Edition 737 - July 27, 2018

Be sure to scroll down to Marco Mayer's article, $3,775 profit!

DON'T MISS OUT!

50% off Traders Notebook Subscription!

Use Coupon Code: andy50

OFFER EXPIRES JULY 31, 2018

Read what a current Traders Notebook subscriber has to say!

”The Traders Notebook authored by Andy Jordan based upon his experience and Joe Ross’s techniques is a premier daily advisory, with the what why and when of carefully selected futures trades and more.

I look forward to receiving the notice every night that a new Notebook is available with Outrights, Spreads and Options recommendations and some tidbits as well.

The presentation, reasoning and basis of each trade is explained in such a concise articulate way that you eagerly spend more time looking at the charts rather than trying to put together a drawn-out explanation. That is a most efficient teaching technique.

Additionally, Andy is not only a commensurate trader and teacher but also available for you, helping you with your questions and observations. He teaches you not to just place orders, but how to become a “trader”. I believe this is the genuine mission of Trading Educators and it is exemplified by TN.”

Frank M., July 16, 2018

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Traders Notebook - Summer Special - OFFER ENDS SOON!

Hi Traders,

Don't miss out on my summer special with Traders Notebook that offers you 50% off our regular subscription price! Take advantage of half the price with a 6-Month or 1-Year subscription with Traders Notebook, but the offer expires on July 31, 2018. Learn while you trade using Traders Notebook, benefit from the trading experiences that are provided to you with a personal touch that no other plan offers. Use coupon code andy50 during checkout and start receiving my trading notifications with guidance. Feel free to email me with questions, This email address is being protected from spambots. You need JavaScript enabled to view it., or check out the Traders Notebook Complete product page for more testimonials and product overview.

I look forward to trading alongside with you,

Andy Jordan

Coupon Code: andy50

Good through July 31st!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

TRADING EDUCATORS' TEASER!!

Andy Jordan's Live Trading Room is currently closed to the public, but will open just for YOU starting September of 2018! More updates will follow.

Listen up Traders Notebook subscribers, in August via email, you will receive special pricing, that's right! It is our way of thanking you for being a preferred Trading Educators' customer.

Check this out, traders!

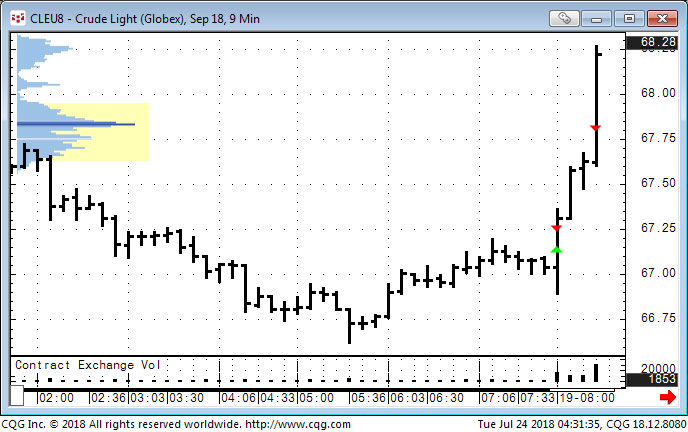

Trading sample from the Live Trading Room on 07/19.

Long at 67.12 with an initial stop at 66.99 trading 2 contracts with an risk of $260 for both contracts.

Selling the first contract at 67.27 for a profit of $150 and the second contract at the target at 67.82 for a profit of $700.

Total profit of $850 or 3.3 times the risk.

Details on how to sign up will follow in upcoming Chart Scan Newsletter Editions!

Email Andy Jordan with any questions, This email address is being protected from spambots. You need JavaScript enabled to view it.!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

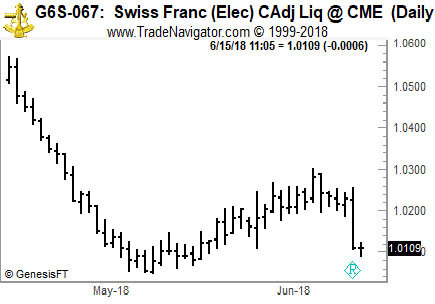

Chart Scan with Commentary: Swiss Franc

Will the Swiss National Bank allow the franc to reach parity with the U.S. dollar?

