Edition 836

July 3, 2020

AMBUSH TRADING METHOD + AMBUSH SIGNALS PRO = $1,187 IN SAVINGS!

SCROLL DOWN TO MARCO MAYER'S AMBUSH ARTICLE TO LEARN MORE

TNsst - Andy Jordan's newest advisory service

Read more about it, scroll down to Andy's article

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Gold

Recently, for about the umpteenth time, I was asked about gold. Will it go up or down? If so, how high will it go? How low can it go?

My answer is, “Look at the chart.” Simple chart analysis can give you the big picture.

Most traders these days rarely look at a monthly chart. I can tell you right now, you are not going to find the big picture on an intraday chart; not even on a daily chart.

Let’s look again at a monthly chart of gold:

How do you know where to draw the lines? Most of you don’t know because you were never taught.

You begin with the lowest low, and draw your line through the low of the most recent consolidation. You then connect the highest high to the high made from the latest upswing. Red lines.

Finally, you connect draw lines connecting the highs of the recent consolidation and draw lines connecting the lows of the recent consolidation. Blue lines.

In either case you see a pennant formation with a down ward tilt.

Looking for a trading pattern indicating which way prices might breakout, we find a 1-2 low. Will it form a number 3 point? There’s no way to know.

Gold is a market, and anything can happen in a market. In a panic, gold could go way below where it currently is. Or with a world event, gold could turn around and head towards 1786, 2500, 3000, or higher. We are not dealing with rocket science here. 1786 would be the high of the recent trading range, minus the low of the recent trading range, added to the high of the recent trading range. (1459-1132) + 1459 = 1786.

Gold has been steadily moving down on the daily charts. An object in motion tends to stay in motion, but moves more slowly over time. For example: What if gold were to retrace 50% of the downtrend? That would mean all the Fibonacci, Gann, and Golden Ratio traders might enter into an orgasmic state. Surely they would try to catch a rising market at the 50% level and short it.

As with any type of analysis, you become encouraged to trade what you think, rather than trading what you see. In the long run, trading what you see works out a whole lot better.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

RECORDED WEBINARS BY JOE ROSS - 35% OFF

COUPON CODE: web35

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: ATR Indicator

How does the ATR indicator work?

The ATR indicator stands for Average True Range, it was one of the handful of indicators that were developed by J. Welles Wilder, and featured in his 1978 book, New Concepts in Technical Trading Systems.

Although the book was written and published before the computer age, surprisingly it has withstood the test of time and several indicators that were featured in the book remain some of the best and most...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

ENJOY 50% OFF JOE ROSS' INSTANT INCOME GUARANTEED FOR A LIMITED TIME - COUPON CODE: iig50

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Instant Income Guaranteed - CDAY TRADE

