Edition 734 - July 6, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Trade What You See

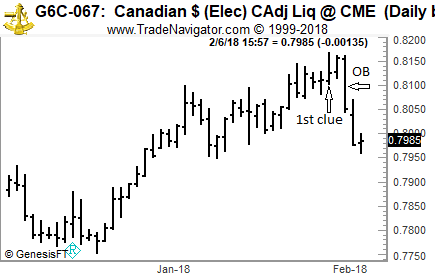

If you are a student of The Law of Charts, you understand that what drives prices in any market are the actions and reactions of traders to the movement of price. Last week, when I began writing Chart Scan, I saw reversing action in the Canadian dollar.

What was causing that reverse action? Part of it was due to profit-taking by traders who were long and benefitted from the recent run-up in the C$. Part of what I saw was the result of selling action by the Central Bank of Canada. The Canadians have become concerned about the rising C$, which makes their exports less competitive. One other possibility is in the picture, and hints that possibly I was seeing the end of to the carry trade.

With possibilities abounding, what is a trader to do? My solution to the problem never changes — trade what you see.

As I looked at a daily chart of the C$, I could see some significant things taking place. There was no need to guess. The first clue was when C$ futures soared to 0.8168, but gave back much of what it had gained by Closing at 0.81255. That kind of giving back is strongly suggestive of an impending reversal. Sure enough, two days later, more evidence of reversal appeared as an outside, long bar (OB) down with a Close much lower than the Open.

When I see that kind of situation, I am ready to sell short. In my private tutoring sessions, I teach traders to do exactly that, because there are no fewer than two strong signals to go short staring them right in the face. However, even if you don't recognize those signals, a simple reading of the chart is all you need to recognize that the upward momentum has, at least temporarily, been lost.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Self-Control

You're in the midst of a perfect trade. You entered where you had planned, and you know when to exit. All you have to do now is wait for the price to reach 53 and sell. But it's not moving fast enough. It seems to be hovering around 51 and 50. You're starting to wonder whether or not it will ever move up. Panic sets in and you sell. About an hour later, the price hits 53 and it now seems obvious that you should have waited. Why didn't you wait? Why did you impulsively sell? If you have trouble maintaining self-control, you're not alone. It's a common ailment.

It's quite possible to have a trading plan all worked out, but fail to follow it. When you plan out the trade in a logical state of mind, you have every intention of following it. You know exactly what you will do and when. At a critical moment of trading, however, something in your inner self goes awry. When you should be especially focused on sticking with your plan, you abandon it. Why did you make such an impulsive decision that you may regret later? Some traders feel that everything happens so quickly that there is very little they can do. To some extent they are right. Your mind and body tend to react so instinctively that you can't slow things down and stop yourself from making an impulsive decision. However, you can practice slowing down the processes that precede an impulsive move. You may not realize it, but every action you take is preceded by thoughts. You have an internal dialog with yourself as you trade; it's sort of like having a conversation with yourself.

What you say in this dialog dictates how you feel and how you act. For example, if you tell yourself, "The price isn't moving the way I want. It never does, and I'm a fool for believing that it will," you will obviously feel uncertain, frustrated, and ready to close out your position. In contrast, if you think, "The price isn't where I would like it to be, but it's too soon to tell what will happen in the end. I need to relax, trust my trading plan and see if it comes to fruition," you will be more likely to stay disciplined and stick with your plan. It may seem obvious that what you say to yourself will dictate how you feel and act, but many people underestimate the power of the internal dialog. They don't realize that thoughts can pop into their head at the wrong moment and seriously impact what they do. If you are not keenly aware of what you are thinking as you trade, you are prone to fall victim to your unproductive thoughts. It is vital to monitor your thoughts, and when you enter a trade, maintain your self-control.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

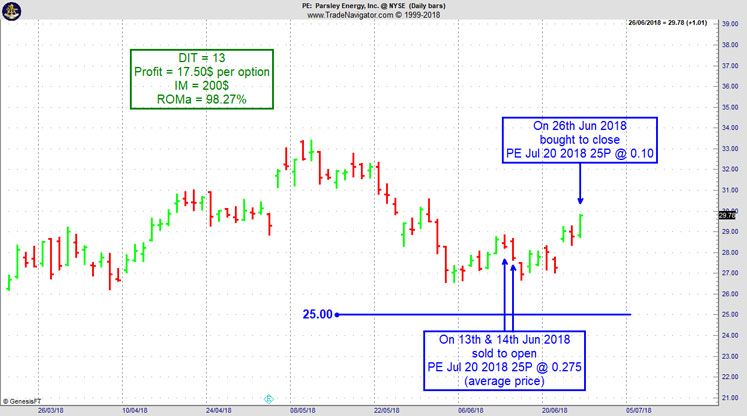

PE Trade

On 12th Jun 2018 we gave our Instant Income Guaranteed subscribers the following trade on Parsley Energy Inc. (PE). Price insurance could be sold as follows:

- On 13th & 14th Jun 2018, we sold to open PE Jul 20 2018 25P @ 0.275 (average price), with 38 days until expiration and our short strike about 13% below price action.

