Edition 736 - July 20, 2018

Summer Special!

50% off Traders Notebook Subscription!

Use Coupon Code: andy50

”The Traders Notebook authored by Andy Jordan based upon his experience and Joe Ross’s techniques is a premier daily advisory, with the what why and when of carefully selected futures trades and more.

I look forward to receiving the notice every night that a new Notebook is available with Outrights, Spreads and Options recommendations and some tidbits as well.

The presentation, reasoning and basis of each trade is explained in such a concise articulate way that you eagerly spend more time looking at the charts rather than trying to put together a drawn-out explanation. That is a most efficient teaching technique.

Additionally, Andy is not only a commensurate trader and teacher but also available for you, helping you with your questions and observations. He teaches you not to just place orders, but how to become a “trader”. I believe this is the genuine mission of Trading Educators and it is exemplified by TN.”

Frank M., July 16, 2018

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Traders Notebook - Summer Special

Hi Traders,

I am running a summer special with Traders Notebook that offers you 50% off our regular subscription price! Enjoy half the price with a 6-Month or 1-Year subscription and my discount is good until the end of July. I assure you that this offer will not only save and earn you a few dollars, but will benefit your trading experiences while providing you a personal touch that no other plan offers. Use coupon code andy50 during checkout and start receiving my trading notifications with guidance. Feel free to email me with questions, This email address is being protected from spambots. You need JavaScript enabled to view it., or check out the Traders Notebook Complete product page for more testimonials and product overview.

I look forward to working with you,

Andy Jordan

Coupon Code: andy50

Good through the month of July!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Sucker’s Rally?

Are we looking at a sucker’s rally? Is the sucker's rally about to top out? No one can say for certain. But sometimes it pays to look at the big picture.

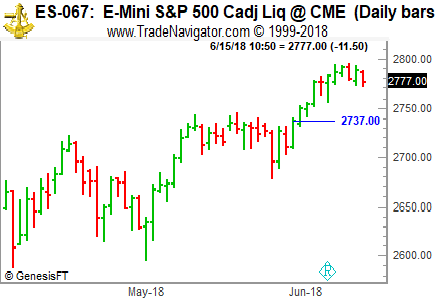

The move from 2678.25 to 2796.00 in the June ES chart chewed through 117.75 points. Can we expect a lot of buying by Fibonacci traders at 2737.00, a 50% retracement, with prices having reached 2796.00?

It would not be out of the question to see a pile of buying enter the market at that point. I'm sure the insiders will be waiting to see if the Fib traders go long in mass at that level, if indeed the ES reaches that level. The current rally could stall out at any time, which is why I'm keeping a close watch on the VIX.

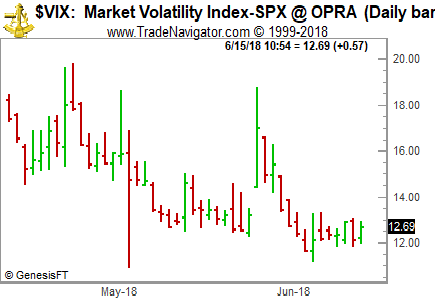

The VIX is an index of implied volatility. The higher the VIX reading, the greater that fear of losing is what drives the market. At the low in March 2009, the VIX exceeded a reading of 50, and it exceeded 80 in November of 2008. But when traders are complacent, as they are now, the VIX reading is very low, at around 13. In fact, the VIX reading is lower than it has been since May of 2018.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Be Humble

Seasoned traders observed long ago that after a series of wins, a trader is vulnerable to over-confidence and trading errors. It's quite understandable. Trading is a competitive business, and when you win, someone else loses. Market participants trade because they are greedy for profits, but often sell out of a fear of losing. How do many traders deal with the inevitable feelings of uncertainty and fear? They become ecstatically happy when they win and ready to brag about their good fortune. Out of a sense of relief, many traders can't wait to brag about their accomplishments. It's important to reward yourself for a job well done, but we have to be careful to avoid getting carried away. Winning traders are humble. They know they can be on top in one market and down in the next. The markets are fickle. A strategy that works in one set of market conditions can fail completely in another set of market conditions.

