Edition 839

July 24, 2020

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Chart Scan with Commentary: Hooks in a Consolidation

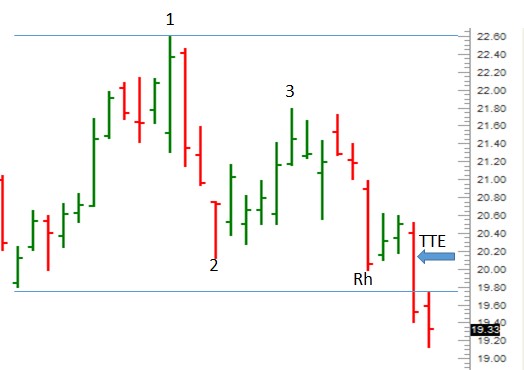

In the chart below, prices are in an extended consolidation. One aspect of the Law of Charts states that when prices have been in consolidation, it takes a 1-2-3 high (or 1-2-3 low) followed by a Ross hook for us to consider a swing inside a trading range to be valid as defining a trend.

Trading ranges are often made up of both 1-2-3 highs and 1-2-3 lows at the end of each leg within the trading range. Therefore, a 1-2-3 formation in and of itself cannot define a trend when prices are in consolidation. What is needed is a tie-breaker, something to indicate that prices are indeed ready to break out. A 1-2-3 formation followed by a Ross hook inside a trading range “defines” a trend. Once prices violate the point of the Ross hook, we can then consider the trend to be “established.” This violation can happen both within and outside of the trading range.

The breakout of the #2 point of the 1-2-3 high formation defined the trend. The breakout of the Ross hook (Rh) results in establishing a trend. The Traders Trick Entry (TTE) ahead of the breakout of the Rh, was a valid trading entry signal even though prices were in consolidation.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Master Trader Joe Ross

Author, Trader, Trading Mentor, and Founder of Trading Educators, Inc.

Developer of Instant Income Guaranteed

Trading Article: Information Overload

Have you ever felt as if the more you know, the less you know, and the more you become confused? Why is this?

People have the tendency to believe that the accuracy of their forecasts increases with more information. This is the illusion of...read more.

© by Joe Ross. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Philippe Guartier: Administration and

New Developments of Instant Income Guaranteed

Instant Income Guaranteed - CVS TRADE

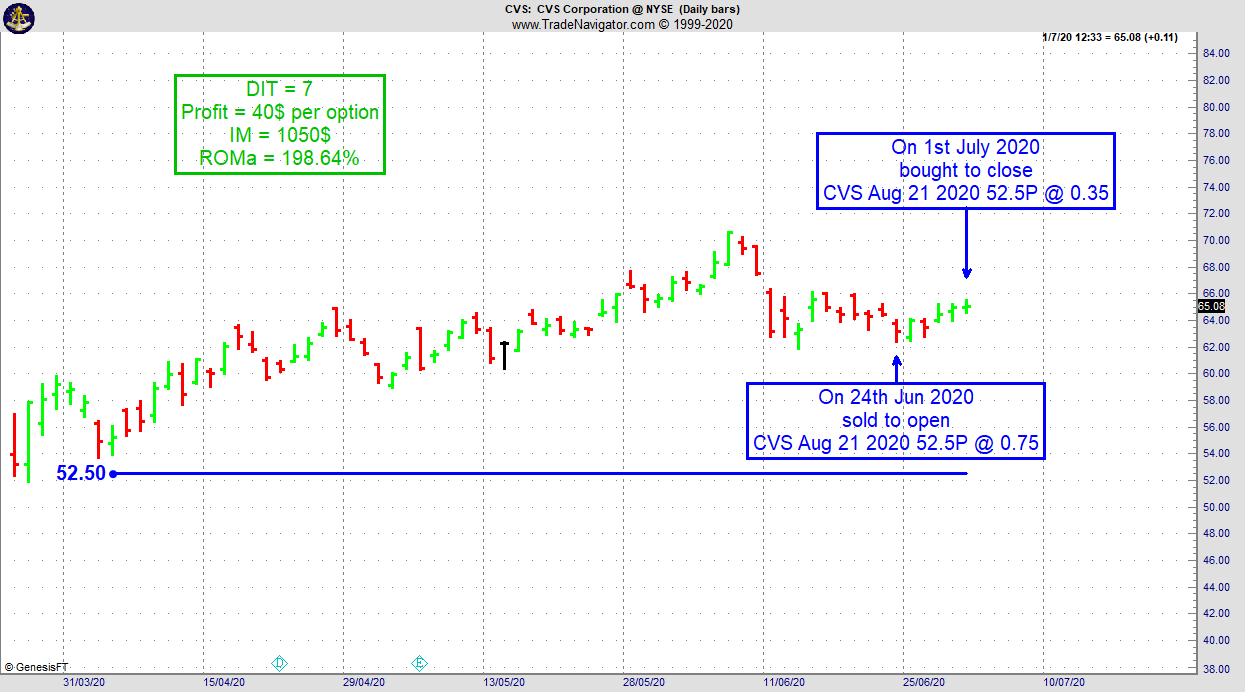

On 23rd June 2020 we gave our Instant Income Guaranteed subscribers the following trade on CVS Corporation (CVS). Price insurance could be sold as follows:

- On 24th June 2020, we sold to open CVS Aug 21 2020 52.5P @ 0.75, with 57 days until expiration and our short strike about 19% below price action.

- On 1st July 2020, we bought to close CVS Aug 21 2020 52.5P @ 0.35, after 7 days in the trade.

