Trading Educators Blog

Insider Buying and Selling

If you are unfamiliar with the term, insider buying refers to when insiders of a company - such as CEOs or directors - purchase shares of company stock on the public market or via private placement. Sometimes, the purchase may be the result of a stock option exercise, but often they are public market transactions.

Insider buying typically means that the insider is bullish on the company's stock; they believe it is undervalued and will rise. Tracking insider buying regularly can help to outperform the market.

Here are some of the pros/cons of tracking insider transactions.

Pros

Insiders usually have better insight into how a company is doing, and a flurry of purchases could be a powerful signal that the stock is undervalued and set to rise.

Insiders tend to time their purchases (and sales) smartly, buying near the bottom and selling near the top.

This information is public and can be easily accessed.

Cons

It can be hard to make sense of the trading activity. A few small purchases or a stock option exercise may not be that relevant.

Insiders are humans just like you and I, and can be wrong. It's not a perfect science by any means.

It's only one piece of information to consider when investing; there are more important factors to consider, like the company's earnings prospects.

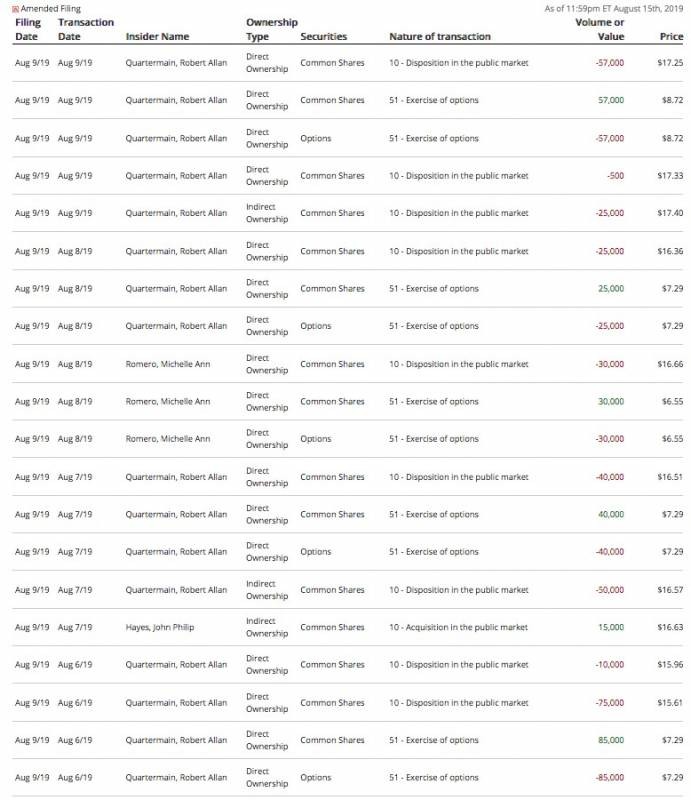

Consider the size of the purchases (especially when compared to the size of the company's market cap), the salary or total annual compensation of the insider buying the shares, the frequency of transactions and where the purchase occurred (public market, private placement, or via option exercise). Following is a picture of Insider Activity for Premium Resources (PVG).

Pretium Resources operates the high-grade, underground Brucejack gold mine in British Columbia. The mine produced 90,761 ounces of gold in Q2 at $940 AISC, generating $41.2 million in operating cash flow.

The company's insiders have been exercising stock options but selling all of the shares instead of holding onto a few.

Here's a summary of the recent transactions from August 6 to 9: Insiders have been selling!

Most notably, direct Peter Birkey (not shown) exercised 132,000 options at C$7.86, and then sold the entire stake at C$7.99, bringing his position down to 94,978 shares, according to filings.

We want to hear from you, Joe Ross wants you to learn trading. Email questions or if you need additional information. Another great investment is private mentoring with Joe, our students find this very helpful to accelerate their trading successes.