What's wrong with feeling proud after making a big win? A little pride doesn't hurt. Trading is difficult. Few people master it, so when you are doing well, it's natural to feel a sense of accomplishment and pride. That said, it is important that you rein in your pride and stay humble, especially when you are on a huge winning streak. When you feel overly proud during a winning streak, you may be prone to making a mistake. You may feel so overly confident that you take risks you should not take. The more humble you are the more open you are to your flaws, and the more astute your perceptions of the markets.

Too much pride often leads to disaster. Those who are especially proud have a burning desire to brag about their accomplishments. But bragging can go too far. When people speak of their successes too often, others often resent them, and can't wait for them to fail. The overly proud trader is likely to cave in to strong social pressure to continue making large financial gains to save face. There's also a risk of becoming stubbornly proud. Stubborn pride often happens when people have spent so much of their life feeling proud of their accomplishments, and trying to feel superior to others, that they have difficulty admitting when they have made mistakes. At an extreme, the overly proud trader becomes afraid to face mistakes and may even deny that they have faults.

Extreme pride has been the downfall of many traders. Trading is hard enough without introducing additional psychological pressures to feel superior to others, maintain social status, or save face. When pride drives trading decisions, a trader is likely to take unnecessary risks in order to make big wins to keep up appearances.

Controlling pride is crucial. It is important to develop internal standards of self-worth. It is useful to trade as if you are running a race with yourself rather than running a race against other traders. Develop your own rules and standards related to your skill as a trader. When you reach your standard, you can feel a little pride, but don't feel the need to tell others about it. If you can feel proud of your accomplishments, without feeling the need to brag about how well you have done, or exaggerate how well you are doing, then you will have learned to feel a true sense of self-worth.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

FN Trade

On 29th Jun 2018 we gave our Instant Income Guaranteed subscribers the following trade on Fabrinet (FN). Price insurance could be sold as follows:

- On 2nd Jul 2018, we sold to open FN Aug 17 2018 30P @ 0.30 , with 45 days until expiration and our short strike about 19% below price action, making the trade very safe.

- On 12th July 2018, we bought to close FN Aug 17 2018 30P @ 0.15, after 10 days in the trade for quick premium compounding

Profit: 15$ per option

Margin: 600$

Return on Margin annualized: 91.25%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

$2,790 PROFIT!

Ambush Traders catch stock traders with a bull trap twice for big profits!

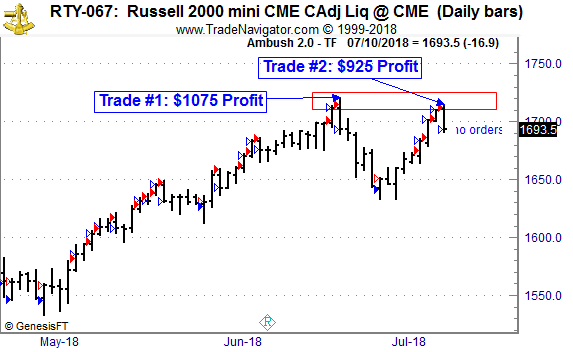

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the Russell 2000 mini Future (RTY) traded at the CME, where Ambush Traders are having a really nice time lately.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

Like many other stock indices, the Russell 2000 approached the June highs again this week, very close to the price level where Ambush traders sold the RTY for a $1k profit per contract. And guess what happened this time? Ambush had another sell signal very close to the last one at 1712 points which turned out to be very close to the high of the day. And like last time it turned out to be another bull trap handing us almost another $1k profit, closing the trade at 1693.5!

Is it always like that? Of course not, but if you’ve been on the other sides of these trades you maybe should think about switching sides!

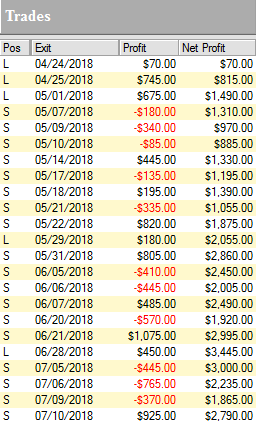

Here’s the result of all of the trades shown on the chart, trading one Russell 2000 mini (RTY) contract, including $10 commissions per trade.

Let’s face it, you don’t want to be on the one caught on the other side of these trades. Also if you’re actively day trading by getting in and out of the market all day long, honestly ask yourself if that’s worth your time? And are you actually doing better than this? With Ambush you’re day trading without even having to be there during the day!

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals!

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook.

Happy Trading!

Marco

Feel free to email Marco with your trading questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.