Edition 854

November 6, 2020

Introduction to a Series on Technical Analysis

This week’s chart scan is a continuation of a series of very basic technical analysis concepts. I’m not a big fan of technical analysis, but I have to admit that I cut my trading teeth using it. Eventually, I came to believe there is a time and place for any and all tools. If something can help you understand the markets and how to trade them, I’m all for it.

There are many beginning traders who read Chart Scan, and over the years I have had many questions from them concerning technical analysis. Instead of giving you an article on the psychological aspects of trading, the next several issues of chart scan will feature articles on technical analysis. My hope is that where and whenever possible, I will show you the right way to use this type of analysis.

Keep in mind, the only real truth on a price chart is price itself. With that in mind and keeping price always in the forefront we can begin taking a look at some tools that fit into the category of technical analysis.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Reversal Bar?

Hey Joe!

The chart below shows an “almost” reversal bar. Would you trade based on the (almost reversal) doji bar marked No. 1 below?

Technically speaking, it could be traded as though it were a reversal bar even if it doesn’t exactly fit some definition of a reversal bar. There are two reasons why someone could consider trading it: 1) The momentum is clearly downward late in the time period. The odds favor a continuation of the downward momentum. 2) The trade can be made with a very tight stop, because either there is, or there is not, a continuation on the next bar within a reasonable amount of time!

While we are looking at the above chart, based on what I see overall, this is a market I would never trade, at least not in the time frame shown. There are excessive doji bars sprinkled about, and many bars that open or close at the exact high, or low. The unusual price action on this chart, reveals a very thinly traded market, and probably a small time frame (5-7 minute bars, perhaps?)

Private Mentoring with Joe Ross is so simple!

- Complete his questionnaire, click here.

- Indicate full day or per hour

- Schedule your date(s) and time(s)

- Skype

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Double Bottom

A Double Bottom pattern is a technical analysis charting pattern that describes a change in trend and a momentum reversal from prior leading price action. It describes the drop of a stock or index, a rebound, a drop to the same or similar level as the original drop, and finally another rebound. The double bottom looks like the letter "W". The twice-touched low is considered a...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Instant Income Guaranteed - AG TRADE

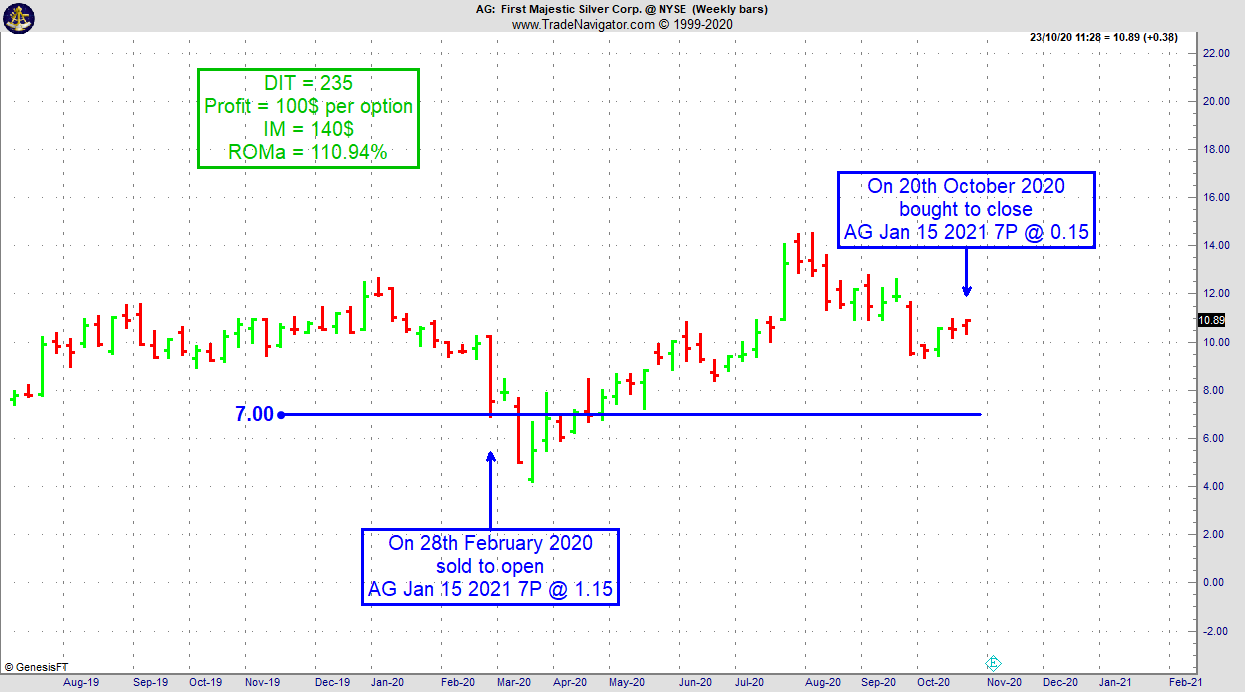

On 28th February 2020 we gave our Instant Income Guaranteed subscribers the following trade on First Majestic Silver Corp. (AG). Price insurance could be sold as follows:

- On 28th February 2020, we sold to open AG Jan 15 2021 7P @ 1.15, with 322 days until expiration

- On 20th October 2020, we bought to close AG Jan 15 2021 7P @ 0.15, after 235 days in the trade

With an options expiration very far out, we could accept having our short strike in the money for some time during an extremely volatile period. Even for a cash covered put, this trade could have been taken with only 700$ in a very small account.

