Edition 750 - October 26, 2018

SALE

30% OFF EBOOKS

boo30

COUPON CODE DURING CHECKOUT

GOOD UNTIL NOVEMBER 9TH

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Bitcoin Futures

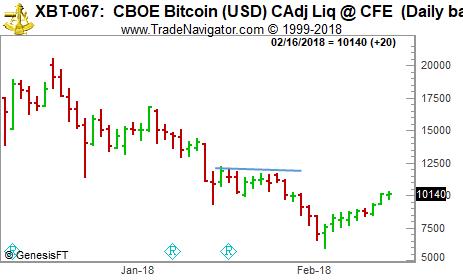

Bitcoin futures are tradable, same as any other financial futures. On the chart below we see that bitcoin has descended from recent highs to first one lower level, where prices moved sideways for several days, and then descended even further into a shallow V bottom. Since that time, Bitcoin has made nine consecutive higher lows. Prices are now set to challenge the recent trading range highs. Failure to break through would be hard on those who believe Bitcoin has much higher to go at this time.

The question is, “Are Bitcoin prices trending?” According to The Law of Charts In-Depth Webinar, prices are in the birth canal of an uptrend. It takes only three consecutive higher lows and higher highs to be able to say prices are beginning to trend. The segment counting method is described in “Trading the Ross Hook.” In other words, there is more than one way to view a trend. Segment counting looks for a trend in the birth canal. Any correction to the segment count after the first 3 segments, constitutes a #2 point.

Notice the trend is not yet defined. To define the trend prices would need to make a lower high and a lower low—a correction, and then continue. If that happened, you would see a 1-2-3 low on the chart, and a violation of the #2 point would define the trend. The first failure of prices to follow a violation of the #2 point would create a Ross Hook. A violation of the Ross Hook would establish the trend.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Break Time

Reality is subjective. There are different states of reality in the same way that there are different states of mind, or different states of emotion. After a series of setbacks, for example, the world can look bleak. Yet after a series of big wins, in contrast, you can feel euphoric, even omnipotent. So which is the true reality? This is a hard question to answer. Perhaps it is best to consider that there are multiple realities, and that some are more conducive to optimal trading than others.

One reality is that you must make profits. If you don't make enough winning trades, you will blow out your account. As true as this fact of trading is, however, forcing yourself to make trade after winning trade can actually make you choke under the pressure. While trading the markets, it is best to put this reality out of your mind. The more you can stay focused on your ongoing experience, rather than dwelling on your performance, the better. The more you just don't care, the better you will trade. Psychologists call this phenomenon the paradox of control: You have to give up control to actually gain control. If you feel that you can lose money and survive, you'll actually make more money. It sounds strange, but it's true. That said, it is hard to forget about your financial needs, aspirations, and expectations. If you are serious about the trading profession, you are probably the type of person who has high aspirations. You seek out success and you are ready to do whatever it takes to succeed.

If you want to trade at your best it is important to get away from it all, psychologically, that is. You need to let your mind relax. You need to let your thoughts slow down. You must occasionally get away from the competitive world of trading. Everyone has his or her approach. Some use meditation. Others work out at the gym until they let off pent up energy and are fully relaxed. And many people get a massage to relieve physical tension. The key is to shake your mind out of one reality and put it into another. Here's one method that can really give your mind the shock it needs. You can immerse your body in warm water (hot but not scalding and preferably at a professionally operated spa) for two minutes and then jump into a pool of cold water. When you immerse your body in a pool of hot water, all you can think about is coping with the heat. It's a little painful and so you must maintain concentration to avoid jumping out. It's a great way to focus.

Trading is inherently stressful. As much as we try to avoid it, our ego is often on the line with our money. It's essential to psychologically get away from it all. Whether it is meditation, exercise or a vacation on a tropical island, it's vital to shake up your reality, rest, and rejuvenate.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

SALE

30% OFF EBOOKS

boo30

COUPON CODE DURING CHECKOUT

GOOD UNTIL NOVEMBER 9TH

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

PAGS Trade

On 9th October 2018 we gave our Instant Income Guaranteed subscribers the following trade on PagSeguro Digital Ltd (PAGS). Price insurance could be sold as follows:

- On 10th October 2018, we sold to open PAGS Nov 16 2018 20P @ 0.30, with 36 days until expiration and our short strike about 31% below price action, making the trade very safe.

