Trading Educators Blog

Cup and Handle

The cup and handle is a great trading pattern that works well with different time frames and with most markets like stocks, futures, commodities and foreign currency markets.

Here's what it means, how to trade it, and tips to use it for potentially bigger profits.

The Cup and Handle pattern is a bullish continuation pattern that begins with a consolidation period followed by a breakout. The pattern was created by William O'Neil and discussed in his book, "How to Make Money in Stocks."

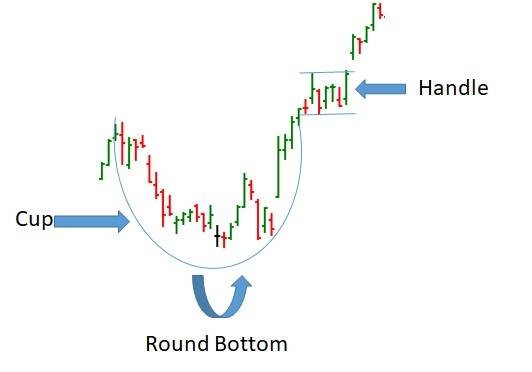

As the name suggests, there are two parts to the pattern: the cup and the handle; the cup forms after a strong move and looks like a bowl or rounding formation. After the cup is completely formed, a trading range develops on the right-hand side of the pattern which ends up being the handle.

It looks like this:

A subsequent breakout from the handle's trading range signals a continuation of the previous price move.

The most important part of the formation is the Handle. This is the last stage of the consolidation prior to the breakout. Generally speaking, Handle patterns should not last more than two weeks for short term trading purposes. This time period is not cut in stone and can be adjusted based on the time frame that took the Cup formation to finish. I have noticed that Handle formations that form in less than two weeks seem to produce the best breakouts with the most follow through momentum. When Handle formations last a very long time it is a sign that the market may not have sufficient momentum to move forward and break out of the trading range.