Profit: 100$ per option

Margin: 140$

Return on Margin annualized: 110.94%

Philippe

TRADING SUCCESSES EMAILED TO YOU DAILY!

~ WE DO THE RESEARCH FOR YOU ~

Learn More! Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Seasonal Spread Trading (TNsst)

Trading Article: How much capital do I need to start trading?

I cannot count the number of times I’ve been asked this question. It seems as though every person who is new to trading asks this question, and sometimes it is asked by people who should know better. It's often the first question that pops up in my email, at seminars, and private tutoring sessions. Right up front I’m telling you I do not know the answer, and I often wonder if it is even the right question to ask? The answer is not as obvious you might think.

Viewed from a conventional standpoint, it seems that all you need is the minimum amount required by your brokerage firm for opening an account. I’m sure this is not the answer.

Authorities come up with minimums that vary according to whether one will be trading....read more.

Andy Jordan is the creator of Traders Notebook, a successful spread trading daily guidance advisory service. Do you want to receive how to manage trades and detailed trading instructions every day? Click here for additional information! Contact Andy Jordan with questions.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Trading the Euro is Easy if you have the right method!

One of the top markets over the last couple of months for Ambush Traders has been the Euro. Whether it's the Euro FX Future or the EUR/USD Forex pair, Ambush Traders had real fun in that market!

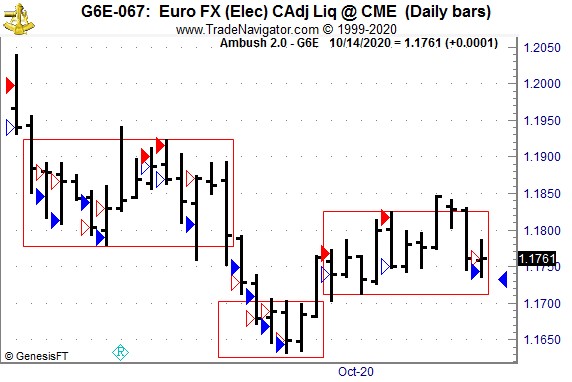

Here's a daily chart of the Euro FX Future (6E), showing the last couple of months of trading. As you can see this market did what markets do 90% of the time, which is why Ambush is such a great trading method. Markets move in boxes/ranges, break out for a few days and then start moving in the next box. The Euro has been boxing a lot lately and so Ambush Traders had a lot of great opportunities!

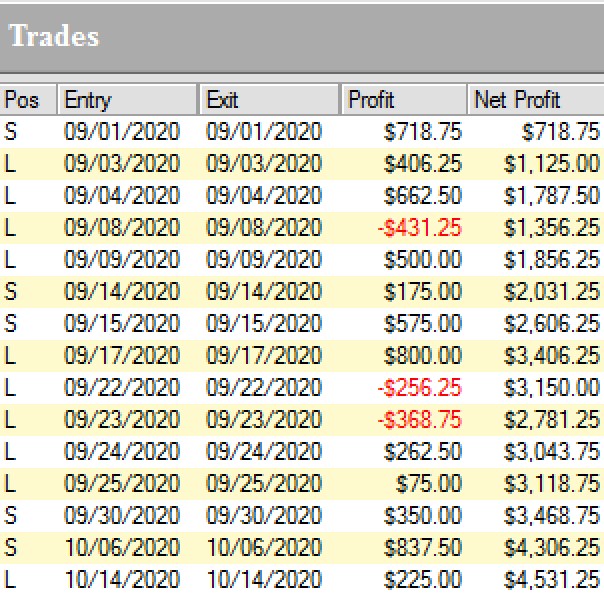

Here are the results of these trades, trading one contract:

Yup, that's over $4k profits with almost no drawdowns in between, a winning rate of 80%, and a Profit Factor of over 5 within that period!

Notice that all of these are actually day trades, even though they're based on end-of-day trading decisions. Ambush is exactly that, an easy way to day trade not for a few tiny ticks with a lot of stress but placing your trades once a day, walk away, and go for the big intraday moves!

Don't miss the next Euro trade and join Ambush Signals today!

Happy Trading!

Marco

The Ambush Trading System was created in 2007 by Marco Mayer. Since then it proved itself in the markets for over a decade and did so with exceptional results. It's the only trading system we're aware of that is still going strong after so many years. While Ambush is a day trading system, meaning you will always enter and exit on the same trading day - you don't have to sit in front of your trading screen. You simply place your entry orders when the trading session starts and come back at the close!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2020 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.