Edition 744 - September 14, 2018

Scroll down to check out Marco Mayer's latest update!

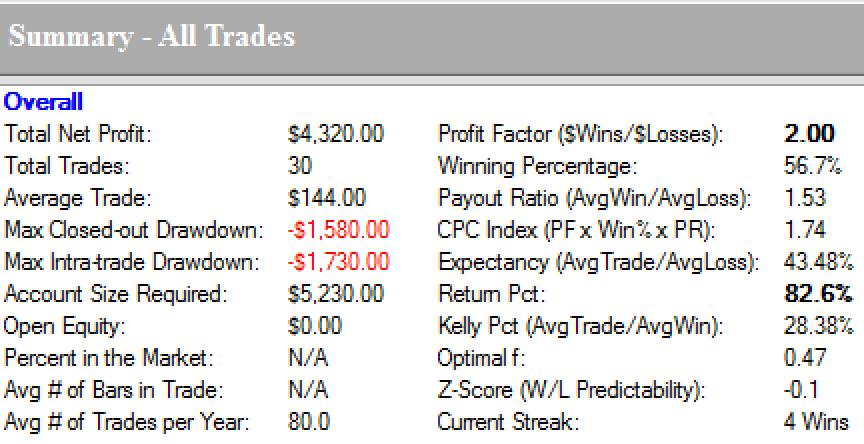

A profit of $4,320 with a profit factor of 2.00!

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: I Love Currency Spreads

Hey Joe! I live in Australia, but I need to hedge against a rising yen. I’ve been long A$ futures since mid-2016 and recently, the A$ has dropped quite a bit. What do you think?

I try to not have an opinion in situations like these. Thinking results in your opinion, which is too often not correct. Some trading decisions are easier based upon trading what you see on a longer term chart.

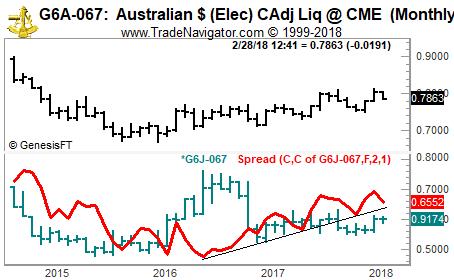

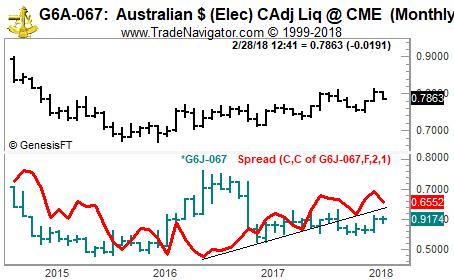

It was from June 30 of 2016 until recently that the Australian dollar (A$) has trended upwards against the Japanese yen.

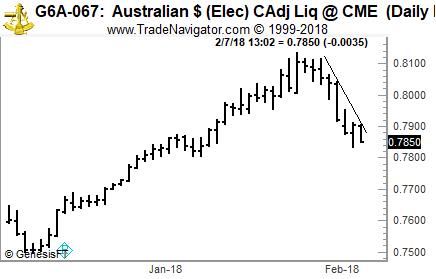

However, in February 2018, both markets began to drop against the US dollar on the daily price chart.

Looking at the monthly chart you see that the A$ began building a base in late June, 2016 and the spread line broke out of that base in December, 2016. The A$ trended upward against the yen for much of the following months.

But in February, 2018, had you looked only at the daily chart of the A$ you might have thought the A$ is going down against the yen. No, it was going down against the dollar.

Looking at the spread between the two on the monthly charts, you would have seen that the trend in the spread had not really changed. As of the date this was written, the spread hadn’t even reached the trend line. There have been ample opportunities to enter long AUD/JPY in Forex, or as a currency spread in the futures markets.

Charts, unlike indicators, never lie. The Law of Charts teaches us to trade what we see. Long-term charts, even long-term spread charts can be used to help us to trade what we see, along with being aware of what is taking place in the world around us.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Are You Worried?

After reading the financial page on Wednesday night, Jim thought, "How could anyone invest in the markets and get a sound night's sleep?" After you saw the major indexes drop on Wednesday, you might have thought the same thing. But as a seasoned investor or trader, you realize that such corrections are commonplace and you've learned to take them in stride. You don't worry about it and know that in the long run, you'll come out ahead. Not everyone is so lucky, however. Some people just can't stop worrying. They look at their portfolio every day, and can't stand to see it lose value, even if it is miniscule and just for a day. They toss and turn all night. Sometimes they even close out positions because they just can't calm down while their money is in play. Unfortunately, some investors worry so much that they just cannot trade efficiently. Other nervous investors just give up. Do you ever get too stressed out while trading? If you are an extreme worrier, perhaps you want to learn to day trade, or just the opposite, learn to trade long term. There are advantages to long-term trading.

Most investors are anxious because they look at the performance of the markets every day and worry about how the natural, transitory ebb and flow of markets may spell doom. By emphasizing the long term nature of trading a worried trader can calm down. Such traders can more easily tell themselves, "Who cares how my positions are doing today? In the long run, over a few weeks or months, I'll come out ahead." That said, some investors are so prone to worry that they cannot relax. They are always thinking of the worst case scenario. In the back of their mind, they truly believe, "I'm going to lose all my money." That's were a stop-loss system can help matters. By using a protective stop set to keep a loss at a reasonable minimum, you'll be able to closely look at the worst-case scenario, realize that the potential loss is minimized, and learn to accept it.

There are other helpful ways to stop worrying. First, you should write down your profit objectives for each trade and keep them nearby. By focusing on your plan, you will be able to stay on target, and when you see how well you are progressing toward you goal, you will feel better. Second, cut back on how often you look at your trades, read the financial section of the newspaper, or watch television coverage of the markets. Looking at how well the markets are doing is merely going to make you worry about how well your trades are doing. If you avoid looking, you'll feel better.

If you are a worrier, trading can be something to fear rather than an activity to enjoy. The more you worry, the higher your potential for losses. By taking precautions, you can stop worrying, relax, and take home the profits.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

THO Trade

On 12th Jul 2018 we gave our Instant Income Guaranteed subscribers the following trade on Thor Industries Inc. (THO). Price insurance could be sold as follows:

- On 13th Jul 2018, we sold to open THO Aug 17 2018 85P @ 0.70 , with 34 days until expiration and our short strike about 15% below price action.

- On 3rd Aug 2018, we bought to close THO Aug 17 2018 85P @ 0.30, after 18 days in the trade .

The underlying stock does not need to go straight up right away for us to profit from price insurance selling.

Profit: 40$ per option

Margin: 1700$

Return on Margin annualized: 47.71%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Idea

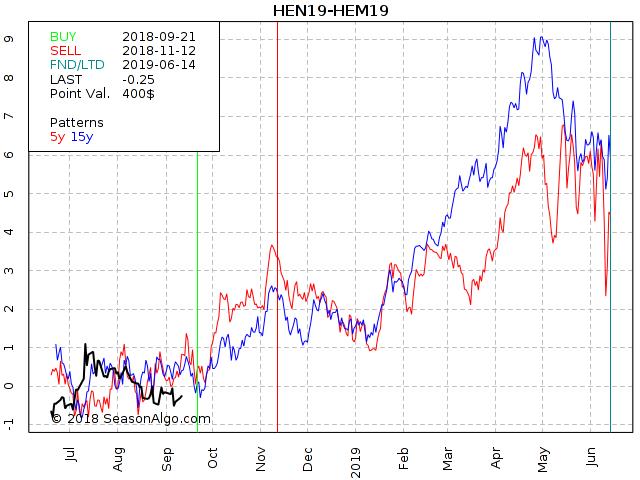

This week, we're looking at HEN19 – HEM19: long July 2019 and short June 2019 Lean Hogs (CME at Globex).

Today we consider a Lean Hogs calendar spread: long July 2019 and short June 2019 Lean Hogs (CME at Globex). This spread has been trading sideways for several weeks in a range between approx. 0.000 and -.500. There is still some time left until the optimized seasonal entry on 09/21 with a possible pull-back to the -.500 level. If not filled, look for a different entry around the 21st of September. Please Note: the exchange traded spread is Lean Hogs June – July and therefore reverse to the one above (the exchange traded spread has to be sold)! Please adjust the entry levels according!

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush Traders keep on profiting big time from stock market uncertainty!

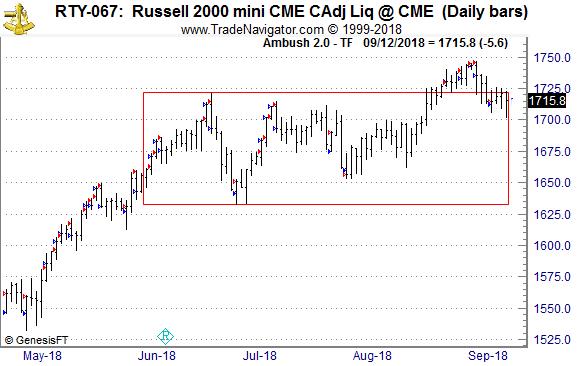

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the Russell 2000 mini Future (RTY) traded at the CME, where Ambush Traders are having a really nice time lately. Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day!

Many of you might remember that back in July we talked about the uncertainty in the stock markets and how well that worked out for Ambush Traders. Since then about two months have passed and guess what, not too much changed! After the Russell 2000 tried to breakout of its trading range, it’s now back inside it and is trading at about the same price as it has been two months ago. At the same time Ambush keeps on hitting those market turning points that are driving other stock market traders crazy…

Here’s the result of all of the trades shown on the chart, trading one Russell 2000 mini (RTY) contract, including $10 commissions per trade:

Yes, that’s a profit of $4320 with a profit factor of 2.00!

Let’s face it, you don’t want to be on the one caught on the other side of these trades. Also if you’re actively day trading by getting in and out of the market all day long, honestly ask yourself if that’s worth your time? And are you actually doing better than this? With Ambush you’re day trading without even having to be there during the day!

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals.

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook. We currently have a special running for the eBook. You can get it 30% off, that’s over $500! Simply use the coupon-code "Ambush30" at the checkout.

Did you check out Ambush's Performance Page? For over 10 years, Ambush Trading Method is one of the longest standing and exceptional trading system in markets like equity indices, currencies, bonds and commodities.

Use coupon code Ambush30 to receive 30% off Marco Mayer's eBook!

I want to hear from you! Send me an email asking questions about the Ambush Trading Method., This email address is being protected from spambots. You need JavaScript enabled to view it.. It will be a good fit for you!

Happy Trading!

Marco

This promotion expires September 30th.

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.