Trading Educators Blog

Multi-Leg Spreads

Not many traders are familiar with futures spread trading. Even fewer traders understand multi-leg spreads. However, trading these types of spreads is as easy as trading an outright futures contract.

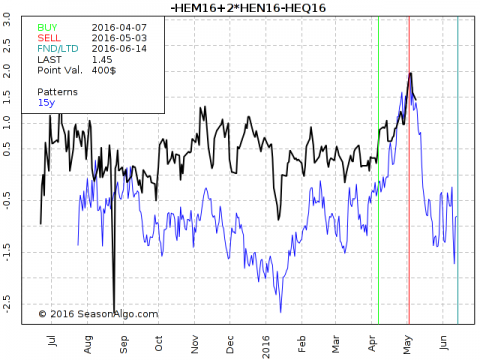

Below is a 3-leg butterfly spread in Lean Hogs that we recently closed out in Traders Notebook: short one contract in June and in August, 2016, and long 2 contracts in July, 2016. The blue line on the chart is the 15-year seasonal pattern, and the black line is the chart of the Lean Hogs butterfly we entered on 03/30 at 0.0. As you can see, the spread nicely followed its seasonal pattern.

I am often asked, “Isn't it difficult to handle three legs at the same time?” My answer is “NO!” It’s as simple as trading an outright futures contract, because butterfly spreads trade at the exchange as a single contract (see the chart below). The only difference is that the spread below is the reverse of our butterfly spread from above, which meant we had to sell the spread on our entry (this is simply a definition by the exchange).

At the end of 2015, we started trading this kind of spread, and so far, we are doing very well. If you are a mid- to long-term trader, you should definitely look into multi-leg-spreads and of course into Traders Notebook (limited time special offer).