tell you what to do, or not do. The trend that started in 2016-01-22 went 15 weeks without a reversal bar. How do you know when to stay in a trade or get out? It does not get much simpler or more powerful than that.

"Too many methods focus 95% on entries. Everyone wants to enter trades. Learning when to enter, when to exit, and when to stand aside are all equal."

If you would like to learn to read the language of the charts you might consider taking private tutoring with Master Trader Joe Ross, or taking our online webinar “The Law of Charts in Depth.”

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Win or Lose: You Are A Winner Every Day

Have you ever spent the day making trade after trade and gotten nowhere? You may have wondered why you woke up that morning, or even bothered trading that day. Perhaps there have been a few days where you've felt this way this week. It's been a hard week so far. If you aren't doing very well, it is understandable. Uncertainty abounds. On days when you are feeling unproductive, it's important to have an upbeat attitude, though. You need to lift your spirits. So what if a given trading day wasn't fruitful? Who cares if you lost money today? Take it all in stride. How can you be so carefree, you ask? Real money was lost, so how can anyone convince himself or herself to feel good? There are trading days when your rewards are tangible profits and you can bask in the glory of success, and then there are those days where you must chalk the day up to experience. You settle for saying, "Perhaps I learned something valuable today. Let's figure out what I learned and be grateful that I got something from my trading.”

What did you learn today? What did you experience? Did you make it through the day relatively unscathed? That's worth something. Maybe you learned that you could stand aside when you wanted to and get out of harm's way. It is something worth learning. Maybe you jumped into the markets too soon, and felt a little bit of regret from losses. Were the losses justified? Did you follow your plan, but the plan didn't work?

If you lost because of a faulty plan, it's still valuable knowing that you could follow a plan. Losses due to impulsive decisions are another matter, however. If you traded impulsively, perhaps you learned how you might prevent impulsive decisions in the future. No matter what happened, though, you learned a valuable lesson.

In the modern, competitive world, we are obsessed with winning races. We want to make more profits than the next trader, and when we fail to make profits, we feel beaten. But the only benchmark that should matter is your own. So what if you don't make profits every single day? Maybe you do not yet have the skills or financial resources to make a profit every day. Even if you consider the metaphor of winning a race with other traders, would you try to run a marathon without the proper amount of practice? Would you feel disappointed if you couldn't reach an athletic goal that you knew would take more training than you had? You definitely would not, so why make such high and lofty trading goals? Give yourself a break. Sometimes it is wise to just do your best and accept what you've achieved. When you set high goals that exceed your skills, you will usually feel discouraged, and that may make you feel like giving up. Rather than kicking yourself for not performing up to par, consider the lessons you learned as a win, and keep on trading.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

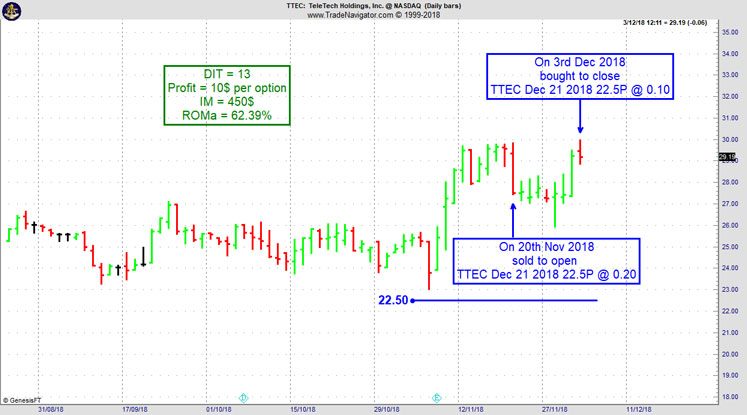

TTEC Trade

On 15th November 2018 we gave our Instant Income Guaranteed subscribers the following trade on Teletech Holdings Inc. (TTEC). Price insurance could be sold as follows:

- On 20th November 2018, we sold to open TTEC Dec 21 2018 22.5P @ 0.20, with 35 days until expiration and our short strike about 24% below price action, making the trade very safe.

- On 3rd December 2018, we bought to close TTEC Dec 21 2018 22.5P @ 0.10, after only 13 days in the trade

Profit: 10$ per option

Margin: 450$

Return on Margin annualized: 62.39%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

ANDY JORDAN HAS A SPECIAL TRADERS NOTEBOOK

END OF THE YEAR OFFER ~ JUST FOR YOU!

