Edition 986

July 7, 2023

Let's Learn the Art of Trading Joe Ross' Way!

"The person who says successful trading cannot be done should not interrupt the person doing it." -- Master Trader Joe Ross

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

This newsletter and future publications are created to keep Master Trader Joe Ross' lessons readily available to traders that want to learn and improve their skills. Our father passed away on September 7, 2021 and will be greatly missed, but his writings will stand the test of time for generations to come. Take it to heart and learn from the best through Joe Ross' trading examples and articles which have impacted thousands of traders on every continent for over 60 years.

Chart Scan with Commentary: Flags

Joe! What can you do with a flag? I’ve heard about them but I have no idea what can be done with them. Can you show us one?

A flag is often synonymous with a ledge. It occurs as a resting place during a trend. If the flag is greater than 10 bars, but less than 21 bar, it becomes a congestion. Beyond 20 bars it is no longer a flag and should be treated as a trading range.

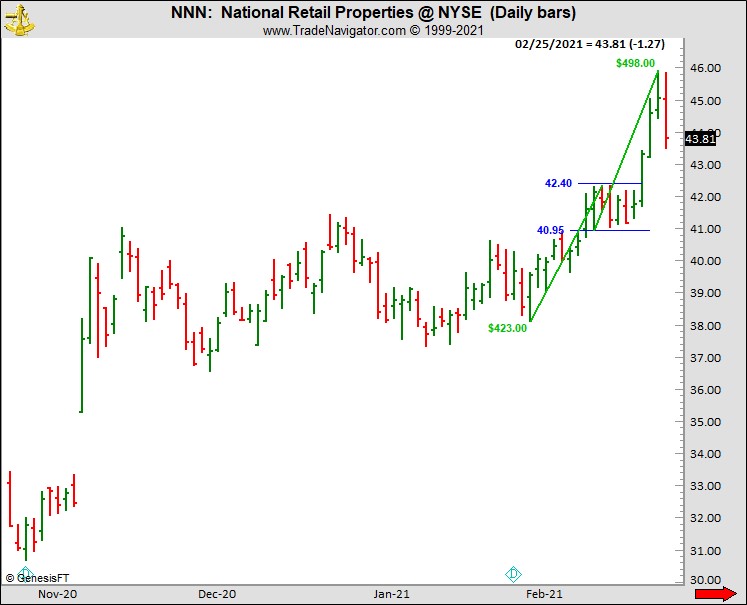

In the case of the chart above, the flag is also a ledge with two matching highs and two matching lows. The matches are separated by at least a single bar. So, what is a flag on the chart above? I’ve marked it off. Looking back, we can see that the low of the flag was at 40.95 delineated by matching lows. The top of the high of the flag was about 42.33 delineated by matching highs.

A flag is a technical charting pattern that looks like a flag on a flagpole and suggests continuation of the current trend. Flags are areas of tight consolidation after a trending movement in price and typically consist of between five and twenty price bars. In the case of the flag above, the flag pole was not very steep. It went from 38.10 to 42.33, or $423. From the bottom of the flag to the top of the breakout the move was approximately $498, which was a bit more than projected by the flagpole.

What can you do with a flag breakout? You can anticipate a continuation of the trend by placing a buy stop at the top of the flag for the underlying asset, or even at the bottom of the flag if you believe that is where support is. You can also play this situation with options, selling Puts, buying Calls, or entering a spread-short Puts, and long Calls.

© by Joe Ross. Re-transmission or production of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Extending our Let Freedom Ring Sale!

Offer Ends July 11, 2023

40% OFF ALL EBOOKS AND RECORDED WEBINARS

~ Click the Links Below and Use Coupon Code "july40" during Checkout ~

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Day Trading

Hey Joe what exactly is day trading? Let’s face it, all orders are placed during the day, but placing an order during the day doesn’t make me a day trader. In fact, lots of times, I am in and out of a trade in a single day, but only by circumstance, not intention.

Day Trading is defined as the buying and selling of an underlying asset within a single trading day. This can occur in any marketplace, but is most common in the...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, and Day Trading, and Editor for 20+ years with Traders Notebook, daily advisory newsletter.

Trading Article: Stress or Just Excitement?

There is a tendency to become overemotional when trading. Overcoming the propensity to play emotionally requires a conscious commitment to specific trading objectives. This entails choosing a target, developing a strategy, and finding a method for adhering to it. A goal enables you to keep a relatively even keel through good and bad periods, to sustain momentum, and to keep from becoming bored.

Of course, most traders enjoy the...read more.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush-Signals.com Launched in 2016 - Still Going Strong

Marco Mayer announced in 2016 a new AlgoStrats service was launched: Ambush Signals for Futures. This is how it all got started....read more.

by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

The Ambush Trading System was created in 2009 by Marco Mayer. Since then it proved itself in the markets for over a decade and did so with exceptional results. It's the only trading system we're aware of that is still going strong after so many years. While Ambush is a day trading system, meaning you will always enter and exit on the same trading day - you don't have to sit in front of your trading screen. You simply place your entry orders when the trading session starts and come back at the close!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Extending our Let Freedom Ring Sale!

