Edition 668 - March 31, 2017

Trading Article - Having an edge in the markets

Trading Article - Having an edge in the markets

by Professional Trader Marco Mayer

Educator for Forex and Futures, Systematic Trader, and

Creator of Ambush Trading Method, Ambush Signals, and AlgoStrats.com

One of the most important concepts to understand in trading is what it actually means to have an Edge in the markets.

First of all, when we talk about an edge in trading, we mean a statistical edge. A good example of a statistical edge is the casino. If you play Roulette, the casino will have an edge, the "house advantage". This will make sure that the casino is going to make money in the long run. Everyone who plays there has a disadvantage but it doesn't mean you cannot win there once in a while. You might have luck sometimes, but that casino edge will always make sure the house makes money, and you lose it in the long run, due to the law of large numbers.

That same law of large numbers is of course also at work in trading which is why it's so important to understand this concept.

If you're trading without an edge (with a random entry for example), you'd expect to have about 50% winning and 50% losing trades in the long run. Which is exactly what's going to happen if you trade often enough to allow the law of large numbers to do its job.

The same way as you can be lucky in the casino, you can also be lucky in trading and you might actually make money in the short-term. You believe you have an edge, you start trading and you actually make money. You're up nicely after 6 months of trading and you think you finally got it. But then you give it all back again and you're exactly where you started wondering if your edge has stopped working. But the truth is you might never have had one in the first place, you might just have been lucky!

This happened multiple times during the first years of my trading career. I was trying to apply whatever method I just believed in (some chart/price action pattern for example), and after looking at a few samples on a price chart, I started trading it without having thoroughly backtested the method. This way I either made money once I started trading it, which of course reinforced my belief in the method and then lost it later on. Or I lost money right away and stopped trading the method shortly after. Which might have been a mistake, as I maybe didn't give the law of large numbers enough time to make money with the edge. In any case, shortly after I started looking for the next holy grail, and unfortunately, there's no lack of utterly useless trading methods on the internet/books/seminars and gurus who were willing to sell it to me.

In trading, there's no house advantage you have to overcome (unless you're trading against your broker), but there are trading costs, which means you actually start out with a disadvantage. The higher your trading costs, the larger this disadvantage will be. So you will lose money in the long run if you trade without an edge as you always will have to pay these trading costs. Truth is, to break even in trading, you already do need an edge to overcome trading costs.

The key point to take away from this is to understand that if you actually do have an edge in the markets, it's just that. You're now the casino, you have the advantage. You have the law of large numbers on your side. In the long run, you will win.

Does this mean you'll be able to predict the outcome of the very next trade you'll take? Will you know it's going to be a winner? No, the same way the casino doesn't know if it will make money in the very next round. Does it guarantee you that you'll make money within the next 10 trades? No, the same way the casino doesn't know it will make money on this table tonight. Could it happen that you get 5 losing trades in a row? Absolutely, the same way someone might double his money 5 times in a row playing roulette in your house.

If you manage to really understand and acknowledge this, your trading will become a lot easier. You'll stop trying to predict what a market will do, knowing that it's simply impossible to know and that the outcome of a single trade is a random event. This way you'll pay much less attention to individual trades and be more focused on the long run.

And that's the only way to succeed in this business. Have an edge, focus on the long run and ignore the noise in between. I hope this article helps you to do just that.

Happy Trading!

Marco

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Latest Blog - Anticipation Regarding Losses

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing/Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Outrights

Most traders don't want to hear the REAL truth about trading, but we know you do...read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Chart Scan with Commentary - The Traders Trick Entry

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Of all the setups available, the Traders Trick Entry is the only one that gets better with more people using it. That may sound strange, but it is true.

Most setups are effective only when limited to a few traders, but the Traders Trick Entry is quite different. The reason is the Traders Trick is designed to take advantage of the momentum of others—the more “others” the more effective the trick becomes.

The Traders Trick Entry has now been in use for over 30 years, and with use, it gets better and better. It is a setup that is so consistent, that many professional traders use it exclusively for their trade entries. The Traders Trick Entry (TTE) takes advantage of retracement turnarounds, and pre-breakout momentum.