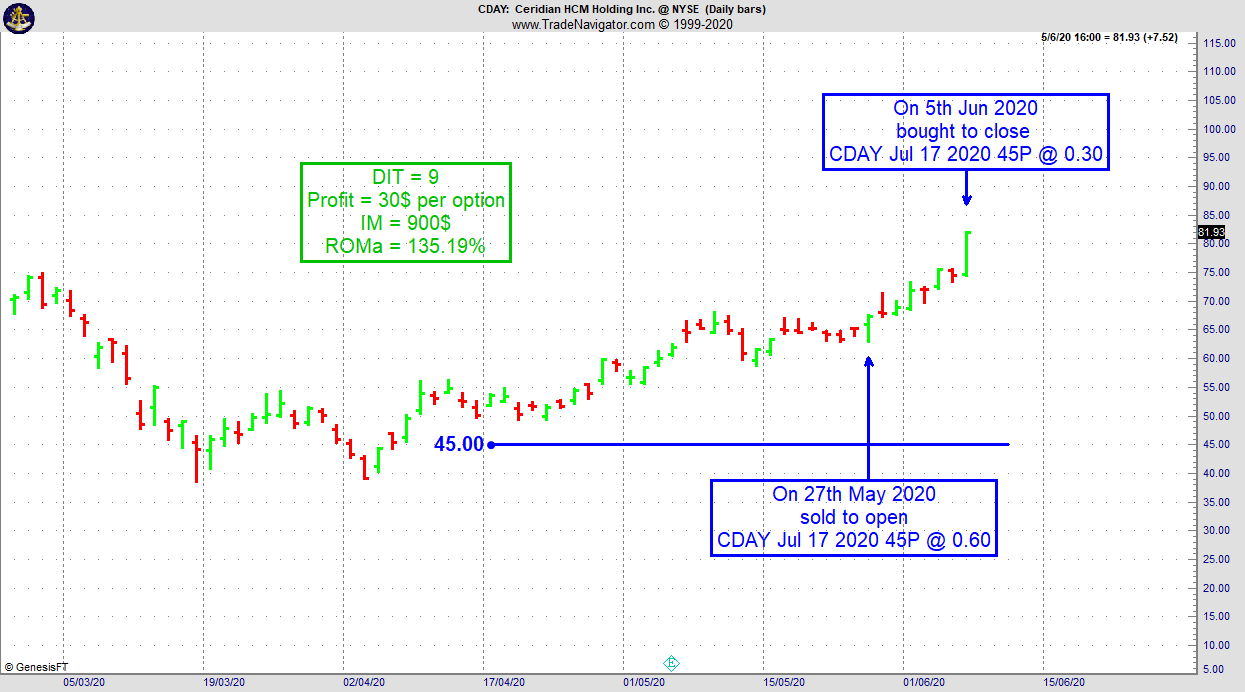

On 26th May 2020 we gave our Instant Income Guaranteed subscribers the following trade on Ceridian HCM Holding Inc. (CDAY). Price insurance could be sold as follows:

- On 27th May 2020, we sold to open CDAY Jul 17 2020 45P @ 0.60, with 50 days until expiration and our short strike about 38% below price action.

- On 5th June 2020, we bought to close CDAY Jul 17 2020 45P @ 0.30.

Profit: 30$ per option

Margin: 900$

Return on Margin annualized: 135.19%

Philippe

Learn More! Instant Income Guaranteed

Receive daily trade recommendations - we do the research for you.

WEALTH BUILDING FOR YOUR FUTURE

Need more information? We want to hear from you.

Contact us with questions!

50% OFF JOE ROSS' INSTANT INCOME GUARANTEED FOR A LIMITED TIME - COUPON CODE: iig50

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Andy Jordan presents...

CHECK OUT ANDY JORDAN'S NEWEST PRODUCT:

Introducing: Traders Notebook Seasonal Spread Trading (TNsst)

After 6 months of intensive forward testing, we are proud to present Andy’s new service “Traders Notebook Seasonal Spread Trading” or short: TNsst.

We’ve talked to Andy Jordan, to see what he can tell us about the new trading service!

Q: Andy, you have been running Traders Notebook, that also includes seasonal spreads, for over almost 17 years. Why are you coming up with a new spread trading service?

Andy: The spread trading from Traders Notebook, or trading in general, has changed quite a lot over the years. When I started in 2003, all trading was done on the trading pits. We had to call the broker to place the orders or write an email. Everything was much slower and the trading was based mainly on End-of-Day only. My idea was to get back to a very easy and slow way of trading the spreads because not everyone has the time to watch the markets during the day.

Q: So why is it different to what you do in Traders Notebook?

Andy: I’ve reduced the trading strategy to a minimum. It is mainly based on 3 simple factors. Entry, Exit, Stop-Loss level. Of course, I am moving the stop level during the trade, sometimes taking partial profits, but all this happens not very often and everyone is able to follow the trades in detail besides working full-time.

Q: Tell us a little bit about the procedure. How do subscribers get the signals?

Andy: Over the weekend, every subscriber is getting a PDF with closed trades, open trades and of course, all the new upcoming trades for the next trading week. That’s all a trader needs because in this PDF they can find all the details outlined. During the trading week, I will only send out emails or Telegram messages, whenever there are any important changes. As I said, it is very easy to follow all the recommendations.

Q: And the results? How did you do during these difficult times? I can hardly believe markets did move “seasonal” during the last few months.

Andy: Honestly, I thought the same, but the spreads behaved surprisingly seasonal. That’s one of the advantages of seasonal spread trading. While outright Futures react much stronger to events and circumstances seasonal spreads behave much more reliable regarding seasonal tendencies. This is why most seasonal spreads are a hedging position (calendar spreads). We are trading the difference of two contracts and therefore the direction of the underlying market doesn’t matter so much.

Q: Can you show us the results over the last several months?

Andy: Of course, that’s probably what most readers want to know. I’ve started around the 10th of January with a hypothetical account of $100k and a max. risk of 2% - 3%. The reason why I am using a $100k account is, that it makes the calculation easy. And it allows me to trade low risk. This is what I usually prefer no matter what and how I am trading.

I am tracking all my trades in my SeasonAlgo account. It even calculates commission, which is very comfortable.

Let’s take a closer look.

Q1 was very quiet because seasonal spread trading is position trading. I try to hold positions for weeks or even months. Today 06/23, not done yet with Q2, it looks like it will turn out very well, especially with all the COVID-19 problems we see worldwide the strategy has performed very well. So far, we are down in June, but keep in mind, that we have an open position of about $1,700 at the moment I am writing these lines (06/23). I am very happy with the results so far to be honest!

Q: When will it be available?

Andy: Right now it is only available for Traders Notebook Complete subscribers. It will stay part of the TN Complete package, but we plan to make it available as a separate product probably in July.

