Edition 762 - February 1, 2019

by Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Managing your Trading Business

Keeping Losses Small

I cannot say this enough times, so I’m saying it again, you must learn to keep your losses small. It is the single greatest concept that I can show you that will help you make profits in the market.

This principle is of such magnitude that it dwarfs all other principles for trade, money, and risk management.

Did you know that if you keep your losses small, you can flip a coin for go long/ go short, and you will make money in the markets? Yes, without even the benefit of trade selection you will make profitable trades if you learn to control your losses.

That means getting out as soon as you see that the trade is not doing what it should.

I know that losing is contrary to human nature. I know how much you hate to take those losses. I know how much you detest admitting you are wrong, especially when you’ve put a lot of work and planning into a trade. But consider this: If the trade doesn’t almost immediately go your way, then you have made a mistake! Either your planning was wrong or your timing was bad. The good trades almost always, quickly go your way.

I can usually spot which of my students will become good traders. How can I tell? They are the ones who are concerned with getting out fast and not losing money. They keep tight stops. They are anxious to protect profits—even small profits. They don’t give a trade “room” until they have locked in some profits. They are the ones who realize that many trades will result in little or no profits, but they realize that the market is going to hand them a sizable profit from time to time. Therefore, they conserve their capital waiting for the big windfall to be handed to them.

They are the ones who exert patience in waiting for such an event to happen. They know that they have to score big only a few times a year to get rich in the markets. In effect, they do not overtrade.

I can tell from what you say at my seminars, in your emails, and what you say when you phone me, that most of you trade far too often. You think that you have to trade every day. If you are daytrading you think you have to make numerous trades during the day. You think you have to watch the markets all day long. You are so greedy to take every opportunity that comes along, that you end up making lots of bad trades.

Trades must be planned ahead of time. They must meet every criterion for a good trade. They must be easily seen, and clear cut. There can be no guess work.

If you flipped a coin whether to go long or short, presumably, over time, you would go long half the time and short the other half. My guess is that half the time you would be correct giving you 1/2 of 1/2 correct trades. It has been statistically shown that a 25% trader can make money in the markets with proper risk management. So for some of you, those unwilling to do the proper planning that results in good trade selection, you would be better off flipping a coin, taking small losses on 75% of your trades, and then milking the 25% winners for all they are worth, while making sure that your winners do not turn into losers. THINK ABOUT IT! Maybe you should do some serious self-examination, spend some time working on what is wrong with YOU that causes you to lose consistently.

Staying with Winners

I’ve been taking you apart for overtrading. Now I’d better put you back together again by explaining how to trade correctly.

As traders, each day we face situations that demand buy or sell decision making. If we are daytrading we may be faced with more trading decisions than position traders, but not necessarily so. It depends upon how many markets we are following.

It’s as though we never run out of decision making opportunities. When we decide correctly, we should make money. When we decide incorrectly, we usually lose money.

If we constantly make decisions in order to satisfy some inner need, or because we get some kind of “rush” from decision making, then we are our own worst enemy. Trading for the “attack” or “flight” adrenaline high is almost a sure way to consistently lose.

As traders, unless we are hedgers, we are speculators. It has been my experience that constant decision making does not result in success as a trader. To be successful, we need to avoid overtrading (constant decision making) for making decisions with decreasing frequency. The more we engage in decision making, the more we expose our equity capital to chance of loss.

Our chances of entering a trade correctly on the flip of a coin is small. We use trade selection and planning to increase the chances of entering a trade correctly. Still, because we may not time the trade exactly right, our chances of entering the trade correctly are small. How many times have you entered a trade, had it go against you, gotten out with a loss, and then see it do exactly what you had planned on its doing? What was wrong? Your timing was wrong! That is why you have to get out right away, take your hit and get out NOW! You can always get back in when you see the trade begin to go according to plan.

Once in a trade, the chances of exiting it correctly are even less than they were for entering the trade correctly.

The chances of being right on both entry and exit are the smallest of all. Therefore, the fewer decisions you have to make about trading, the better off you will be.