Profit: 40$ per option

Margin: 1050$

Return on Margin annualized: 198.64%

Philippe

Receive daily trade recommendations - we do the research for you.

Learn More! Instant Income Guaranteed

© by Joe Ross and Philippe Gautier. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Andy Jordan

Educator for Spreads, Options, Swing, Day Trading, and

Editor of Traders Notebook Complete and Traders Notebook Seasonal Spread Trading (TNsst)

READY TO LAUNCH IN NEXT WEEK'S NEWSLETTER

JOIN ANDY'S TRADING TEAM

Introducing: Traders Notebook Seasonal Spread Trading (TNsst)

LEARN MORE - WATCH THIS INFORMATIVE VIDEO

Contact Andy Jordan

Click Here to Learn more!

© by Andy Jordan. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

Professional Trader Marco Mayer

Educator for Forex, Futures and Systematic Trader

Creator of Ambush Trading Method, Ambush Signals, and Head of AlgoStrats.com

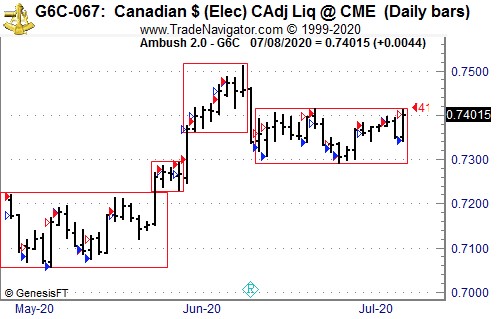

Ambush traders rock the Candian Dollar known as the Loonie

One of the top markets over the last couple of months for Ambush Traders has been the Canadian Dollar, also known as the Loonie. Doesn't matter if you're trading the regular Canadian Dollar Future, the Micro Future, or the USD/CAD Forex pair, Ambush Traders had real fun in that market!

Here's a daily chart of the Canadian Dollar Future (6C), showing the last couple of months of trading. As you can see this market did what markets do 90% of the time, which is why Ambush is such a great trading method. Markets move in boxes/ranges, break out for a few days and then start moving in the next box. The loonie has been boxing a lot lately and so Ambush Traders had a lot of fun!

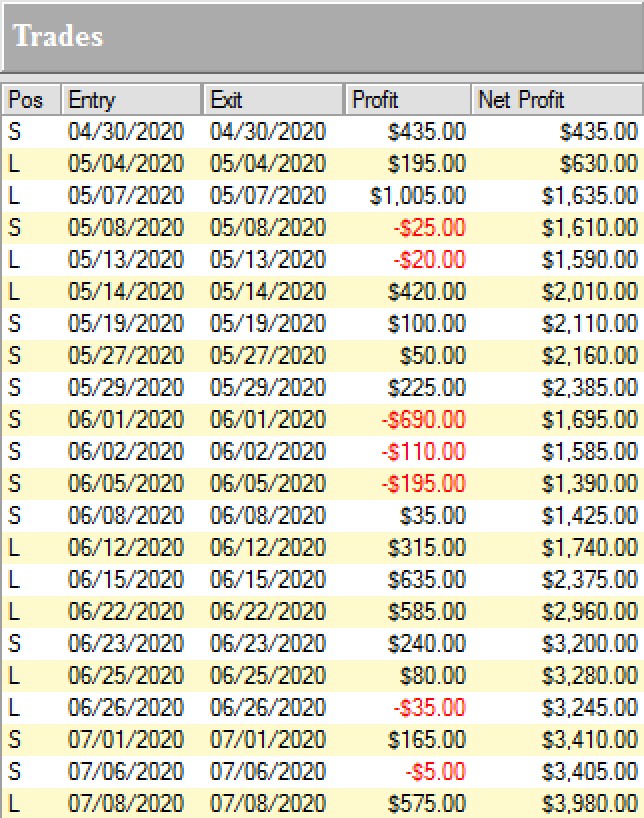

Here are the results of these trades, trading one contract:

Almost $4k profits with very little drawdowns in between!

Notice that all of these are actually day trades, even though they're based on end-of-day trading decisions. Ambush is exactly that, an easy way to day trade not for a few tiny ticks with a lot of stress but placing your trades once a day, walk away, and go for the big intraday moves.

Join Ambush Signals, let's have some fun with trading!

Happy Trading,

Marco

The Ambush Trading System was created in 2007 by Marco Mayer. Since then it proved itself in the markets for over a decade and did so with exceptional results. It's the only trading system we're aware of that is still going strong after so many years. While Ambush is a day trading system, meaning you will always enter and exit on the same trading day - you don't have to sit in front of your trading screen. You simply place your entry orders when the trading session starts and come back at the close!

© by Marco Mayer. Re-transmission or reproduction of any part of this material is strictly prohibited without the prior written consent of Trading Educators, Inc.

WE APPRECIATE YOUR TRUST IN US

THANK YOU FOR YOUR BUSINESS!

Check out our Blog!

To view previous published Chart Scan newsletters, please log in or click on "Join Us,"

shown above, to subscribe to our free "Members Only" section.

A WEALTH OF INFORMATION & EDUCATION:

Joe Ross-Trading Educators' popular free Chart Scan Newsletter has been published since 2004.

Note: Unless otherwise noted, all charts used in Chart Scan commentary were created

by using Genesis Financial Technologies' Trade Navigator (with permission).

Legal Notice and Copyright 2020 Disclaimer - Published by Trading Educators, Inc.

Chart Scan is a complimentary educational newsletter.