TTE works in all markets and in all time frames. The primary consideration for the TTE to work is that there be enough room between the point of entry and the targeted breakout point to be able to earn a profit.

Through 20 years of global experience, by thousands of traders, TTE has been refined to a point that it possible to earn a living using only that single setup.

The Traders Trick Entry is not a mechanical system—in fact it is not even a discretionary method. It is a setup, pure and simple. As a setup, it is one way to implement two of the three primary formations of the Law of Charts. Those formations are 1-2-3 highs and lows, and Ross Hooks.

One of our associates here at Trading Educators, uses the TTE exclusively for trading stock options. A gentleman in South Africa uses it to trade futures on point and figure charts. We have a student who uses TTE exclusively to trade the financial markets. TTE is used by many to trade Forex. Another of our associates uses it to trade spreads on futures.

TTE can be, and is used, by traders who prefer candlestick charts, point and figure charts, range charts, tick charts and regular bar charts. It is completely independent of market or time frame because of the fact that it is the implementation of a physical law.

Just as the physical laws underlying the fact of electricity can be used to generate heat, light, and turn a motor, the physical laws underlying the Law of Charts can be used to produce profits.

The chart above is a weekly chart. It could be the weekly of anything that is chartable. The only way you know that this is a weekly chart is because I told you it is, and I have left off the identifying information on the chart.

Prices have dropped to a low noted by the number 1 point on the chart. From there prices rose to point number 2 and subsequently retraced to point number 3. The Traders Trick Entry Calls for a trade to be entered one tick, pip, bip, or X cents above the high of the bar labeled 3.

Of course, there is more to it than the simple explanation above. There are refinements that can be used to make the trick extremely effective. It is also important to know the market dynamics behind the trick, so that you have a complete understanding of how and why it works.

The free eBook you received when signing up igningAt our website, we have an elementary explanation of the Traders Trick Entry. For a more complete explanation, and to see it in action you can purchase our webinar "Traders Trick Advanced Concepts," or sign up for private one-on-one tutoring with Joe Ross. You can trade for a living with the simple setup Traders Trick Entry. Traders all over the world are using it. Don’t be left out.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Trading Article - Maintaining Discipline: When Past Choices Influence Future Decisions

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Traders and investors have difficulty "letting their profits run." When you see your investment increase in value, it's hard to avoid selling early to lock in profits. But not every trade goes your way, so when you come upon a trade that does produce a profit, it's vital for your long-term success to optimize the profits for that particular trade. You must make more profits on your winning trades than you lose on your losing trades, but this is difficult to do if you consistently sell prematurely. Waiting for your price objective takes self-control. You must fight the urge to sell early. A thinking strategy that may help you increase your ability to maintain self-control when you need to suggest viewing economic decisions as "linked" in that the decisions you make on earlier economic choices influence the decisions you make on later economic choices.

How do you approach discipline when you trade? Do you think, "I'll sell early on this trade, but on future trades, I'll let my profits run." Is there harm in thinking that way? It may set a bad precedent. What you do early on may influence what you do later: If you sell early on some trades, you may tend to sell early on other trades. In an experiment with a simple thinking strategy, participants were told to think of a series of decisions as linked together. They were told that initial choices were good predictors of future choices. The choices they made concerned deciding on a smaller reward up front, or waiting for a larger reward later. For example, a participant might decide between one piece of pizza now and two pieces of pizza in a week. It's quite similar to taking a smaller profit early rather than patiently waiting to take a larger profit later. Some participants were asked to consider the advantage of putting off taking a smaller reward up front.

Results of the study showed that this simple thinking strategy worked. When people were reminded of the recurring nature of choices, and that they should show self-control early on, they were able to actually show more discipline and self-control when asked to make later economic decisions. These findings suggest that if you want to trade with discipline, it is essential that you maintain discipline at all times. Don't sell early, and think, "I'll hold on next time." The mind doesn't seem to work that way. You must show self-control early and on all decisions. So when you are about to sell early, stop! Remind yourself that the long term consequence of taking profits prematurely is that it will set a bad precedent. You won't be able to show self-control and restraint when you really need to. And in the long run, it will severely cut into your overall profits.