- On 26th June 2018, we bought to close PE Jul 20 2018 25P @ 0.10, after 13 days in the trade for quick premium compounding.

Profit: 17.50$ per option

Margin: 200$

Return on Margin annualized: 98.27%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Part 2 - What's my real reason for trading?

Last week we talked about the real reasons for trading and what our hidden goals are. I've received a couple of emails asking me if I can name a few of these hidden goals.

There are numerous motives, but here are just a few to help you get the idea:

- There are those with a deep-rooted belief that things always go wrong and good things never happen to them. They have a wish to confirm this fact to themselves (trading works wonderful for this).

- There is the individual who feels deeply insecure and is looking for something to raise his self-esteem and self-worth.

- There is the trader who believes in creating memorable, flourishing triumphs to be remembered by everyone.

- There is the person who uses trading in the same way people use punching bags – to get rid of the day's frustration. And there is the person who uses himself as a punching bag, employing trading to do the damage.

- There are those who are simply hooked on the adrenaline of the action.

It ought to be stressed that none of these hidden motives are illegal, evil, or bad. They may be exactly what someone wants out of trading. But the problem is, not very many of these motives have any relation to the task at hand ─ trading with the discipline necessary to win consistently.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Many successes in your trading,

Andy Jordan

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

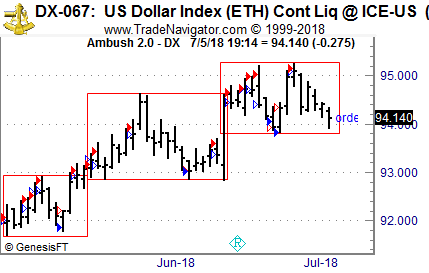

Trading Example: Profitably trading the Dollar Index in uncertain Times!

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the Dollar Index Future (DX) traded at the ICE, where Ambush Traders are having a really nice time lately.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

Due to the uncertainty in the US moving towards a potential trade war, the Dollar Index has been tough to trade lately. While it has been somewhat moving higher it did so in a very unsteady way with a lot of sideways action in between, see this daily chart of the DX:

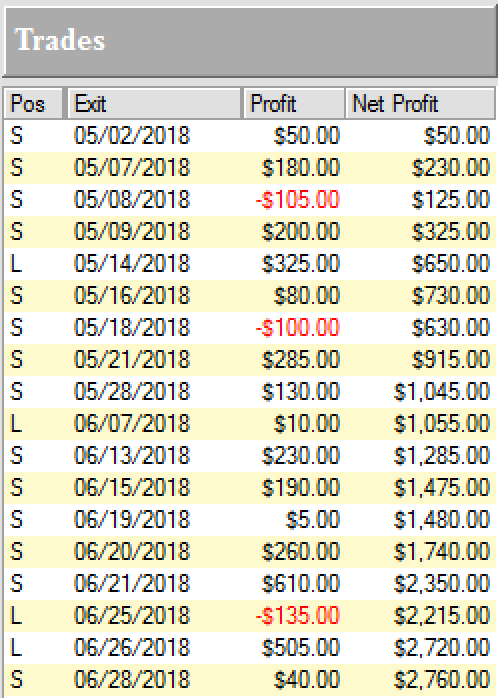

Luckily, Ambush has no trouble at all in such markets and so Ambush Traders had a really good time trading DX during the last two months! As you can see we had a lot of trades at the tops and bottoms of these trading ranges, whether they’re small or a bit more expanding.

Where’s the Dollar Index going next? For sure to either the top or the bottom of the trading range it’s in. As Ambush Traders we don’t mind, we’ll be there ready to sell to or buy from the novice traders who’ll then accelerate our profits as they got to get out of their next losing trade.

Here’s the result of these trades, trading one Dollar Index (DX) contract, including $10 commissions per trade. Yes that’s a win rate of over 83% and a profit factor of 9!

Is it always like that? Of course not, but if you’ve been on the other sides of these trades you maybe should think about switching sides!

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals!

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook.

Happy Trading!

Marco

Feel free to email Marco with your trading questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.