This fact is the best reason I know for placement of resting stops for both entry and exit. Resting stops allow the market to come to you. Resting stops on entry allow the market to sweep you in when the market is moving your way: If it keeps on moving then you will make money. If the market doesn’t keep on moving, then something is wrong and you must get out quickly. On exit, resting stops take away the need for a decision in the heat of battle, when you are most apt to make the wrong decision.

How often do you get to buy at the bottom or sell at the top? Occasionally, by pure chance, it happens. Usually, you are forced to go with the trend. You must be a buyer in bull markets and a seller in bear markets. You must let the market tell you what to do. If you don’t, then you have some kind of ego problem that makes you think you can control the markets. You want to be God!

The only sound basis besides simple chart reading that I’ve ever found for exiting a trade is the trailing stop. Granted it keeps you from getting out at the market extreme. When you are too busy to constantly track every trade all day long, the trailing stop makes more sense than anything else.

Almost any logical scheme for trailing it is good. You can draw a trend line and keep moving your stop just outside the trend line. You can curve fit a moving average to the trend and keep your stop just outside the moving average. It doesn’t much matter whether the moving average is simple or exponential, or whether it is offset or not offset.

You can trail your stop just beyond the extreme of the last market correction. The main idea here is that once a position is in the money, you don’t give back more than 1/2, or 1/3, or 1/x of what you’ve already seen in unrealized paper profits, and besides protecting that 1/x of what you’ve seen, you DO NOT CROWD the trade. Give it room, but never move your stop further away once you have determined where it should be. If you are using a 3/3 offset moving average and it shows good containment of the trend, then at the point at which there are ample profits, you may even switch over to say a 7/5 offset moving average containment, to give the trade plenty of room to continue its trend.

Another way to help you to stay in winning trades longer is to view corrections as opportunities not to unload your position, but rather to add to your position. A good way to do this is to consider selling out part of your position at corrections, thereby taking some profits, with the idea that as soon as the trend is underway again, you will put on additional positions. Remember, when you add a new position you are adding new risk and you must trade add-on positions in the same way that you would trade any new position, carefully and with tight initial stops.

If you would like to know the best method I have ever found for setting stops consider a small investment in my eBook “Stopped Out.”

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Trading Idea: Instant Income Guaranteed

TER Trade

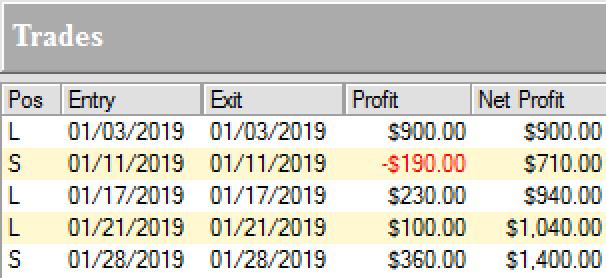

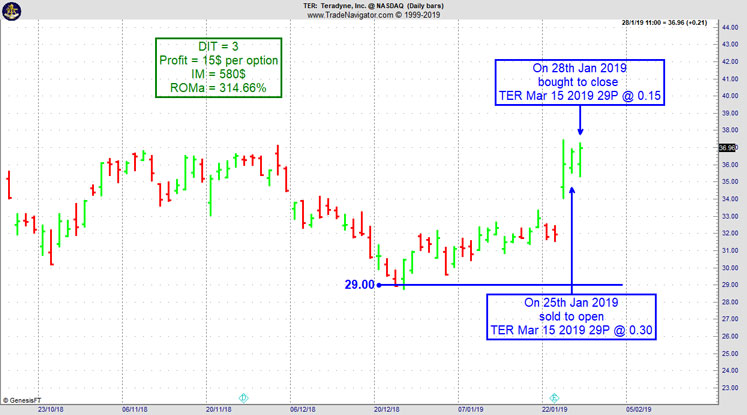

On 24th January 2019 we gave our Instant Income Guaranteed subscribers the following trade on Teradyne Inc. (TER). Price insurance could be sold as follows:

- On 25th January 2019, we sold to open TER Mar 15 2019 29P @ 0.30, with 50 days until expiration with our short strike about 20% below price action, and well below the earnings gap.