If you need more information about Traders Notebook or TN Seasonal Spread Trading

Don’t hesitate - contact Andy Jordan

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

READ MORE

MARCO MAYER'S SALE!

OVER $1,000 IN SAVINGS!

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush Gold Rush & Rare Summer Special: Save over $1000!

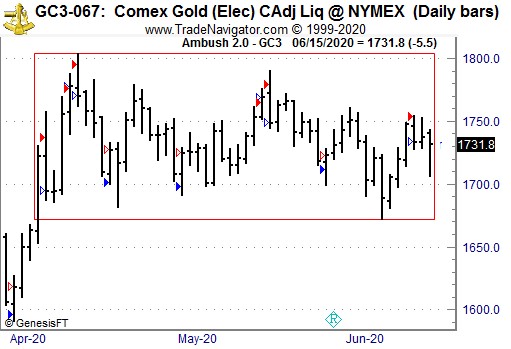

One of the top markets over the last couple of months for Ambush Traders has been the Gold markets. Whether you're trading the Gold Future, Micro Future, or the XAU/USD Forex pair it's been a real gold rush!

Here's a daily chart of the Gold Future (GC), showing the last couple of months of trading. As you can see it didn't move too much actually but was quite volatile within its trading range. Perfect conditions for Ambush!

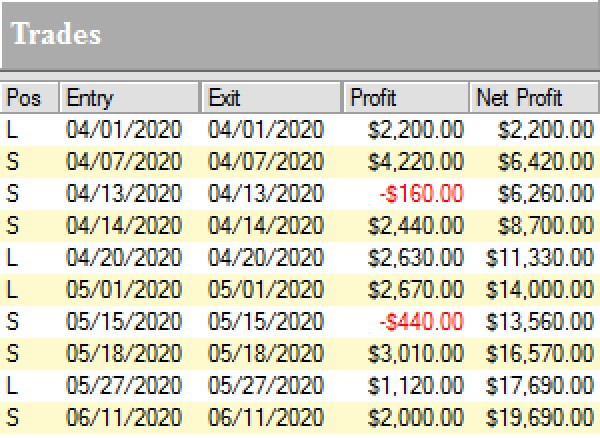

Here are the results of these trades, trading one contract:

Yup, that's almost $20k profits with almost no losses in between!

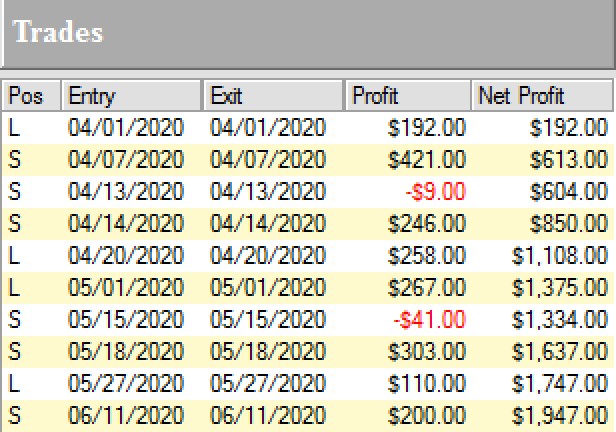

Now that's a lot and for a small trading account, the risk would simply be too high. So here are the results of trading the Micro Contract:

As expected it's about 1/10th the profits, but also 1/10 the risk which makes this work very nicely for smaller accounts.

Notice that all of these are actually day trades, even though they're based on end-of-day trading decisions. Ambush is exactly that, an easy way to day trade not for a few tiny ticks with a lot of stress but placing your trades once a day, walk away, and go for the big intraday moves!

Don't miss the next gold trade and join Ambush Signals today!

Ambush eBook Summer Special:

Purchase the Ambush eBook for just $999 instead of $1799. Yes, that's an $800 saving! But we got more. To get you started off on the right track, you get three months of Ambush Signals Pro on top! That's another $387 saving! Don't miss out on this super rare opportunity, simply use coupon code ambushsummer during the checkout!

Happy Trading

Marco

The Ambush trading System was created in 2007 by Marco Mayer. Since then it proved itself in the markets for over a decade and did so with exceptional results. It's the only trading system we're aware of that is still going strong after so many years. While Ambush is a day trading system, meaning you will always enter and exit on the same trading day - you don't have to sit in front of your trading screen. You simply place your entry orders when the trading session starts and come back at the close!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

SAVE OVER $1,000 WITH AMBUSH TRADING METHOD AND 3-MONTHS OF AMBUSH SIGNALS PRO FREE!

COUPON CODE: ambushsummer

ENJOY 50% OFF JOE ROSS' INSTANT INCOME GUARANTEED FOR A LIMITED TIME - COUPON CODE: iig50

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2020 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.