- On 16th October 2018, we bought to close PAGS Nov 16 2018 20P @ 0.15, after 6 days in the trade for quick premium compounding

Profit: 15$ per option

Margin: 400$

Return on Margin annualized: 228.13%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: FEAR

There are three foes you must overcome in order to become an adequate trader.

The first foe is fear. If a trader runs away out of fear and avoids trading, nothing will happen except that he will never learn.

Fear causes your logic to become fuzzy and unclear. Lack of clarity becomes the second foe you have to overcome. Clearness of mind about the trading process removes fears. If you yield to the power of fear, you will have succumbed to a lack of clarity.

In trading what can get you into trouble are not the eventualities you took into account, but rather the variables you never thought to question. You must see clearly and use it only to trade what you see, and wait patiently and measure carefully before entering and following a trade.

If you can learn to see clearly, you will possess power. However, power wrongly used is the third foe you have to overcome. Power improperly deployed can destroy you. You must keep everything under control and know how to use power. Power in trading means understanding the markets and how they work. If you do not possess such understanding, power can come and go. If you have such power, it should be used only when it feels right.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

Click Here for Valuable Information about Traders Notebook

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

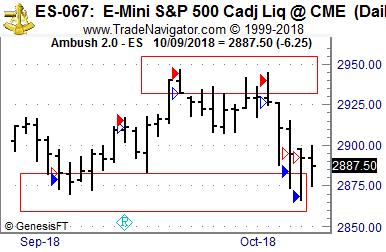

Ambush Traders make over $3,400 winning 100% of the time in the E-Mini S&P 500

The Ambush trading method is specialized in catching intraday market tops and bottoms in a variety of Futures markets. Including the E-Mini S&P 500 (ES) traded at the CME, where Ambush Traders are having a really nice time lately. Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

The S&P 500 has been moving sideways along with most other stock indices over the last months. That’s perfect for the Ambush Method that is specialized in catching tops and bottoms in such market conditions. As you can see on the chart that worked out perfectly over the last month. Right at the bottom of the range Ambush bought close to the low of the days and had sell orders ready right at the very top of the range.

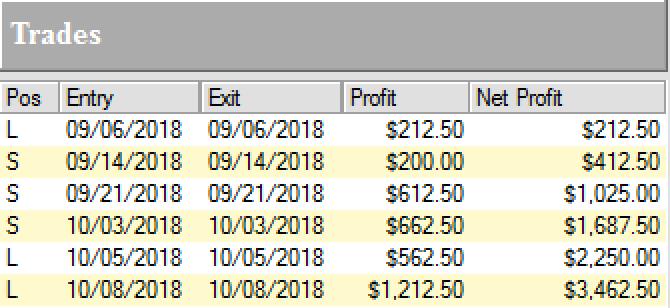

Here’s the result of all of the trades shown on the chart, trading one E-Mini S&P 500 (ES) contract, including $10 commissions per trade:

Yes, that’s over $3,400 profits per contract within just six trades, all of which have been day trades without a single loss!

Let’s face it, you don’t want to be on the one caught on the other side of these trades. Also if you’re actively day trading by getting in and out of the market all day long, honestly ask yourself if that’s worth your time? And are you actually doing better than this? I know day traders who place more than 6 trades within a single hour, but they just make their brokers rich and are all stressed out. With Ambush you’re day trading without even having to be there during the day!

Join us and become an Ambush Trader!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customize what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences. Learn More about Ambush Signals.

If you’d prefer to rather generate the signals on your own and want to know the exact trading rules of Ambush, you want the Ambush eBook.

Happy Trading!

Marco Mayer

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

SALE

30% OFF EBOOKS

boo30

COUPON CODE DURING CHECKOUT

GOOD UNTIL NOVEMBER 9TH

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.