- On 28th January 2019, we bought to close TER Mar 15 2019 29P @ 0.15, after only 3 days in the trade for quick premium compounding.

Profit: 15$ per option

Margin: 580$

Return on Margin annualized: 314.66%

Philippe

Receive daily trade recommendations - we do the research for you.

♦ SIGN UP TODAY! THIS IS WORTH THE INVESTMENT ♦

Learn More!

Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete

Trading Article: Emotions

Letting your emotions influence your trading decisions is virtually a guarantee that you will lose as a trader. If you are...read more.

Andy Jordan is the editor for Traders Notebook which shows you Futures Trading Strategies in Spreads, Options, and Swing Trades. Learn step-by-step how to trade successfully.

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

by Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

Ambush Traders start the year with a big bang in the currency markets!

The Ambush trading method is specialised in catching intraday market tops and bottoms in a variety of Futures markets. Including many currency markets like the Dollar Index Future (DX), the Australian Dollar Future (6A) and the New Zealand Dollar Future (6N), where Ambush Traders had an amazing start into 2019.

Ambush day trades on an end-of-day basis so there’s no need to even check the markets during the day.

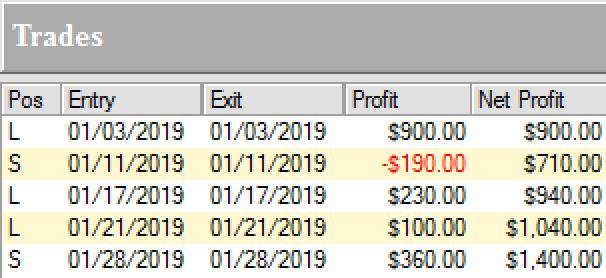

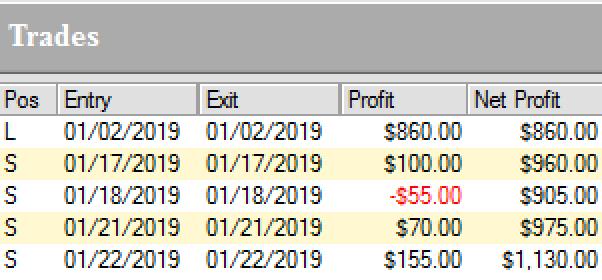

Here’s the result of all of these trades, trading one contract, including $10 commissions/slippage per trade:

New Zealand Dollar Future (6N):

Australian Dollar Future (6A):

Dollar Index (DX):

Is it always like that? Of course not, but if you’ve been on the other sides of these trades trying to buy the breakouts you maybe should think about switching sides!

Join us and become an Ambush Trader!

With Ambush Signals you can easily follow Ambush, a system specialized in catching intraday market tops and bottoms in the Futures markets!

The most popular and easiest way to follow Ambush is Ambush Signals. It does all the work for you, allows you to customise what markets you want to see and has a position sizing tool implemented to automatically adjust the positions to your risk preferences.

Each day around 6:30 pm NY Time the Signals are available for you on the Dashboard. You can then place your orders and literally walk away until the next market close! To find out more about the details of Ambush and how Ambush Signals works, have a look at the Ambush Signals Website.

Let’s be realistic. Following any System can be tough, especially in the beginning. It simply needs time to build the confidence needed to make it through inevitable drawdowns. So what if you are unlucky and don’t catch a good start right away?

I want you to succeed trading Ambush Signals, so here’s something for you that will strongly increase your odds of success and allow you to easily gain the confidence you’ll need to become a long-term profitable Ambush trader.

Find out more about Ambush and Ambush Signals!

Did you come up with questions? Don't be shy, email Marco Mayer, he wants to hear from you! This email address is being protected from spambots. You need JavaScript enabled to view it.

Sign up for Ambush Signals Today!

LEARN ABOUT AMBUSH TRADING METHOD

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2018 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.