However, there is another way to handle trades—one that can give you the best of both worlds. The way we do it at Trading Educators is to take a small but quick profit as soon as possible, move to breakeven, and then allow the market to take you as far as it is willing.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Instant Income Guaranteed - X Trade

Developer: Joe Ross

Administration and New Developments: Philippe Gautier

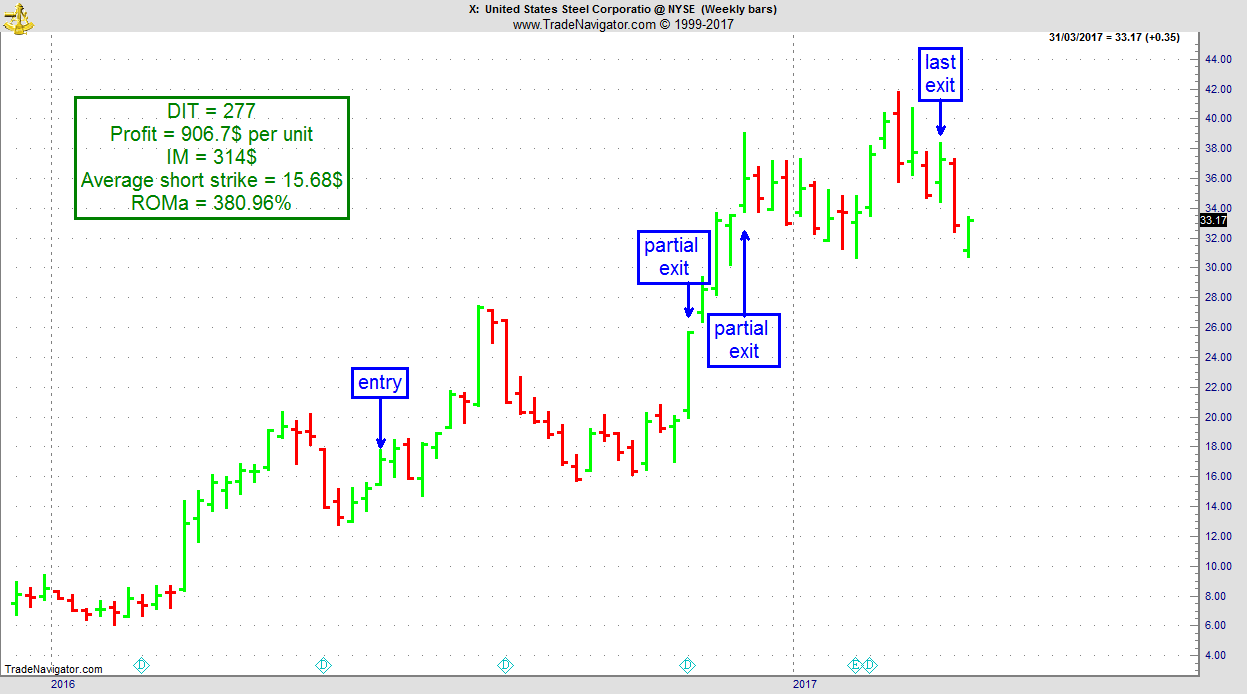

On 9th June 2016, we gave our subscribers a new type of trade on US Steel (X), which was showing accumulation on a pullback on the weekly chart.

We entered a "complex position", entered for a net credit (still working with OPM, i.e. other people's money, as usual), but with unlimited upside potential.

- On 10th June 2016, we entered the trade for a credit of $1.70 (or $170 per position).

- On 9th November 2016, we took partial profits on our long position.

- On 7th December 2016, we took new partial profits on our long position and closed our short position.

- On 13th March 2017, we took our profit on our last long position on a weekly trailing stop.

DIT = 277 days

Profit: $906.70 per unit

Average short strike = $15.68

Margin: $314

Return on Margin annualized: 380.96%

These are low maintenance, low stress trades with lots of upside potential. Our total profit was about 3 times our average margin requirement on this trade.

We presently have 22 of these trades opened, some of them with no margin requirements left.

Philippe

Receive daily trade recommendations - we do the research for you!

Instant Income Guaranteed

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2017 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent.