Edition 849

October 9, 2020

Introduction to a Series on Technical Analysis

This week’s chart scan is a continuation of a series of very basic technical analysis concepts. I’m not a big fan of technical analysis, but I have to admit that I cut my trading teeth using it. Eventually, I came to believe there is a time and place for any and all tools. If something can help you understand the markets and how to trade them, I’m all for it.

There are many beginning traders who read Chart Scan, and over the years I have had many questions from them concerning technical analysis. Instead of giving you an article on the psychological aspects of trading, the next several issues of chart scan will feature articles on technical analysis. My hope is that where and whenever possible, I will show you the right way to use this type of analysis.

Keep in mind, the only real truth on a price chart is price itself. With that in mind and keeping price always in the forefront we can begin taking a look at some tools that fit into the category of technical analysis.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Traders Trick Entry

Hi Joe,

I have a question regarding the TTE. Below, I have included a picture of a formation I see quite often.

It is a 1-2-3 Low, and after #2, there are three correction bars. However, there are not 3 cleanly falling segments down to #3, the second correction bar "sticks out" a little. My question is if you'd still trade that using a TTE entry when the high of bar #3 is taken out.

Great question. Thanks for sending it.

Unless there was something else preventing me, I would take the TTE.

I’ve seen formations like that before, but I don’t recall anyone ever asking about it.

Go beyond the free material Joe Ross has provided you!

For many years, Trading Educators has given away the information about the The Law of Charts (TLOC) and Traders Trick Entry (TTE). Many have used it to their benefit, but many have failed to see the real value of the Traders Trick.

Those who have read the Traders Trick description are missing out on the finer points of the Trick. Over the years, and with extensive feedback from successfully trading students, the Traders Trick has evolved far beyond what is available in the free Traders Trick information.

Use Coupon Code "tte20" for 20% OFF during checkout.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Trade the Trend

Trend Trading is a trading strategy that attempts to capture gains through an analysis of the momentum of prices in a particular direction. Trend traders enter into a long position when a security is trending...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Instant Income Guaranteed - MDT TRADE

On 27th September 2020 we gave our Instant Income Guaranteed subscribers the following trade on Medtronic Inc. (MDT). Price insurance could be sold as follows:

- On 2nd October 2020, on a GTC order, we sold to open MDT Nov 20 2020 87.5P @ 1.00, with 49 days until expiration and our short strike about 15% below price action.

- On 6th October 2020, we bought to close MDT Nov 20 2020 87.5P @ 0.50

Profit: 50$ per option

Margin: 1750$

Return on Margin annualized: 260.71%

Philippe

TRADING SUCCESSES EMAIL TO YOU DAILY!

~ WE DO THE RESEARCH FOR YOU ~

Learn More! Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Seasonal Spread Trading (TNsst)

Trading Article: Option Spreads to Sell Premium

Most options expire worthless, so lots of traders are interested in selling options. I certainly agree with that thinking. Options are a wasting asset. All things being equal, an option will lose part of its value day after day until finally, the option expires worthless. As time passes, the option seller earns premium from time decay.

The risk to the option seller is that of a large move against his short position. All options sellers are short the chosen option strike price. Adverse moves in the underlying futures also bring an increase in implied volatility, which translates to...read more.

Andy Jordan is the creator of Traders Notebook, a successful spread trading daily guidance advisory service. Do you want to receive how to manage trades and detailed trading instructions every day? Click here for additional information! Contact Andy Jordan with questions.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

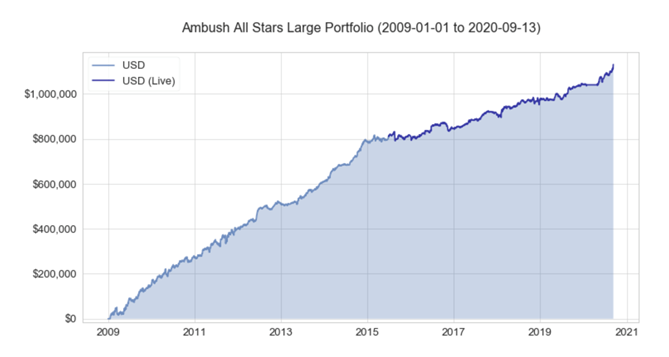

Ambush makes new all-time-highs again in 2020!

After having a blast in 2019, Ambush Traders are set up to have another great year as the Ambush performance is making new all-time highs again in 2020! I have to admit, it is really amazing to witness this year after year for over a decade now.

Previously I had reported how Ambush Signals subscribers managed to make it through the corona crisis relatively smoothly and how traders got informed well before the markets crashed in March. Since then the performance literally exploded!

Here's the long-term performance of the Ambush All-Stars large Portfolio featuring 10 markets consisting of stock indices, currencies, treasuries, and commodity markets:

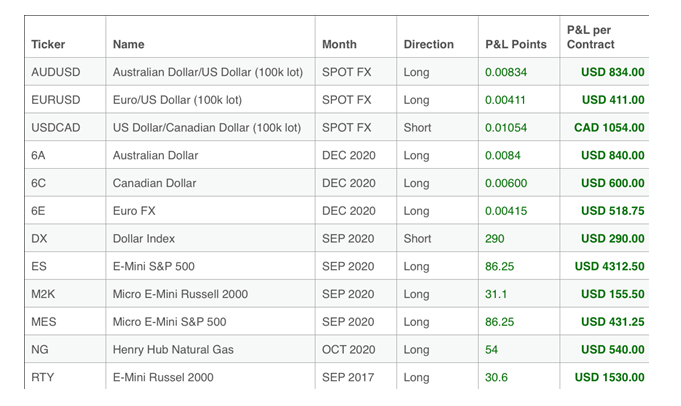

In case you're wondering about that sharp spike up at the end, we had one of our best days ever last week:

Didn't matter what you're into, currencies, stock indices, or commodities - as you can see, September 9th was a really happy trading day!

Notice that all of these are actually day trades, even though they're based on end-of-day trading decisions. Ambush is exactly that, an easy way to day trade not for a few tiny ticks with a lot of stress but placing your trades once a day, walk away, and profit from the big intraday moves!

But a day is just a day and that is of course statistically completely meaningless. As all of the All-Stars Portfolios are making new all-time highs you might want to have a look at the updated performance report to get a better idea of the long-term performance.

Those of you who participated in the previous free trial could see for themselves day by day how easy and simple it is to actually take those trades. If you don't want to miss our on these trades anymore, sign up now to Ambush Signals.

Also if you're interested in the Ambush Method eBook, we have good news for you. There are still copies available and if you buy the eBook now, you get three months of Ambush Signals Pro for free. That's a $387 saving!

Happy Trading and Stay Healthy!

Marco

The Ambush Trading System was created in 2007 by Marco Mayer. Since then it proved itself in the markets for over a decade and did so with exceptional results. It's the only trading system we're aware of that is still going strong after so many years. While Ambush is a day trading system, meaning you will always enter and exit on the same trading day - you don't have to sit in front of your trading screen. You simply place your entry orders when the trading session starts and come back at the close!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2020 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.