Edition 838

July 17, 2020

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: What is it?

There’s a saying, “it’s in the eye of the beholder.”

Many traders have noticed that a 1-2-3 pattern is often the right shoulder of a Head and Shoulders pattern. We see it on the chart below.

As you can see, prices broke below the neckline/#2 point.

What causes these patterns to form? The answer is the initiating action and reaction of human beings as they follow their emotions. In this case, what you are seeing is a mixture of the emotions of fear and greed. I’ll explain.

With the euro having moved above 1.20 dollars to one euro, European exports were falling because prices had become too high. European exporters are as greedy as anyone else, and high prices were cutting into their profits. Fearing further losses of business, exporters put pressure on the European Central Bank (ECB) to push the price of the euro down. The bank complied with the request, and began printing lots of euros. The entire Head and Shoulders pattern was caused by human emotion.

Anyone could have read about what was happening in the news. But even without the news, the truth was visible on the chart. If there was any doubt about what was happening, the violation of the #2 point was a dead giveaway of what the ECB was doing.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Day Trading or Swing Trading?

Hey Joe! Which is more profitable day trading or swing trading?

Wow! What a loaded question.

Many traders who are just starting out, want to know which type of trading they should focus on. Some traders prefer day trading while other traders prefer swing trading, and quite often traders like to mix it up a bit and trade both styles simultaneously.

The most important thing to keep in mind...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

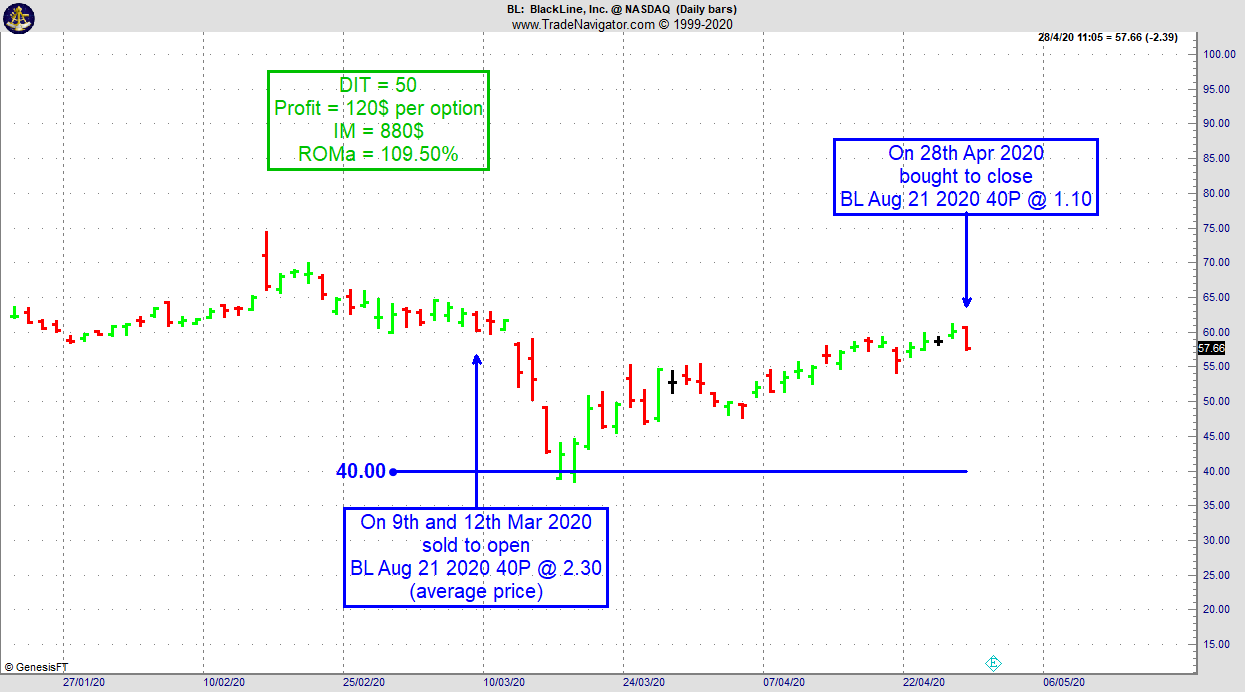

Instant Income Guaranteed - BL TRADE

On 8th March 2020 we gave our Instant Income Guaranteed subscribers the following trade on Blackline Inc. (BL). Price insurance could be sold as follows:

- On 9th and 12th March 2020, we sold to open BL Aug 21 2020 40P @ 2.30 (average price), with 162 days until expiration initially and our short strike about 36% below price action.

