Trading Educators Blog

Why Pips Don’t Matter!

On a regular basis I get questions regarding Forex Trading in general or AlgoStrats:FX like:

- How many Pips do you make per month?

- How many Pips does a good trader make per month?

- Does your Strategy make 100 Pips a week?

Additionally to that, there’s advertisements all around that promise traders 1000 pips a month or performance reports that look like this:

This month trades:

27 Sep: GBP/NZD +140 Pips

29 Sep: EUR/USD -80 Pips

…

Total Profit: + 60 Pips

But the problem is that „number of pips“ is probably the worst measurement of performance you can come up with. Actually it tells you almost nothing about the real performance.

Why? Well first of all what a Pip is worth depends on how many units you’re risking per trade and what your base account currency is. But even if we assume that this has been taken care of and we’re targeting the same Pip value for all crosses/markets while ignoring trading costs altogether, there’s another issue and that is volatility.

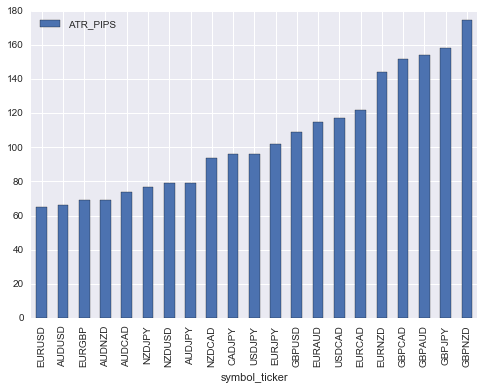

This graph shows us how many Pips each of the majors and their crosses currently moved per day during the last two weeks:

So for example, the EUR/USD moved on average about 60 Pips per day, while GBP/NZD moved almost 180 Pips per day. That is 3 times as much as EUR/USD.

Now coming back to our example above that stated a total profit of 60 Pips, having won 140 Pips in GBP/NZD and lost only 80 Pips in EUR/USD, having the knowledge regarding the daily volatility of the two pairs, we can see these numbers from a much more realistic perspective.

With GBP/NZD moving about 180 Pips a day, a profit of 140 Pips looks much less impressive, and the loss in EUR/USD of 80 Pips looks much worse with the EUR/USD moving about 60 Pips a day.

Actually if our trader in some way considered volatility in his risk management, he probably lost money with these two trades having a much higher Pip value for EUR/USD than for GBP/NZD. And if he doesn’t, he probably is simply not aware that every trade he puts on in GBP/NZD is about 3 times the size of each trade in EUR/USD considering the actual risk/volatility.

This is why you should run as fast as you can when someone starts talking about Forex trading results in Pips. It’s a red flag of either someone who doesn’t know what he’s talking about or worse, simply is trying to deceive you.

Happy Trading!

Marco