Offer Ends July 11, 2023

40% OFF ALL EBOOKS AND RECORDED WEBINARS

~ Click the Links Below and Use Coupon Code "july40" during Checkout ~

Even though Master Trader Joe Ross passed away September 7, 2021, his trading knowledge of over 60 years will carry a trading legacy and will live on. As you learn about Joe Ross and understand what he was trying to teach his students, you will find that within his writings, he had a very special gift. Most importantly, it was his students that kept him striving to provide comprehendable trading material to actually teach traders and become independent, to rely on anyone, but themselves.

Joe Ross has been trading and investing since his first trade at the age of 14, and is a well known Master Trader and Investor. He was able to survive all the up and downs of the markets because of his adaptable trading style, using a low-risk approach that produces consistent profits.

Joe Ross is the creator of the Ross hook™, and has set new standards for low-risk trading with his concepts of "The Law of Charts™" and the "Traders Trick Entry™." Joe was a private trader and investor for much of his life, but a serious health situation in the late 80's caused him to shift his focus, and that is when he decided to share his knowledge. After his recovery, he founded Trading Educators in 1988, to teach aspiring traders how to make profits using his trading approach.

Joe Ross has written twelve major books and countless articles and essays about trading. All his books have become classics, and have been translated into many different languages. His students from around the world number in the thousands. His file of letters containing thanks and appreciation from students on every continent is huge: As one student, a successful trader, wrote: "Your mastery of teaching is even greater than my mastery of trading".

Joe Ross holds a Bachelor of Science degree in Business Administration from the University of California at Los Angeles. He did his Masters work in Computer Sciences at the George Washington University extension in Norfolk, Virginia. He is listed in "Who's Who in America." After 5 decades of trading and investing, Joe Ross still tutors, teaches, writes, and trades regularly. Joe is an active and integral part of Trading Educators. He is the founder and contributor of the company's newsletter Chart Scan™.

Let's Learn the Art of Trading Joe Ross' Way!

"The trouble with trading is, you're halfway through it before you realize it's a do-it-yourself thing." -- Master Trader Joe Ross

Joe's philosophy for helping traders is:

"Teach our students the truth in trading - teach them how to trade."

and

"Give them a way to earn while they learn - realizing that it takes time to develop a successful trader."

Joe sets forth the mission of Trading Educators as follows:

To show aspiring futures traders the truth in trading by teaching them how to read a chart so that they can successfully trade what they see, and by revealing to them all of the insider knowledge they need in order to understand the markets.

To enable them to trade profitably by training them to properly manage their trades as well as their mindset and self-control.

To accomplish our mission for our students we educate them so that they know and understand:

Benefits for our Clients:

- Where prices are likely to move next.

- Independence from complicated trading methods, magic indicators, and black-box systems.

- Independence from opinion, anyone's opinion, including their own.

- Independence achieved through knowing how to read a chart.

- Independence through having knowledge of insider actions.

- Independence achieved by taking holistic and eclectic approaches.

- Independence coming from knowing how to manage both the trades and themselves.

- Independence because they understand and trade what they see.

- Independence because they have learned how and why prices move as they do, through studying the truth in trading and the truth about markets.

Students learn only proven methods and techniques, which helps them to preserve capital and create more consistent profits; they are offered simple methods that will assist them to earn while they learn.

- They learn to work smarter and more effectively.

- They learn to treat trading as a business; we offer no Holy Grail or magic systems.

- They learn to adapt to changing market conditions.

- They learn a systematic approach to trading rather than a mechanical system for trading.

- Why prices will move there.

- Who and what cause prices to move.

- How far prices are likely to move when they do move.

- Their own role in the movement of prices..

- How to take advantage of the knowledge they receive.

- How to properly manage and exit a trade which they have entered.

- How to manage themselves and acquire the discipline needed to become successful traders.

Read some personal testimonials which Joe has received.

WE APPRECIATE YOUR TRUST IN US AND THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please click on the "newsletter" button located at the top of our website.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2023 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.

Dear Traders,

Master Trader Joe Ross passed away September 2021, and prior years he was continously sending me folders filled with Chart Scan and Trading Articles. The emails would be titled "More to follow" and I would reply, "Keep'em coming". I am calling these lessons "hidden vault" material because if Joe were still alive, this is exactly what would be shown in your inbox every Friday morning. This is not regurgitated material; this is new stuff written by Joe or as he would refer to it with such passion, "This is good stuff".

As we continue to receive newsletter sign ups, new students from every continent will start to learn trading Joe's way especially in this challenging market. This is where he would reinforce to his students, yes, that includes you, that learning to trade is possible even in this environment, "A chart, is a chart, is a chart". His writings will stand the test of time to provide teaching lessons and guidance.

The proceeds of Trading Educators will continue to support Joe's wife, Loretta, of 62 years of marriage, which she is our number one priority. We thank everyone with continued support and prayers for her well-being in late stages of dementia.

As expressed in the past editions, the trading world has lost a unique and passionate trader and his material will continue to be relevant. Let's start learning to trade Joe Ross' way with our future Chart Scan publications. I am here to help, so feel free to email me with any comments, questions or concerns.

This newsletter and future publications are created to keep Master Trader Joe Ross' lessons readily available to traders that want to learn and improve their skills. Our father passed away on September 7, 2021 and will be greatly missed, but his writings will stand the test of time for generations to come. Take it to heart and learn from the best through Master Trader Joe Ross' trading examples and articles which have impacted thousands of traders on every continent for over 60 years.

Happy trading,

Martha Ross-Edmunds

© by Trading Educators, Inc. Re-transmission or reproduction of any part of this material is strictly prohibited without prior written consent