- On 28th April 2020, we bought to close BL Aug 21 2020 40P @ 1.10.

Our short strike, carefully chosen, was never exceeded on a closing basis, and we could go through the sharp correction in March without any trouble.

Profit: 120$ per option

Margin: 880$

Return on Margin annualized: 109.50%

Philippe

Receive daily trade recommendations - we do the research for you.

Learn More! Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Seasonal Spread Trading (TNsst)

Introducing: Traders Notebook Seasonal Spread Trading (TNsst)

READY TO LAUNCH THE END OF JULY

Contact Andy Jordan

Click Here to Learn more!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

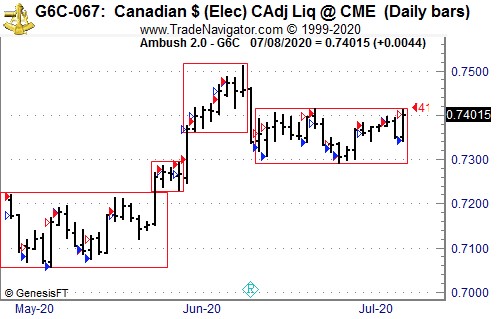

Ambush traders rock the Candian Dollar known as the Loonie

One of the top markets over the last couple of months for Ambush Traders has been the Canadian Dollar, also known as the Loonie. Doesn't matter if you're trading the regular Canadian Dollar Future, the Micro Future, or the USD/CAD Forex pair, Ambush Traders had real fun in that market!

Here's a daily chart of the Canadian Dollar Future (6C), showing the last couple of months of trading. As you can see this market did what markets do 90% of the time, which is why Ambush is such a great trading method. Markets move in boxes/ranges, break out for a few days and then start moving in the next box. The loonie has been boxing a lot lately and so Ambush Traders had a lot of fun!

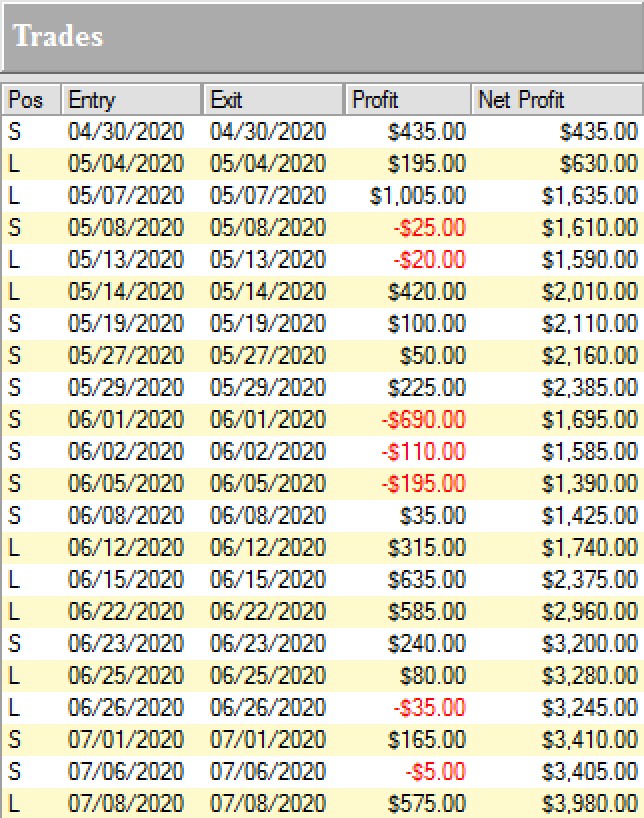

Here are the results of these trades, trading one contract:

Almost $4k profits with very little drawdowns in between!

Notice that all of these are actually day trades, even though they're based on end-of-day trading decisions. Ambush is exactly that, an easy way to day trade not for a few tiny ticks with a lot of stress but placing your trades once a day, walk away, and go for the big intraday moves.

Join Ambush Signals, let's have some fun with trading!

Happy Trading,

Marco

The Ambush Trading System was created in 2007 by Marco Mayer. Since then it proved itself in the markets for over a decade and did so with exceptional results. It's the only trading system we're aware of that is still going strong after so many years. While Ambush is a day trading system, meaning you will always enter and exit on the same trading day - you don't have to sit in front of your trading screen. You simply place your entry orders when the trading session starts and come back at the close!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2020 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.