35% OFF

1-YR & 6-MO SUBSCRIPTIONS

Use coupon code during checkout: tn35

Valid through January 11th!

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Hesitating before a Trade

There are any number of reasons why a trader hesitates before a trade. The main one is lack of planning. Without a plan, there is no degree of confidence a trade will be successful, it’s all wishful thinking. Unless they are outright gamblers, traders usually have a strong need to protect their assets and avoid risk. This is especially true for beginning traders. It can take a long time to build up sufficient capital for serious trading. By that I mean sufficient capital to be able to trade for a living. It is quite understandable to fear losing all or part of your initial capital. Beginners tend to seek absolute certainty before taking a risk, and gaining true confidence in their ability to trade successfully can take time. Unscrupulous marketers of mechanical trading systems and methods take advantage of the beginners fears and lack of confidence by advertising “sure-fire” “magic” ways to trade, instead of revealing the truth about the difficulties in becoming a consistently successful trader.

When it comes to short term trading, there isn't very much time for long deliberations. Market conditions are in continuous flux. Decisions need to be made relatively quickly, and if one waits too long to execute a trade, he or she may miss a significant opportunity. The reasons for hesitation are everywhere, and traders must be aware of them, and create a plan to prevent them.

Identifying, directly facing, and eventually eliminating a problem of hesitation is the only way to truly deal with it. Chronic hesitation will eventually destroy the confidence a trader needs for success. If the problem is not dealt with and the traders continues to hesitate, miss important market moves, and see his or her equity begin to dwindle, that trader runs the risk of becoming a phantom trader, a pretender, becoming convinced that the imaginary trades being made are real. If you are prone to hesitation, it's vital that you deal with this problem early in your trading endeavors. Identify the reasons for it, confront the problem, and make changes as soon as possible. These are changes you have to make within yourself. If you will truly engage in self-examination with the object of eliminating hesitation, you can trade become consistent and successful in trading profitably.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

MARCO MAYER WANTS YOU TO SAVE $629 BEFORE THE YEAR IS UP!

AMBUSH SIGNALS SPECIAL ~ JUST FOR YOU!

SEE BELOW!

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Save up to $629 on Ambush Signals Today!

Ambush Signals Special

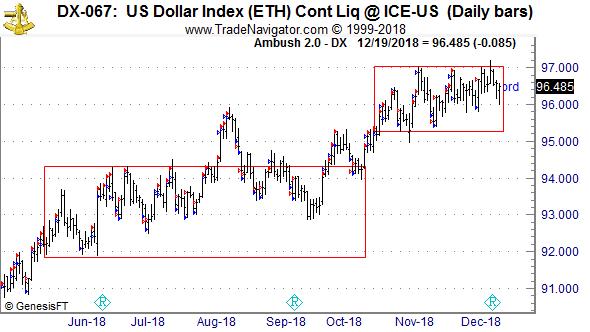

While everyone is confused about the Dollar, Ambush Traders cashed in heavily in 2018!

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the Dollar Index Future (DX) traded at the ICE, where Ambush Traders are having a really nice time lately.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

As you might remember we talked about the Dollar Index a couple of times already during 2018. It’s been one of the trickiest markets to trade this year as there’s a lot of uncertainties. Luckily Ambush has no trouble at all in such markets, quite the opposite and so Ambush Traders had a really good time throughout the year trading DX!

Luckily Ambush has no trouble at all in such markets and so Ambush Traders continued having a really good time trading DX!

Here’s a chart of the last 6 months of DX trading. As you can see it’s been going sideways (or nowhere, see red boxes) most of the time. In between we had some failed breakouts and small rallies to the next trading range level.

Once you realize that this isn’t that uncommon but that it’s exactly what the markets do most of the time don’t you want a strategy that works well under such conditions?

Where’s the Dollar Index going next? For sure to either the top or the bottom of the trading range it’s in. As Ambush Traders we don’t mind, we’ll be there ready to sell to or buy from the novice traders who’ll then accelerate our profits as they got to get out of their next losing trade.

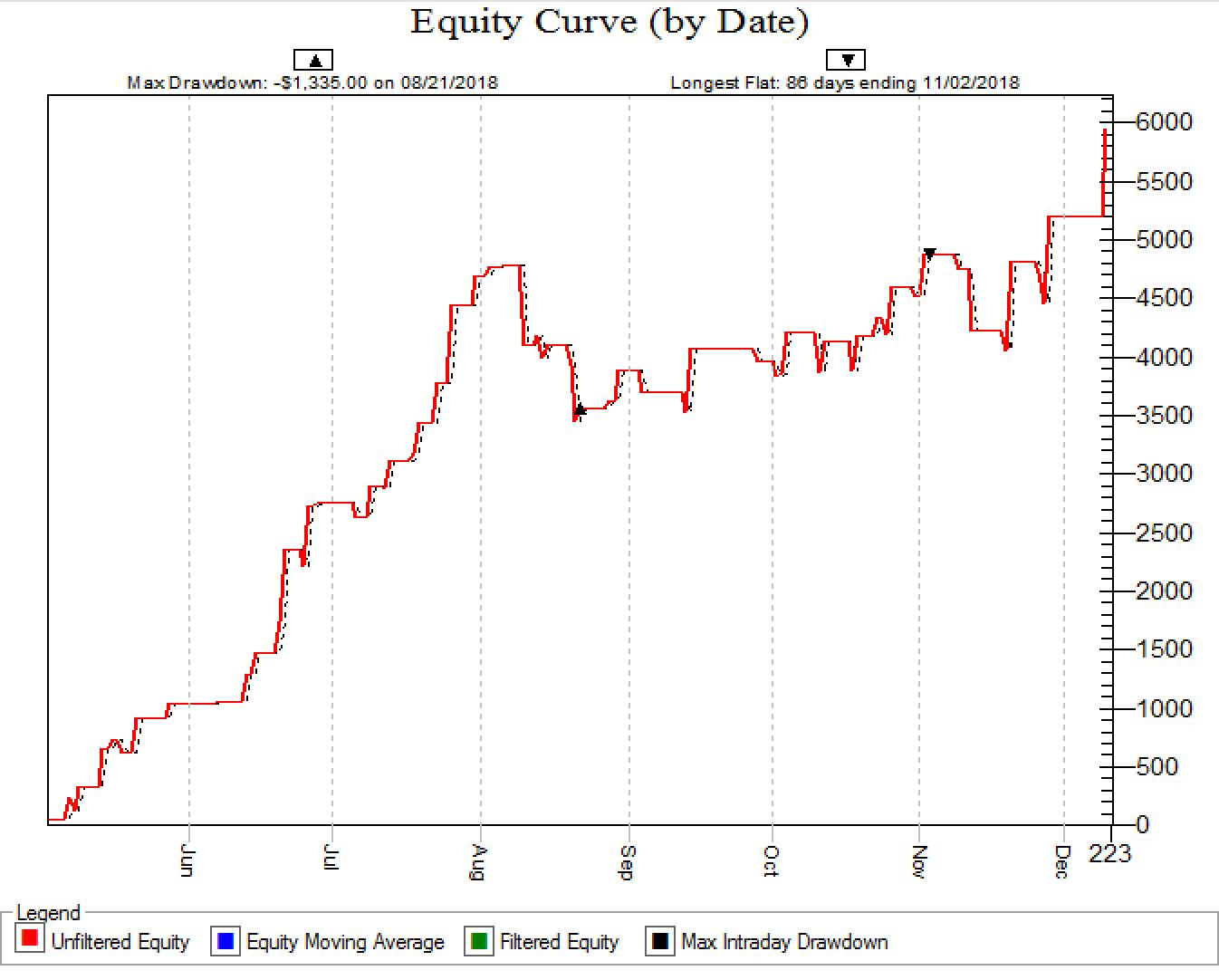

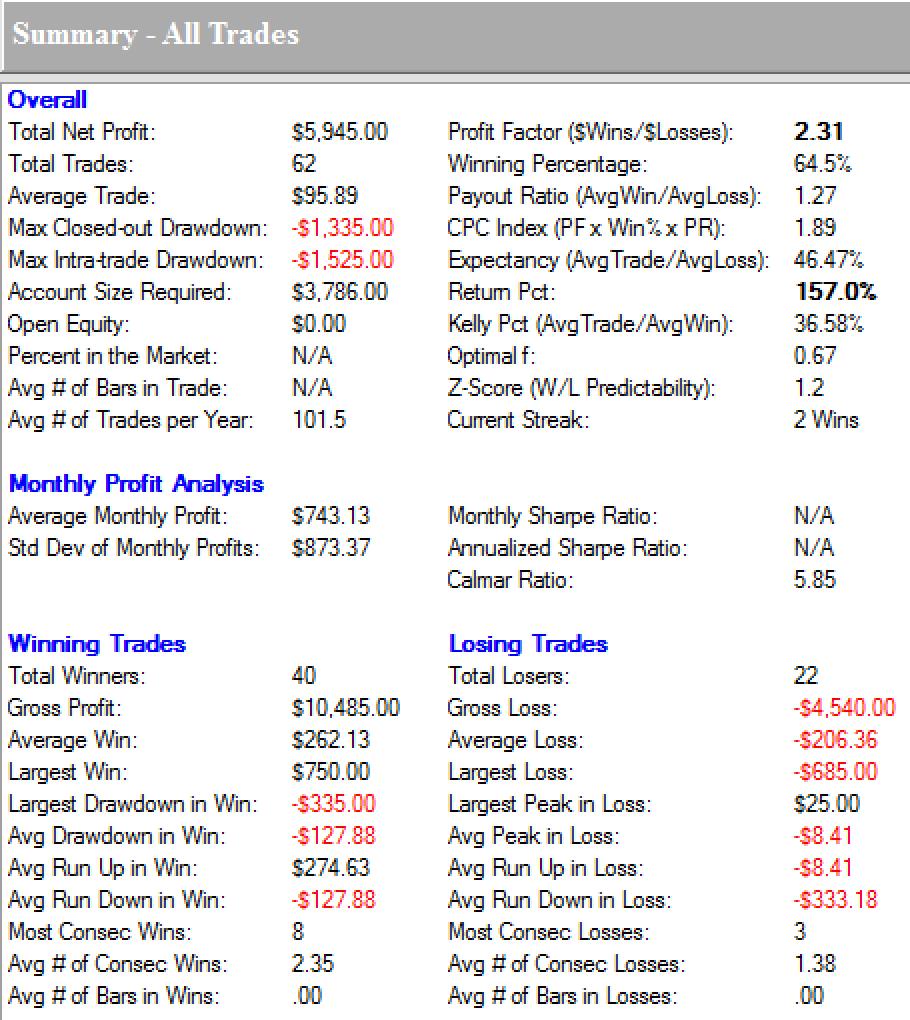

Here’s the result of all of these trades, trading one Dollar Index (DX) contract, including $10 commissions/slippage per trade.

Is it always like that? Of course not, but if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides!

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets.

Join us and become an Ambush Trader!

Save up to $629 on Ambush Signals Today!

As you know I don't send out emails to you very often. But as many of you have been asking me about longer-term subscriptions for Ambush Signals at a discount, I thought this might be interesting to you. Usually, I only offer monthly or 3-month subscriptions, but till Saturday you can also get:

- 6 Months of Ambush Signals for $499 (save $215)

- 12 Months of Ambush Signals for $799 (save $629)

Additionally, you can get the Ambush eBook $500 off, for $1,299 instead of $1,799: simply use the coupon-code "ambush500“ at the checkout.

You can find out more about the sample portfolios and the long-term performance of each of the Ambush Markets on the Performance Page.

2018 has been quite a year for Ambush and if you missed it so far, join us now for what looks like a promising finale of the year and start 2019 on the right side of the markets.

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Today you can also get:

- 6 Months of Ambush Signals for $499 (save $215)

- 12 Months of Ambush Signals for $799 (save $629)

Now if instead of simply getting the daily Ambush Trading System Signals you want to know the actual trading rules behind the System, you can get the Ambush eBook $500 off, for $1,299 instead of $1,799 by using the coupon code "ambush500“ at the checkout.

Happy Trading!

Marco Mayer

Learn all you need to know about our new Ambush Signals service during this presentation by Marco Mayer. What is the Ambush System, what's the idea behind it and how does Ambush Signals make trading Ambush so much easier! Find out more about Ambush and Ambush Signals!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.