Edition 735 - July 13, 2018

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Commodity Characteristics

Could Crude Oil hit $86/bbl?

If you look at a daily chart, it seems pretty far away. But....

If you look at a weekly chart of Crude Oil futures, you realize it's no big thing for prices to hit that high – especially if the economy continues in an inflationary mode.

The strange thing about commodities is that commodity prices are determined by commodity prices.

When commodity prices are high, it drives producers and users to find alternatives. Demand drops, and eventually, commodity prices drop. High prices bring in more supply, and before you know it you have too few dollars chasing too much supply.

The opposite is true as well. When commodity prices are low, supply drops off, eventually resulting in short supply. Demand increases as producers and users drop alternative sources in favor of less expensive sources. At some point, you have too many dollars chasing too little supply.

After many years of hearing about peak oil, it may come as a shock that all sort of new supply is coming into play. Some huge new discoveries have been made, and technology will soon bring even more oil online. We are far, far away from running out of oil.

So, while $85/bbl is entirely possible, so, too, is $45/bbl for Crude Oil.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: It Takes Guts

Short-term winning traders have guts. They have to. No one has a crystal ball. You can guess what the markets will do, but you can never know what will happen with complete certainty. Only the traders who risk enough money, and make enough winning trades can hope to achieve glory. And living under these conditions takes guts.

Trading can be about 90% market psychology. Do fundamentals play a role? Sure they do, but mass psychology can play a bigger role at times. Consider a current news headline: ZZZ Company recently announced that it was doubling its second-quarter loss to $254 million. What can you do with this information? It's hard to know. On the one hand, you might anticipate the stock price to fall as sales continue to decline and pension costs plague an already vulnerable company. On the other hand, the stock price may be at a bottom, and ready to rise at the slightest news of prosperity. In the end, no one (besides insiders) will know for sure what will happen in the next few weeks or months.

What can a trader do? You have to take a risk and think optimistically. Rather than mull over how much money you may lose on a trade, it's useful to put the trade in perspective. It's merely one trade among many. Think of the bigger picture. You may lose on a single trade, but across a series of trades you will come out ahead overall. By risking only a small percentage of your capital on a single trade, you can allow yourself to feel at ease, and calmly assess where any given trade is going. You can nonchalantly close the trade when it isn't going well, or let it ride when it is winning. Successful traders plan on executing many trades and know that not all trades need to be winners in order to increase the equity in their accounts. It's your success overall that counts. Keeping this in mind takes some of the pressure off, and allows you to go from trade to trade in order to allow the law of averages to work in your favor.

Although thoughtful and astute analysis of a company and its stock performance is vital, trading can also be a matter of chance. It may be impossible to anticipate the outcome of any single trade. However, with a large enough number of trades and a trading approach that has a high chance of producing wins, you can expect to come out ahead if you make enough trades.

Although trading involves chance and risk taking, you should not draw the conclusion that winning traders are reckless. They aren't. They approach trading systematically. They develop clearly defined trading plans and they trade them. They wait for market conditions that increase their odds of success. But most of all, they have a positive attitude. They know that if they do their homework and make enough trades, they will take home a profit. There are no guarantees, but if you work hard, and have the guts to take a risk, you will experience the glory of trading like a winner.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

PCG Trade

On 24th Jun 2018 we gave our Instant Income Guaranteed subscribers the following trade on Pacific Gas & Electric Co (PCG), after the breakout of the point 2 of a 123 Low. Price insurance could be sold as follows:

-

On 25th Jun 2018, we sold to open PCG Jul 20 2018 35P @ 0.475 (average price), with 25 days until expiration and our short strike about 18% below price action.

-

On 5th July 2018, we bought to close PCG Jul 20 2018 35P @ 0.20, after 10 days in the trade for quick premium compounding.

Profit: 27.50$ per option

Margin: 700$

Return on Margin annualized: 143.39%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Fear in Trading

For some traders it is imperative that they run scared. For those traders it is the emotion of fear that can generate the concentration necessary to survive.

Trading is a stressful business. In other fields we see constant demonstrations of performing under stress. It is the ability to thrive under stress that sets athletic superstars apart. It is the ability to go on stage when your stomach is full of butterflies that can make a stage performer into a star.

An effective trader learns to handle stress. His natural instinct of self-preservation is what makes him effective when challenged.

There are other forms of stress besides fear. Selfishness can cause a trader to fight in greedily for what he thinks he must have. Such a trader will trade without any consideration for personal honesty. His attitude is get what you want. Win somehow.

As a trader you must find out who you are and learn to accept yourself that way.

Regardless of the source of your stress, if you are going to trade effectively, you must face the cause of it and learn to deal with it.

Many successes in your trading,

Andy Jordan

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

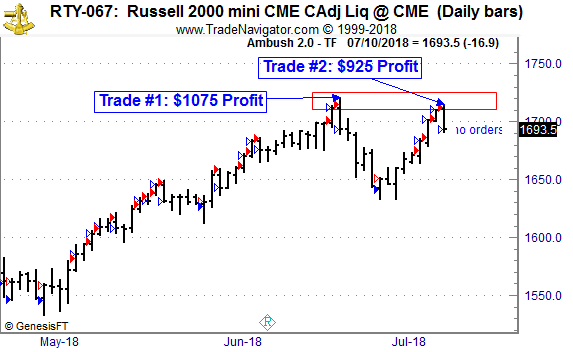

Trading Example: Ambush Traders catch stock traders with a bull trap twice for big profits!

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the Russell 2000 mini Future (RTY) traded at the CME, where Ambush Traders are having a really nice time lately.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

Like many other stock indices, the Russell 2000 approached the June highs again this week, very close to the price level where Ambush traders sold the RTY for a $1k profit per contract. And guess what happened this time? Ambush had another sell signal very close to the last one at 1712 points which turned out to be very close to the high of the day. And like last time it turned out to be another bull trap handing us almost another $1k profit, closing the trade at 1693.5!

Is it always like that? Of course not, but if you’ve been on the other sides of these trades you maybe should think about switching sides!

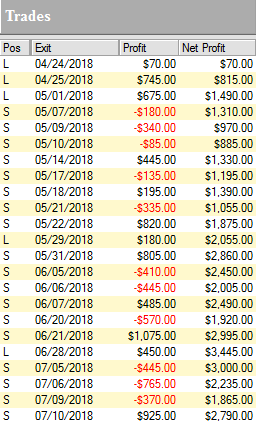

Here’s the result of all of the trades shown on the chart, trading one Russell 2000 mini (RTY) contract, including $10 commissions per trade.

Let’s face it, you don’t want to be on the one caught on the other side of these trades. Also if you’re actively day trading by getting in and out of the market all day long, honestly ask yourself if that’s worth your time? And are you actually doing better than this? With Ambush you’re day trading without even having to be there during the day!

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals!

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook.

Happy Trading!

Marco

Feel free to email Marco with your trading questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.