In the past, every time the franc tried to equal the buck, the Swiss National Bank (SNB) intervened and bought or sold francs. Recently, I looked at the daily chart of the franc, and decided that we will probably see the franc reach parity against the dollar in spite of any actions by the SNB.

As long as the euro keeps rising, there is no problem for the Swiss if their currency rises. The Swiss are inextricably tied to the value of the euro. In general, the euro is the anti-dollar. When the dollar falls, the euro rises. The falling dollar rightfully scares the bejeebers out of a lot of investors, and they run to the franc for some sort of feeling of safety.

Of course, the franc is no longer backed by gold, so flight to the franc is a bit silly. The franc is not safer than the euro in many respects, and currently franc bank deposits are paying negative interest. The SNB cannot allow the franc to rise much against the euro because the economies of their major trading partners are all based on the euro, with Germany being the main importer of Swiss products.

What could stop the franc from reaching parity would be a dollar rally—a rally that many think is long overdue. A dollar rally will move the euro down, and the franc will almost surely have to follow.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Trading Preparations

Are you ready to tackle the markets at any time? Bring it on, right? It would be ideal if we were ready to trade at any given moment, but the human mind has its limits. You don't have an endless supply of energy. After a marathon stretch of trading, for example, you may not be able to tackle the markets in earnest. You may not be able to concentrate fully. You may be easily distracted, and while you are in a state of confusion, you are likely to make trading errors. It is necessary to prepare to trade. It is vital to get your mind ready to trade the markets.

Trading when you’re at your best, and at the right time requires the proper amount of challenge on the one hand, but a good match with your skills on the other. If a trading task is too hard, you will choke. But on the other hand, if you spend your entire trading life blandly fighting boredom, you'll never feel motivated to trade. If trading is a challenge for you, you can get psyched up and be ready to trade at your peak.

Don't make the mistake of thinking that trading doesn't require some preparation. Some seasoned traders actually rate their mental state before they trade. If they are in a bad mood, or feel dazed and confused, they stand aside for the day. It makes little sense to trade in the wrong state of mind. You will end up making trading errors that you'll regret later.

How can you prepare yourself to trade in the proper mental state? The first step is to make sure that you are rested. Many people think they can get away with the minimal amount of sleep or skip nutritious meals. But proper nutrition and adequate sleep are necessary to cultivate an optimal mindset. Trading saps up psychological energy, and psychological energy is limited, so it is vital that you take steps to maximize your energy through proper sleep and nutrition.

Trading in a peak performance mindset requires intense concentration and focus, but it's difficult to maintain this stance when the pressure is on you to perform. Thus, a second step that you can take is to reduce any psychological pressure that may potentially sap up limited psychological energy. The most obvious way to relieve such pressure is to think in terms of probabilities and carefully manage risk. It's useful to remember that you may not win on any single trade, but after a series of trades, you will have enough winners to make a profit in the long run. It's also important to manage your risk. Determine your risk up front and risk only a small amount of trading capital on a single trade. Doing so will ease a lot of the pressure, allowing you to be more open to see the opportunities that the market offers.

It is also important to anticipate any obstacles that may interfere with your ability to trade. For example, if a stressful event is about to happen, such as a move to a new home or a visit from an overbearing relative, it is important to account for such events. You will have trouble trading when you are stressed out. If you anticipate an upcoming stressful event, you should plan to stand aside until the stressful event passes.

Don't think that you can trade the markets without being mentally and physically prepared. Unless you are at your peak, you will make mistakes. Give yourself a break. You can't trade under all possible conditions. If you are rested, relaxed, and ready to trade at your peak, you will increase your chances of taking home huge profits.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and New Developments

Developer: Joe Ross

Trading Example: Instant Income Guaranteed

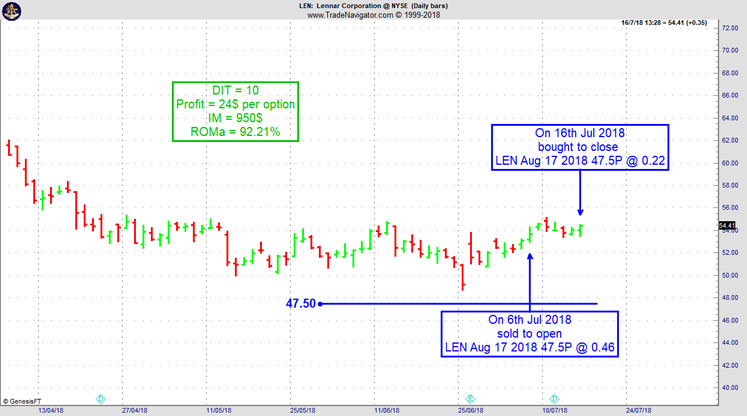

LEN Trade

On 5th Jul 2018 we gave our Instant Income Guaranteed subscribers the following trade on Lennar Corporation (LEN). Price insurance could be sold as follows:

- On 6th Jul 2018, we sold to open LEN Aug 17 2018 47.5P @ 0.46 , with 41 days until expiration and our short strike about 11% below price action.

- On 16th July 2018, we bought to close LEN Aug 17 2018 47.5P @ 0.22, after 10 days in the trade for quick premium compounding.

Profit: 24$ per option

Margin: 950$

Return on Margin annualized: 92.21%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

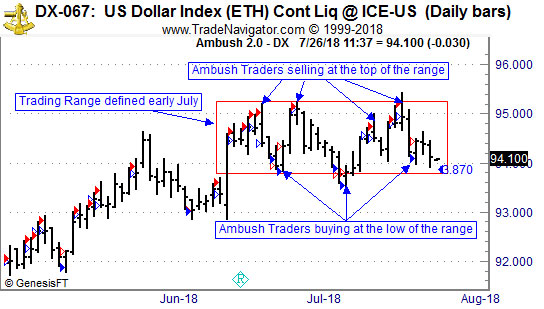

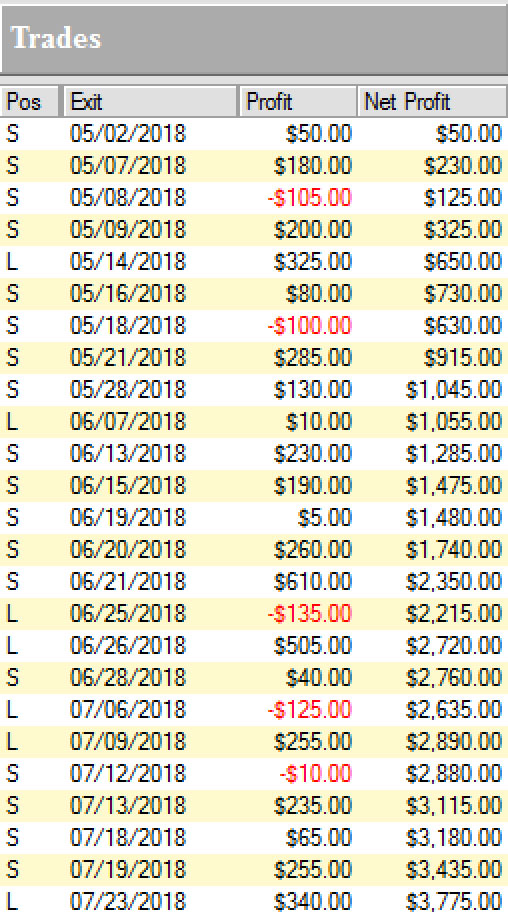

$3,775 PROFIT!

While everyone is confused about the Dollar, Ambush Traders continue to cash in!

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the Dollar Index Future (DX) traded at the ICE, where Ambush Traders are having a really nice time lately.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

As you might remember we talked about the Dollar Index a couple of weeks ago and I’d like to give you an update! Back in early July a trading range formed (see chart) and Ambush traders cashed in by following Ambush Signals: selling at the top and buying at the bottom of the range. Guess what, everyone is still confused about the USD as no one knows how that trade war is going to end:

Luckily Ambush has no trouble at all in such markets and so Ambush Traders continued having a really good time trading DX!

Where’s the Dollar Index going next? For sure to either the top or the bottom of the trading range it’s in. As Ambush Traders we don’t mind, we’ll be there ready to sell to or buy from the novice traders who’ll then accelerate our profits as they got to get out of their next losing trade.

Here’s the result of these trades, trading one Dollar Index (DX) contract, including $10 commissions per trade. Yes that’s a win rate of 80% and a profit factor of almost 9!

Is it always like that? Of course not, but if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides!

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals!

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook.

Happy Trading!

Marco

Feel free to email Marco with your trading questions, This email address is being protected from spambots. You need JavaScript enabled to view it..

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.